- United States

- /

- Metals and Mining

- /

- NYSE:MTRN

Did Materion's (MTRN) Strategic Shift Boost Its Margin Narrative and Growth Prospects?

Reviewed by Sasha Jovanovic

- Earlier this month, Heartland Advisors named Materion Corporation its top performer for the third quarter of 2025, citing the company's recent operational improvements and successful expansion efforts in high-margin semiconductor capacity in South Korea.

- A key insight from these developments is Materion's decision to divest its unprofitable Architectural Glass business, contributing to record margins and enhanced growth prospects amid recovering demand across core end markets.

- We'll examine how Materion's margin expansion through operational streamlining informs the company's current investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Materion Investment Narrative Recap

For investors considering Materion, the core thesis centers on its ability to leverage growth in semiconductors and advanced materials while maintaining robust margins through efficiency gains. The recent recognition by Heartland Advisors for operational improvements and the divestment of the Architectural Glass business supports the near-term margin expansion story, but customer concentration and cyclical risks within core markets remain the most significant short-term concern; the news itself does not materially reduce this risk.

Among recent developments, the company’s announcement of record second-quarter margins and increased earnings per share is particularly relevant, aligning closely with the streamlined focus highlighted in Heartland’s endorsement. This performance improvement arrived alongside continued growth in semiconductor demand, reinforcing the idea that operational execution remains a key catalyst for Materion’s ongoing story.

However, investors should keep in mind that with Materion’s increased exposure to semiconductors, any weakness in global end-market demand or rapid shifts in customer buying behavior could still...

Read the full narrative on Materion (it's free!)

Materion's narrative projects $2.1 billion revenue and $355.2 million earnings by 2028. This requires 7.2% yearly revenue growth and a $338.9 million earnings increase from $16.3 million today.

Uncover how Materion's forecasts yield a $127.00 fair value, in line with its current price.

Exploring Other Perspectives

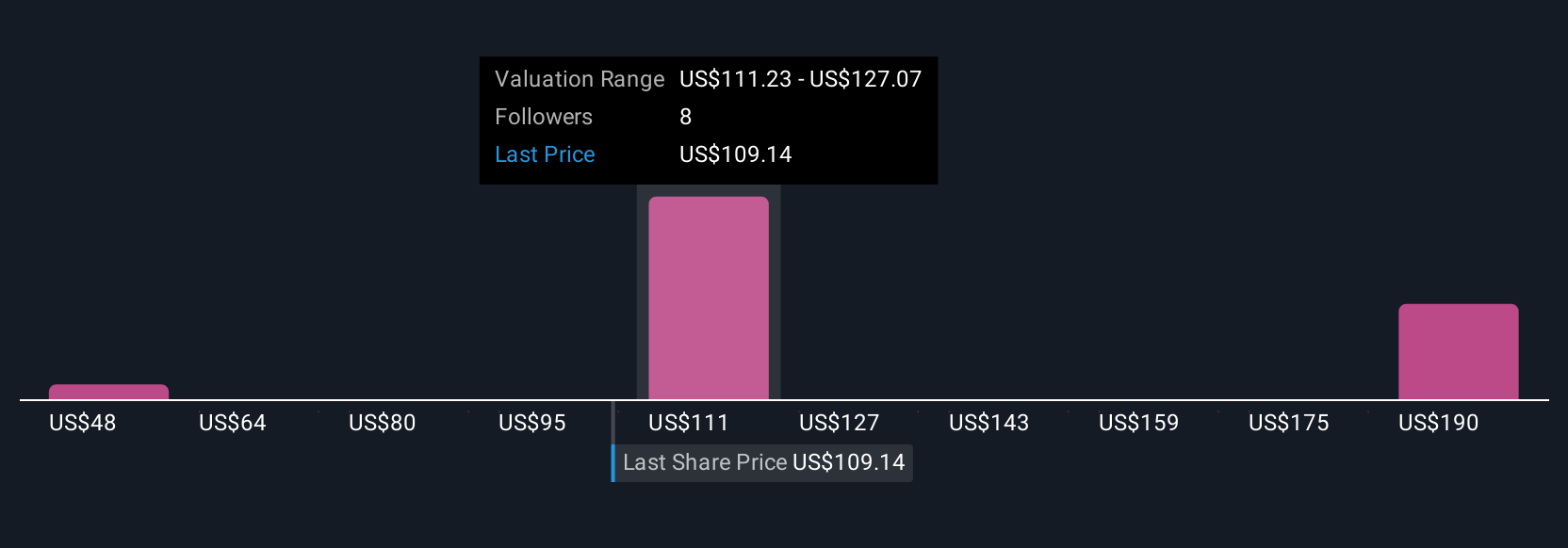

Simply Wall St Community members provided four distinct fair value estimates for Materion, ranging from US$47.87 to US$195.85 per share. Despite the company’s margin gains, broad agreement remains elusive, particularly as concerns about customer concentration risk continue to influence expectations for future performance.

Explore 4 other fair value estimates on Materion - why the stock might be worth less than half the current price!

Build Your Own Materion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Materion research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Materion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Materion's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTRN

Materion

Produces advanced engineered materials in the United States, Asia, Europe, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives