- United States

- /

- Chemicals

- /

- NYSE:LYB

Will Evercore’s Cautious Stance on Oversupply Reshape the Strategic Path for LyondellBasell (LYB)?

Reviewed by Sasha Jovanovic

- Earlier this week, Evercore ISI maintained its In Line rating on LyondellBasell Industries N.V. while voicing concern over challenges like European operations restructuring, weaker oxyfuels performance, and ongoing industry oversupply.

- This underscores how structural shifts in the chemical sector and internal business adjustments are shaping investor sentiment around LyondellBasell's prospects.

- We’ll explore how Evercore’s caution about industry oversupply might influence expectations for LyondellBasell’s long-term profitability and portfolio transformation.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

LyondellBasell Industries Investment Narrative Recap

To be a shareholder in LyondellBasell, you need to believe in its ability to transform its portfolio, expand in circular and low carbon solutions, and enhance operational efficiency, even as global chemical markets face persistent oversupply. Evercore ISI's recent cut to its price target, reflecting concerns about European restructuring and sustained industry headwinds, does not materially shift the biggest near-term catalyst, which remains tangible progress in portfolio optimization and cost management. The principal risk stays tied to a prolonged sector downturn and the financial impact of industry-wide oversupply.

Among recent company announcements, the May review of European assets stands out as most relevant to Evercore’s concerns. This review directly addresses the challenge of right-sizing operations in a tough market, aligning with efforts to shore up margins and support cash flow, key factors underpinning both short-term momentum and long-term transformation. Still, investors should note that realization of these benefits will depend on timing, execution, and market recovery.

On the other hand, keep in mind that the risk of continued oversupply affecting both revenue and margins is something investors should be aware of...

Read the full narrative on LyondellBasell Industries (it's free!)

LyondellBasell Industries is projected to have $29.2 billion in revenue and $2.2 billion in earnings by 2028. This outlook assumes a 9.0% annual revenue decline and a $2.05 billion increase in earnings from the current $150 million.

Uncover how LyondellBasell Industries' forecasts yield a $59.61 fair value, a 21% upside to its current price.

Exploring Other Perspectives

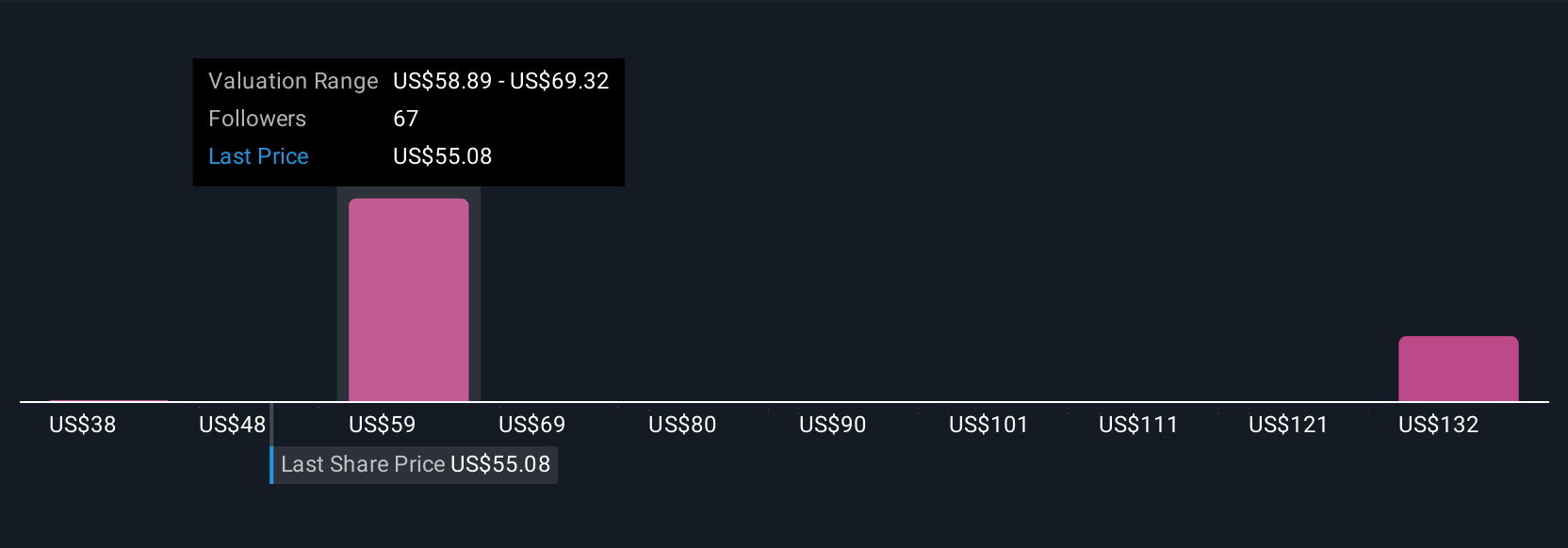

Fourteen private investors in the Simply Wall St Community have pegged LyondellBasell’s fair value anywhere from US$35.57 to US$141.92 per share. With sector oversupply remaining a major risk, you can see how opinions about the company’s future prospects truly span a wide spectrum.

Explore 14 other fair value estimates on LyondellBasell Industries - why the stock might be worth over 2x more than the current price!

Build Your Own LyondellBasell Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LyondellBasell Industries research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

- Our free LyondellBasell Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LyondellBasell Industries' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LYB

LyondellBasell Industries

Operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Community Narratives