- United States

- /

- Metals and Mining

- /

- NYSE:MP

MP Materials: Valuation Analysis Following Landmark Defense Contract and Strategic Supply Chain Push

Reviewed by Kshitija Bhandaru

MP Materials has been in the spotlight after signing a landmark contract with the U.S. Department of Defense involving equity investment and price guarantees for rare earth materials. The deal signals a strategic focus on strengthening America’s supply chain.

See our latest analysis for MP Materials.

Investors have taken note of MP Materials’ new Department of Defense contract and strategic supply deals, sending a clear signal that optimism is building around the company’s long-term prospects. The momentum has been steady, as MP’s 1-year total shareholder return sits at just over 3%, while its recent share price performance reflects solid, risk-adjusted gains rather than speculative hype. This positioning, combined with government backing and key commercial partnerships, points to a narrative of cautious growth rather than runaway exuberance.

If you’re watching the rare earths story unfold, this might be the perfect moment to explore other companies with strong ties to national security and next-generation technology. See the full list in our Aerospace & Defense Screener: See the full list for free.

But with government incentives and commercial contracts already boosting sentiment, the question remains: does MP Materials remain undervalued in the market, or is its future growth already fully reflected in today’s share price?

Most Popular Narrative: 7.1% Undervalued

Based on the most popular narrative, MP Materials' fair value is set at $77, which stands above the last close of $71.5. This gap signals that the current price may not fully reflect upcoming catalysts and sets the stage for some bold expectations.

MP Materials' recently secured long-term, government-backed offtake agreements, including a minimum price floor and guaranteed EBITDA for magnet output from the Department of Defense, as well as a $500M+ multi-year supply contract with Apple, ensure predictable and resilient revenue streams insulated from price volatility. This directly enhances future revenue and earnings visibility.

Curious how these guaranteed deals and a high-profile tech partner might reshape the company's future? There is a twist in the narrative tied to ambitious growth targets and a profit outlook that is raising plenty of eyebrows. Dive in to uncover the projections driving this surprisingly optimistic fair value.

Result: Fair Value of $77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in ramping up new facilities or unexpected regulatory changes could quickly curb MP Materials’ momentum and present challenges to today’s optimistic outlook.

Find out about the key risks to this MP Materials narrative.

Another View: What Do the Numbers Say?

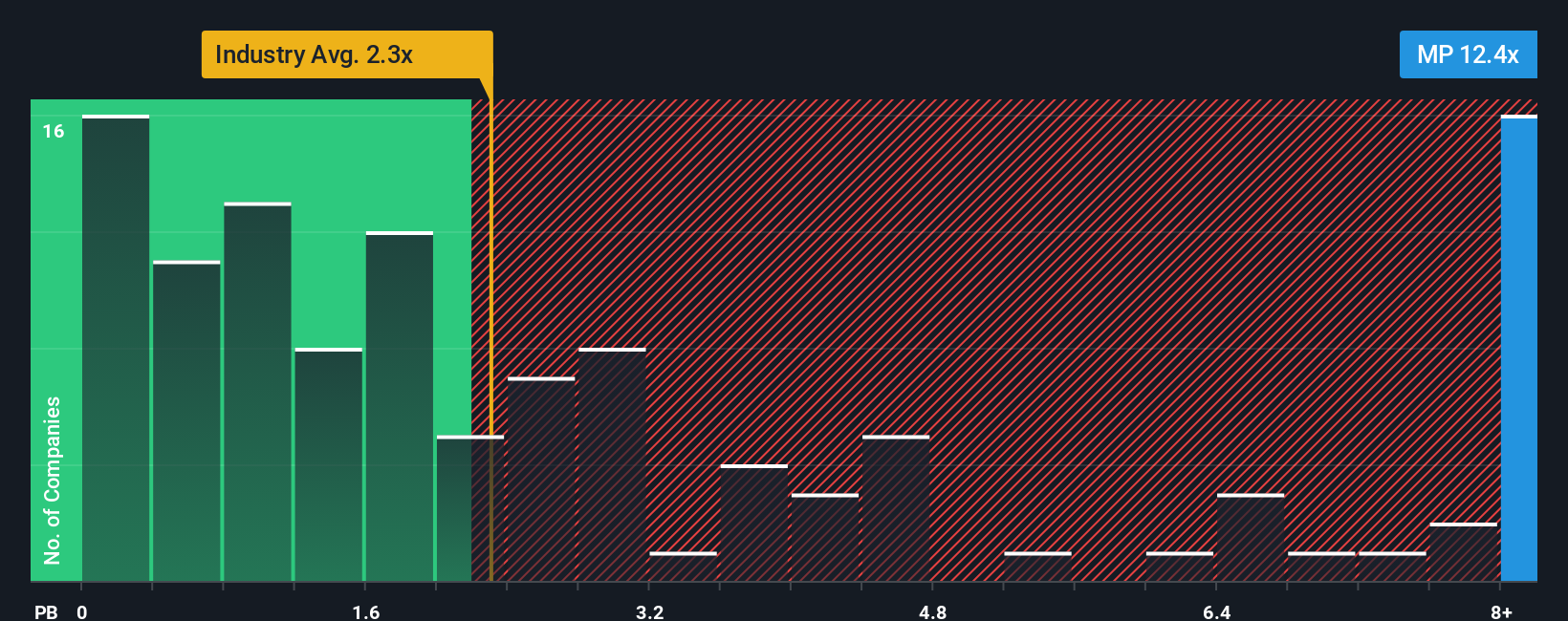

On the other hand, if we look at MP Materials’ price-to-book ratio, the story changes. The company trades at 12.5 times its book value, much higher than the US Metals and Mining industry average of 2.4 times and also surpassing peer averages. This may point to limited upside if the market shifts toward more typical valuations, raising the risk for investors focused on current fundamentals rather than growth.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MP Materials for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MP Materials Narrative

If you see things differently or want to dig into the numbers yourself, you’re just a few clicks away from building your own perspective. Do it your way.

A great starting point for your MP Materials research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Missing out on today’s smartest strategies can set back your portfolio for years. Let’s make sure you’re always ahead of the curve with breakthrough opportunities.

- Accelerate your search for long-term value by checking out these 896 undervalued stocks based on cash flows, which consistently trade below their intrinsic worth.

- Kickstart your growth thesis with these 24 AI penny stocks, harnessing artificial intelligence to disrupt entire industries and deliver outsized returns.

- Tap into stable income streams by reviewing these 19 dividend stocks with yields > 3%, delivering yields above 3 percent and rewarding shareholders consistently.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MP

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives