- United States

- /

- Metals and Mining

- /

- NYSE:MTAL

Is MAC Copper Poised for Growth After New Infrastructure Fund Announcement?

Reviewed by Bailey Pemberton

Thinking about what to do with MAC Copper stock? You are not alone. The company’s recent price trajectory has caught the eye of both cautious investors and optimistic speculators. In the last year, the stock slipped by 12.2%, but look further back and the story changes. MAC Copper is still up 24.4% over the last three years and an impressive 15.7% so far this year. If you have been watching for signs of life after a slow month or two, the near-flat 30-day and 7-day returns show the market might just be catching its breath.

Several industry watchers point to changing market conditions around key copper producers as part of the explanation. Shifts in demand for industrial metals and recent chatter about infrastructure investments are adding complexity to what is driving MAC Copper’s price. It is a stock that invites second (and third) looks whenever commodity cycles seem to be turning.

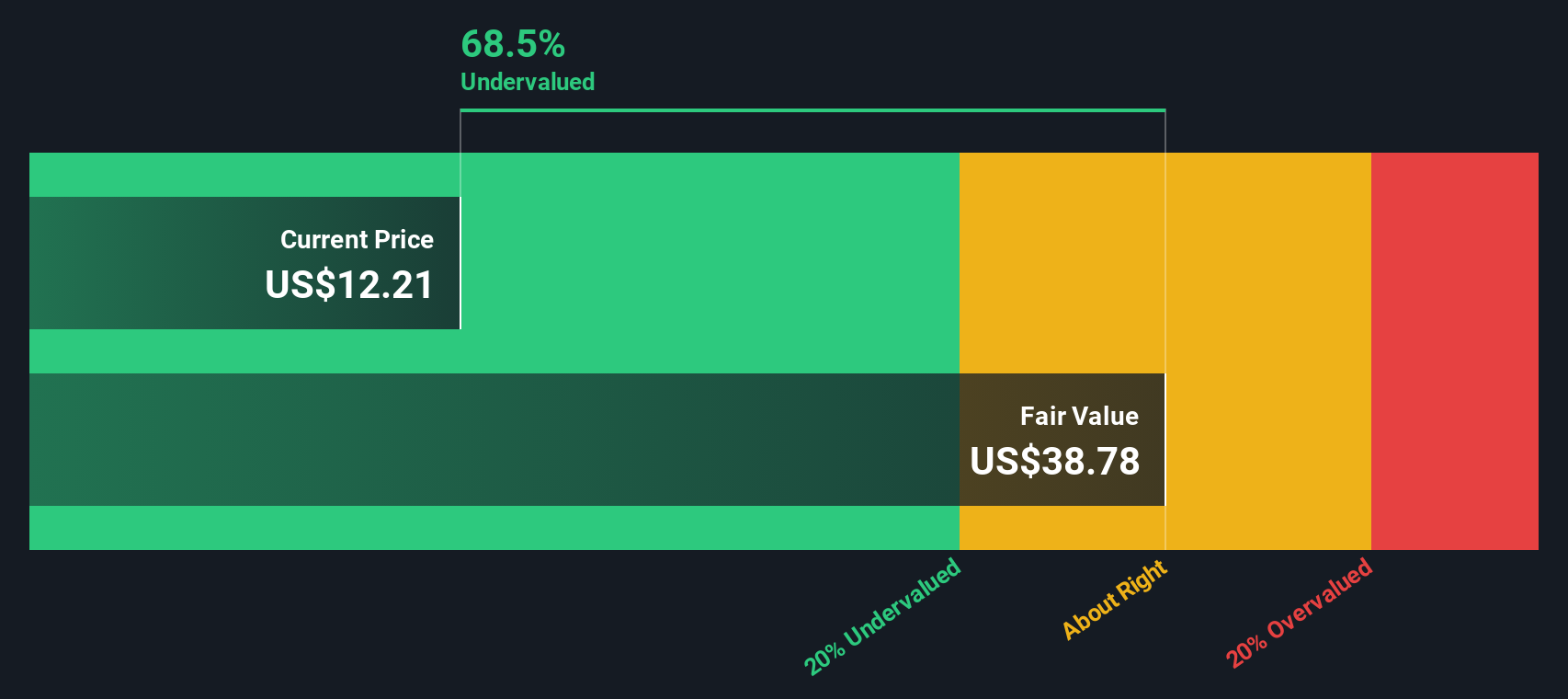

So, is MAC Copper really a value pick or just another rollercoaster ride? Right now, the company earns a valuation score of 3 out of 6, a signal it looks undervalued by three separate yardsticks. That is meaningful for investors weighing what comes next. In the sections ahead, we will break down exactly how those valuation checks stack up, and at the end, I will share an even sharper way to think about what MAC Copper is truly worth.

Why MAC Copper is lagging behind its peers

Approach 1: MAC Copper Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and then discounting them back to today’s dollars. For MAC Copper, this means looking at how much cash the business is expected to generate each year and working out what that stream of money is worth right now.

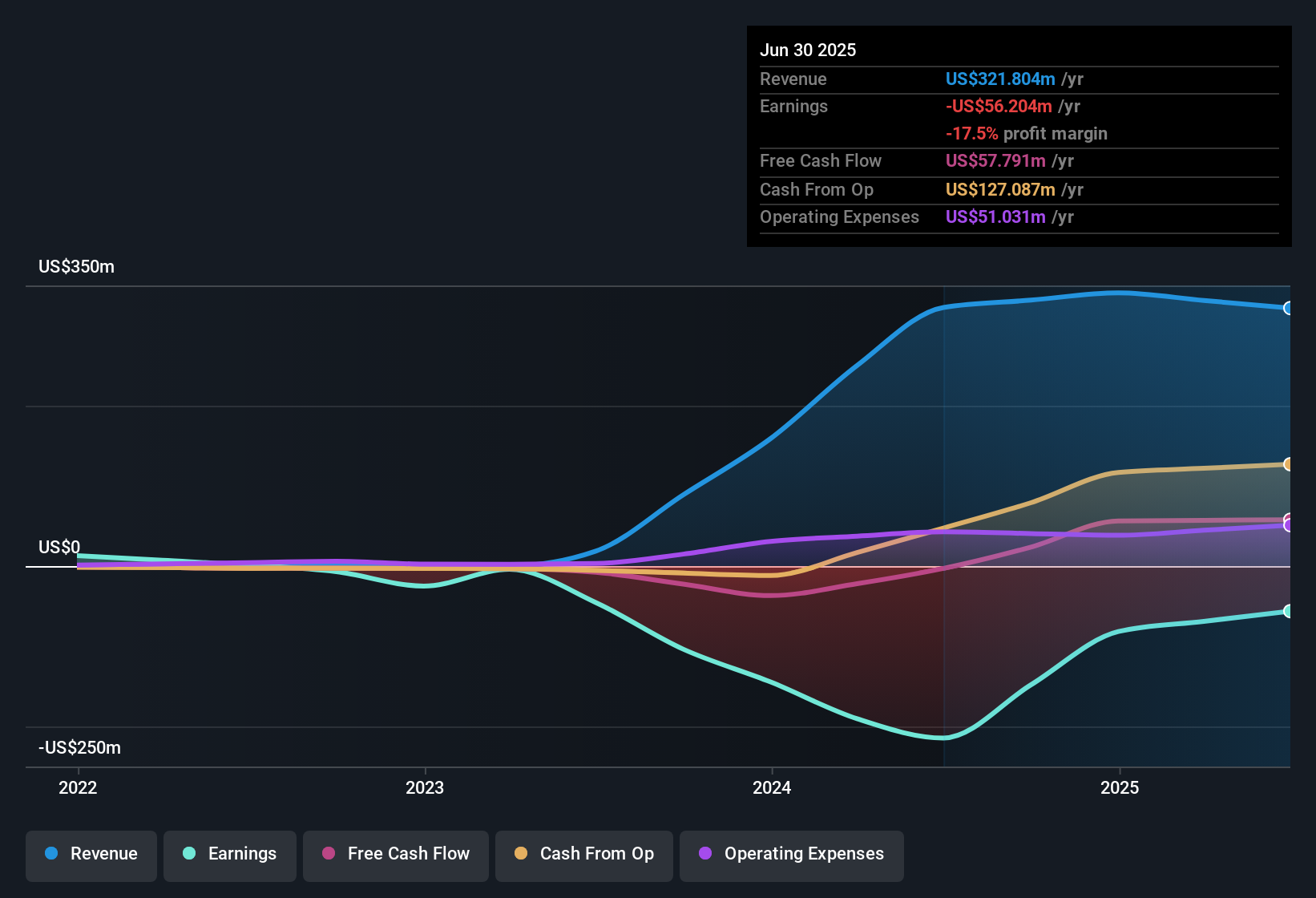

Currently, MAC Copper’s Free Cash Flow stands at $67.93 million. Analyst forecasts anticipate this figure will climb steadily in the coming years, with projected cash flow reaching $177 million by 2028. Beyond the analyst window, Simply Wall St extrapolates expected growth, estimating Free Cash Flow at just over $201 million by 2035. These numbers, all in US dollars, show a positive longer-term trend, even as the company navigates normal industry swings.

Running these cash flows through the DCF formula gives MAC Copper an intrinsic value of $31.98 per share. Compared to its current market price, this represents a steep discount. Specifically, the model suggests the stock is 61.8% undervalued. For value-focused investors, this gap is hard to ignore.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MAC Copper is undervalued by 61.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

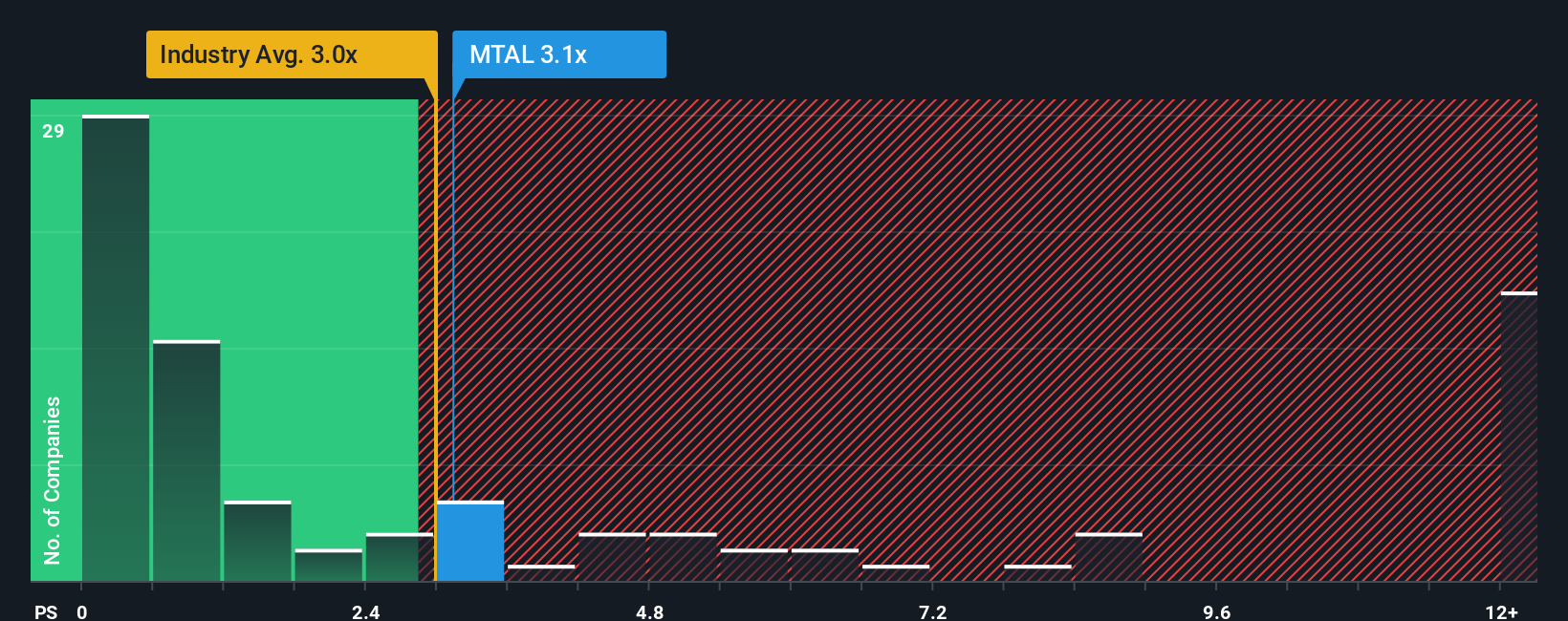

Approach 2: MAC Copper Price vs Sales

The Price-to-Sales (P/S) ratio is a popular way to value profitable companies, especially in the metals and mining sector where earnings may be volatile but sales are consistent and substantive. The P/S ratio helps investors understand how much the market is willing to pay for each dollar of MAC Copper's revenue. This offers a clearer perspective during periods when profits are influenced by temporary headwinds or cyclical dips.

What counts as a "normal" or fair P/S multiple depends on the company's growth prospects and risk profile. Generally, companies with higher growth or stronger competitive positions command a higher ratio, while those with greater uncertainty or lower margins may deserve a discount. Right now, MAC Copper trades at a P/S ratio of 3.13x, which is slightly above the metals and mining industry average of 2.95x but below the peer average of 28.62x.

Simply Wall St introduces the "Fair Ratio" to provide a more tailored benchmark for valuation. Instead of using a broad industry average or comparing with selected peers, the Fair Ratio considers MAC Copper's own sales growth, profit margins, market capitalization, and risks. This leads to a more precise view of what the stock deserves to trade at based on its real fundamentals. In MAC Copper’s case, the Fair Ratio stands at 1.83x, noticeably below the current 3.13x. This comparison suggests that, on a Price-to-Sales basis, the stock may be priced higher than its fundamentals justify.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your MAC Copper Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. In simple terms, a Narrative is your story about a company, bringing together your assumptions about its future, such as revenue, earnings and margins, with your own fair value estimate. Rather than just focusing on the numbers in isolation, Narratives help you connect the bigger picture of what a company is doing with a forecast of where it could go, and then link that directly to a price you think is fair.

Narratives are an easy and accessible tool available on Simply Wall St’s Community page, used by millions of investors. They help you decide when to buy or sell by tracking your Fair Value versus the current Price. Narratives update dynamically as new news or company results are released, so your investment view always stays relevant.

For MAC Copper, for example, some investors believe the upcoming Merrin Mine expansion will drive earnings up to $209.4 million and a fair value of $14 per share. Others are more cautious, forecasting $117.4 million in earnings and a fair value closer to $10.50. By building and tracking your own Narrative, you can invest with clarity and confidence and respond quickly as things change.

Do you think there's more to the story for MAC Copper? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTAL

MAC Copper

Focuses on operating and acquiring metals and mining businesses in Australia.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)