- United States

- /

- Basic Materials

- /

- NYSE:MLM

Martin Marietta Materials (MLM): Evaluating Valuation After Mixed Q3 Beat on Growth but Miss on Estimates

Reviewed by Simply Wall St

Martin Marietta Materials (MLM) just posted Q3 results showing double digit revenue and earnings growth versus last year, but both missed Wall Street estimates, creating a mixed setup that is now shaping investor sentiment.

See our latest analysis for Martin Marietta Materials.

The latest results land after a strong run, with the share price now at $623.41 and a robust year to date share price return of 22.10% alongside a powerful five year total shareholder return of 142.05%. This suggests momentum is still broadly intact, even if expectations are getting tighter around each earnings print.

If this kind of steady compounding appeals, it could be a good moment to see what else is out there in infrastructure linked names and more niche building plays by exploring fast growing stocks with high insider ownership.

With the shares sitting close to analyst targets after years of strong compounding, the key question now is whether Martin Marietta still trades below its true worth, or if the market has already priced in the next leg of growth?

Most Popular Narrative Narrative: 6.4% Undervalued

With Martin Marietta Materials last closing at $623.41 against a narrative fair value of $666.29, the framework points to modest upside still on the table.

The analysts have a consensus price target of $648.227 for Martin Marietta Materials based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $725.0, and the most bearish reporting a price target of just $440.0.

Want to see what justifies paying up for a heavy materials business usually priced like a cyclical, not a compounding franchise? The narrative leans on steadily rising revenues, expanding margins and a future earnings multiple more often associated with growth leaders than quarry operators. Curious which long term earnings path and return assumptions turn those inputs into today’s fair value signal? Dive in to see the view that underpins this valuation roadmap.

Result: Fair Value of $666.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing residential demand or weaker than expected infrastructure funding could quickly challenge the growth assumptions behind this modest undervaluation signal.

Find out about the key risks to this Martin Marietta Materials narrative.

Another Lens On Valuation

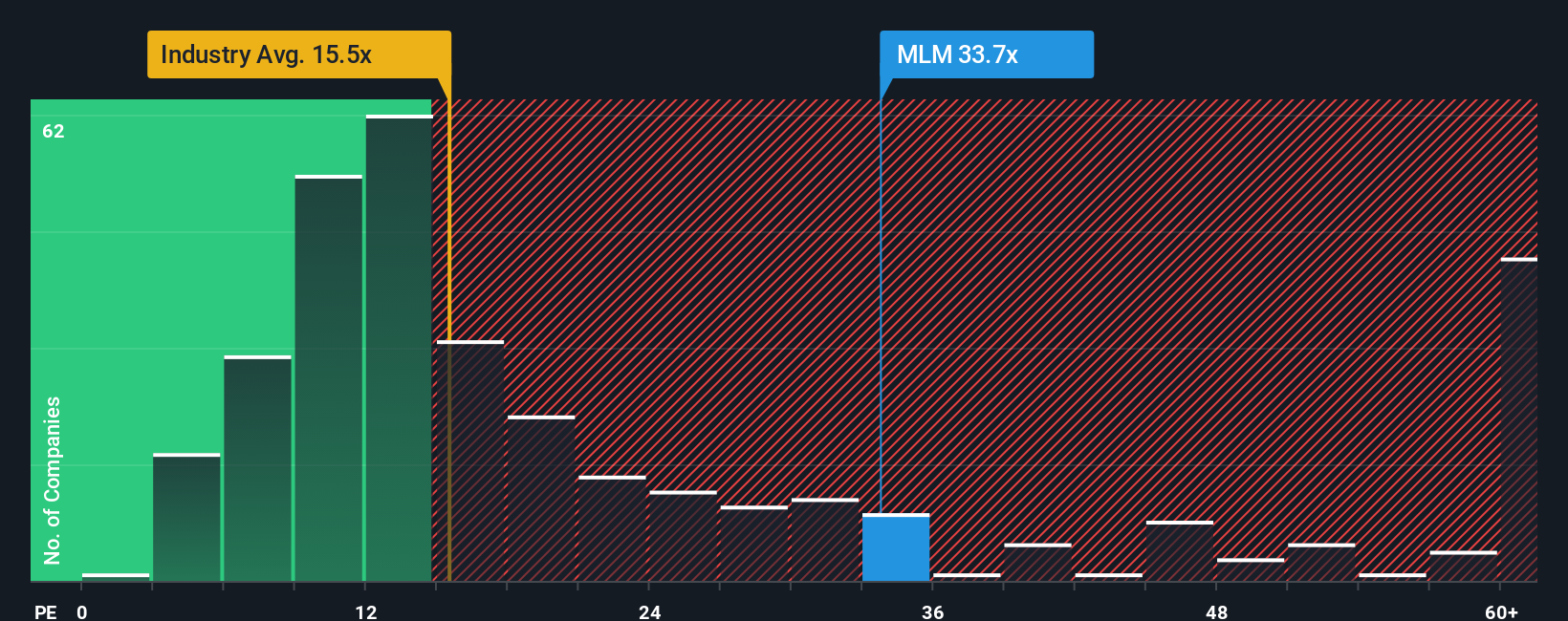

On earnings, the picture looks very different. Martin Marietta trades on a 31.8x price to earnings ratio, well above US peers at 26.2x, the global sector at 14.7x, and even our fair ratio of 23.2x. That implies the narrative may already be in the price, so what would make paying this premium still worthwhile?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Martin Marietta Materials Narrative

If you are not fully convinced by this view, or would rather dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Martin Marietta Materials research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one opportunity when you can quickly scan fresh themes and sectors on Simply Wall Street and turn overlooked ideas into your next winning position.

- Explore potential upside opportunities by targeting undervalued businesses with robust cash flows through these 908 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Position yourself to benefit from innovation by focusing on emerging opportunities in these 26 AI penny stocks before they become mainstream.

- Identify potential income opportunities by focusing on companies offering attractive yields using these 12 dividend stocks with yields > 3% that many investors may not be considering.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MLM

Martin Marietta Materials

A natural resource-based building materials company, supplies aggregates and heavy-side building materials to the construction industry in the United States and internationally.

Mediocre balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)