- United States

- /

- Packaging

- /

- NYSE:IP

Does International Paper Offer Value After the Recent Packaging Division Sale?

Reviewed by Bailey Pemberton

Thinking about whether to buy, hold, or move on from International Paper? You are not the only one. The company’s share price is always a conversation starter, and if you have been watching the stock tickers lately, you know there has been a bit of everything. In the past week, shares nudged up 0.6%, while the last month brought a steadier 3.0% gain. Still, looking at the year so far, International Paper is down about 11.7%, a slump that may have caught some investors off guard. However, zoom out to three or five years, and you will see returns of 65.3% and 32.2% respectively. This paints a very different, more optimistic long-term picture.

Why all the movement? Apart from the daily noise of the markets, investors are processing ongoing industry shifts. There is steady demand for packaging and paper products, but also competition and changing costs. Lately, big-picture market trends, such as renewed interest in sustainable materials and shifts in global supply chains, have been in play. These factors keep the stock interesting for anyone weighing the company’s future potential and its value today.

Speaking of value, the numbers tell an intriguing story. By classic valuation checks, International Paper scores 4 out of 6 for being undervalued. That is a solid indicator the stock could be trading below its true worth, at least by some measures. We will break down each valuation approach next, then take it a step further with a fresh perspective on what really matters for stock value.

Approach 1: International Paper Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow, or DCF, model estimates a company’s worth by projecting its expected future cash flows and discounting those figures back to today’s dollars. This method focuses on forecasting how much money International Paper could generate in coming years and determining what that is worth in current terms.

Currently, International Paper’s latest twelve months free cash flow stands at -$112.4 million. Looking forward, analysts estimate the company’s free cash flow will rebound rapidly, reaching approximately $1.93 billion by 2029. Simply Wall St then extrapolates further growth in the following years, suggesting a pattern of modest gains based on both analyst expectations and conservative long-term assumptions.

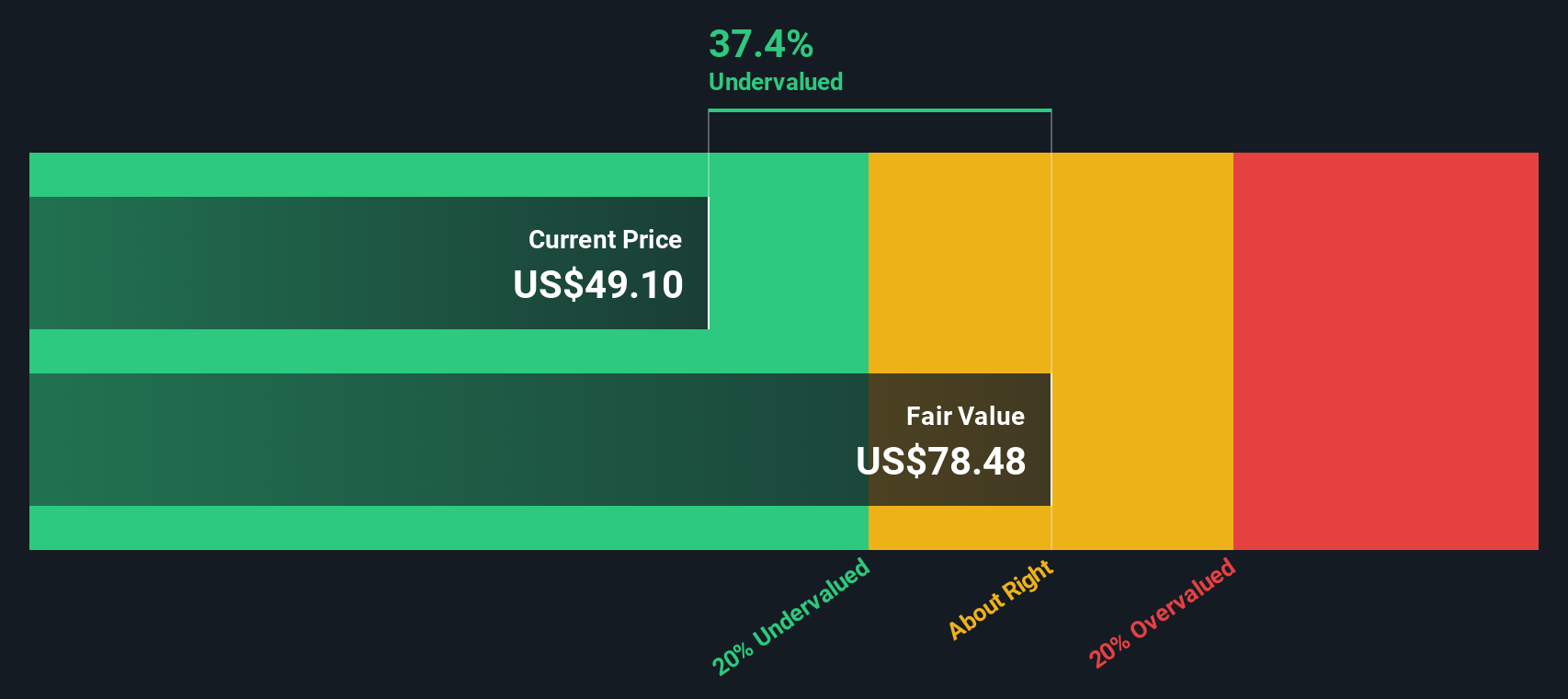

When these future cash flows are discounted back, the DCF model assigns International Paper an intrinsic value of $76.95 per share. Since this is about 39% above the current share price, the implication is that International Paper appears to be significantly undervalued by the market at the moment.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests International Paper is undervalued by 39.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

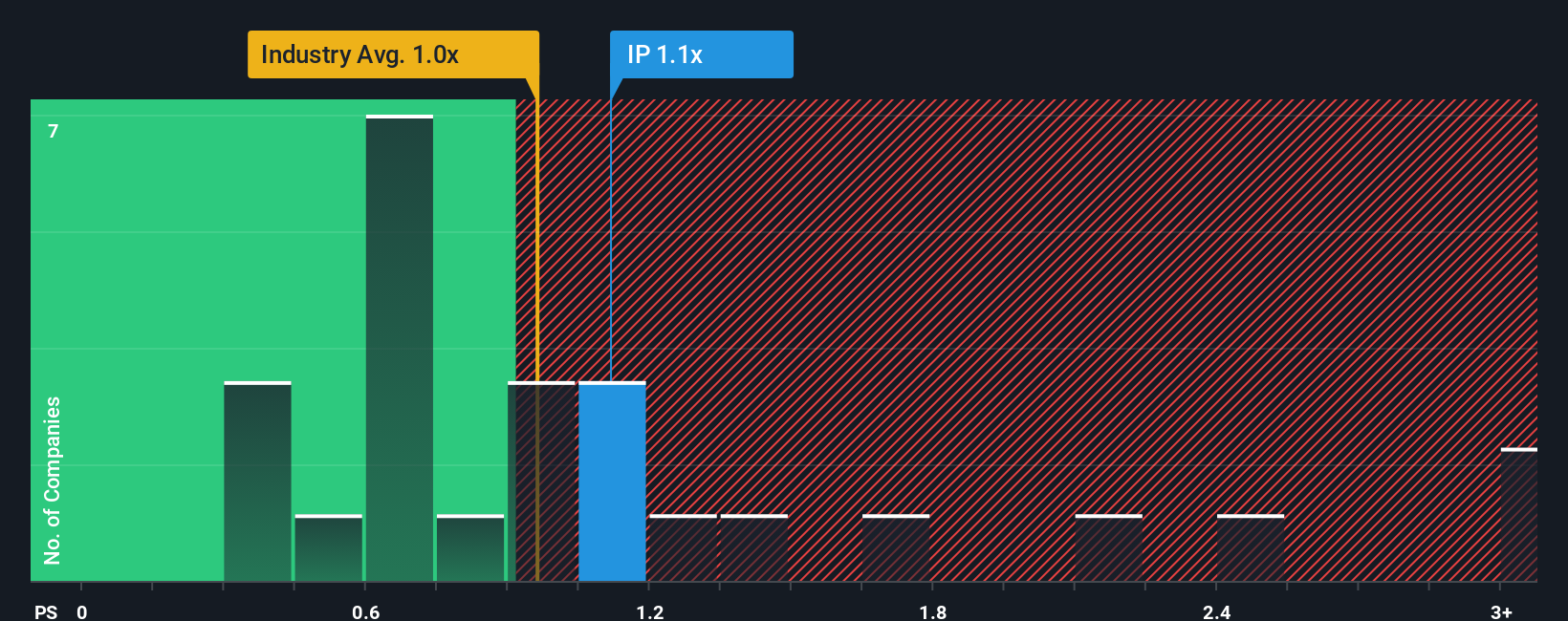

Approach 2: International Paper Price vs Sales

The Price-to-Sales (P/S) ratio is a common way to value companies, especially those in industries like packaging where profit margins may fluctuate but revenue remains a good indicator of underlying business strength. For established and profitable firms, the P/S ratio helps investors see how much the market is paying for each dollar of sales. This makes it a useful metric when earnings figures are volatile or temporarily depressed.

What counts as a fair P/S ratio can vary a lot, usually influenced by expectations for future growth, company size, and risks in the business. Companies with higher growth prospects or lower perceived risks often command higher ratios, while mature or riskier names might trade at lower P/S multiples.

International Paper currently trades at a P/S ratio of 1.13x. This compares to an industry average of 0.95x and a peer average of 1.38x, meaning International Paper sits between the broader industry and its direct competitors. However, Simply Wall St introduces the idea of a “Fair Ratio”, calculated here as 1.88x. This proprietary figure is based on the company’s growth rates, profitability, industry positioning, and factors like market cap and risk profile. As a result, it offers a more tailored and realistic benchmark than blunt industry averages.

Since International Paper’s current P/S of 1.13x is well below the Fair Ratio of 1.88x, this suggests the market may be undervaluing the company compared to what its fundamentals and outlook justify.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your International Paper Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personal story or perspective behind International Paper’s numbers, turning estimates about future revenue, earnings and margins into a clear forecast and an actionable fair value. It links what you believe about the company’s prospects, such as the impact of market trends, management actions, or industry shifts, to a financial outlook and ultimately a share price that feels right for your unique view.

Narratives are designed to be simple and accessible, and on Simply Wall St’s Community page, they let you build, share and compare your assumptions with millions of other investors. By creating a Narrative, you can quickly compare your calculated Fair Value to the current price and decide if the stock looks attractive to buy or better to sell, using facts that reflect your personal insights, not just generic averages.

Best of all, Narratives update as soon as new information such as news or earnings is available, so your view always stays fresh. For example, some International Paper investors use a bullish Narrative expecting $63 per share, while others take a cautious stance with a $42 view. Which story fits your outlook best?

Do you think there's more to the story for International Paper? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IP

International Paper

Produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives