- United States

- /

- Metals and Mining

- /

- NYSE:MTAL

MAC Copper (MTAL): Exploring Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

MAC Copper (MTAL) recently caught investors’ attention, with its stock performance reflecting steady movement over the month and past 3 months. For those tracking materials sector trends, there is renewed curiosity about where the company’s fundamentals stand.

See our latest analysis for MAC Copper.

Broadly, MAC Copper’s share price is up 15.7% year-to-date. However, the total shareholder return over the past year sits at -5.9%. This suggests that while momentum is picking up in the short term, some long-term holders may still be waiting to recapture earlier gains. This points to shifting sentiment and evolving growth expectations.

If you’re curious about what else is picking up steam, this is a good moment to broaden your search and discover fast growing stocks with high insider ownership

With MAC Copper’s recent gains and a share price hovering just shy of analyst targets, the big question remains: are investors overlooking hidden value, or has the market already baked in expectations for future growth?

Most Popular Narrative: 30% Undervalued

MAC Copper’s current share price of $12.21 sits noticeably below the most popular narrative’s fair value of $12.25, creating a narrow but intriguing margin for potential upside. With valuation hanging in the balance, the reasoning behind this target draws on major catalysts and bold assumptions for the next phase of growth.

Acceleration of the Merrin Mine development and its early ramp-up will add significant, low-cost copper production to total volumes. Development costs are estimated at roughly one-third those of current operations, supporting higher top-line revenue and expanding margins as a result of lower unit costs.

Earnings inflection, margin expansion, and a cost structure shake-up: which of these levers transforms MAC Copper’s fair value projection? One core assumption changes everything. Hungry for the real numbers and projections that anchor this compelling narrative? The details will surprise you.

Result: Fair Value of $12.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing uncertainty over Merrin mine resources and fluctuating ore grades could undermine production forecasts and challenge the bullish outlook on MAC Copper’s growth story.

Find out about the key risks to this MAC Copper narrative.

Another View: Testing Value with Sales Ratios

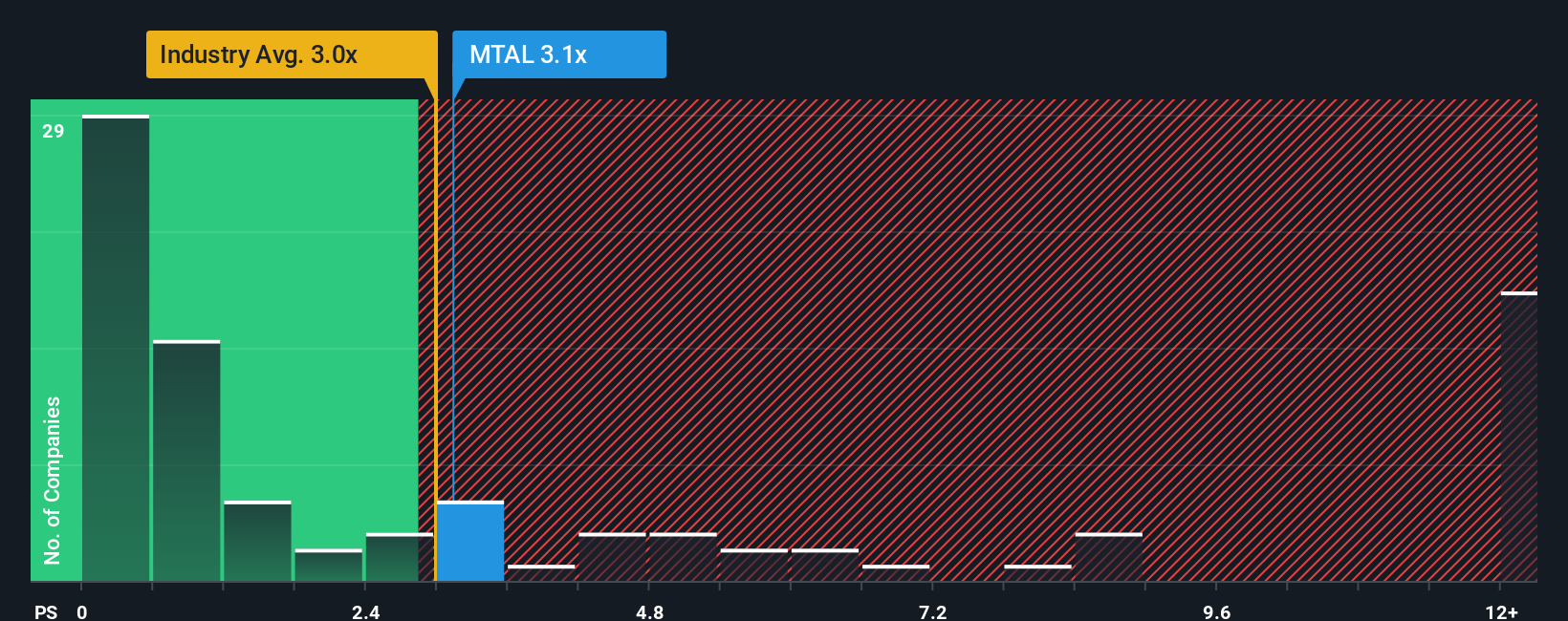

While the most popular narrative sees MAC Copper as undervalued, sales ratios raise a caution flag. The company trades at 3.1 times sales, which is higher than the fair ratio of 1.8 times and even above the industry average of 3 times. This premium may signal risk if growth falls short. Could this point to optimism, or does it hint at overpayment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MAC Copper Narrative

If you’re not convinced by these perspectives or simply want a closer look at the numbers, you can quickly craft your own view. In just a few minutes, explore the options and Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding MAC Copper.

Looking for more investment ideas?

Why settle for just one opportunity? Unlock smarter investing moves, grounded in real data, by getting hands-on with other promising stock ideas today.

- Capture tomorrow’s leaders in artificial intelligence by checking out these 24 AI penny stocks, which are setting the pace with innovation and rapid market adoption.

- Grow your income potential and spot reliable cash flow with these 19 dividend stocks with yields > 3%, all featuring yields above 3% for your portfolio.

- Stay ahead of the curve with these 79 cryptocurrency and blockchain stocks, powering real-world applications in digital payments, online security, and future financial systems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTAL

MAC Copper

Focuses on operating and acquiring metals and mining businesses in Australia.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)