- United States

- /

- Chemicals

- /

- NYSE:IFF

Will IFF’s New Bread Freshness Enzyme Reveal the Next Chapter in Its Innovation Strategy (IFF)?

Reviewed by Simply Wall St

- Earlier this month, International Flavors & Fragrances Inc. announced the launch of POWERFRESH® ACE 2000 in the U.S., offering industrial bakeries a next-generation enzyme solution aimed at extending bread freshness, softness, and cohesiveness for up to 34 days.

- This product targets bakeries' needs to deliver longer-lasting bread amid rising ingredient costs, directly addressing the consumer preference for extended freshness and operational efficiency raised in a recent company survey.

- We'll examine how the introduction of POWERFRESH® ACE 2000 could reshape IFF's innovation-driven narrative, especially in bakery ingredients.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

International Flavors & Fragrances Investment Narrative Recap

To be a shareholder in International Flavors & Fragrances (IFF) is to believe in its ability to spark growth through differentiated, innovation-driven products and deliver margin improvement amid challenges like pricing pressures and market softness in core segments. The launch of POWERFRESH® ACE 2000 is a positive step for IFF’s innovation story in bakery ingredients but is not likely to materially impact near-term performance, the most important short-term catalyst remains further progress in improving business mix and restoring growth in key markets, while risks around margin pressure in legacy Fragrance Ingredients still stand out.

One of the most relevant recent announcements alongside the POWERFRESH® ACE 2000 launch is IFF’s July release of ENVIROCAP™, a sustainable scent delivery system for fabric care. Both announcements reinforce the company’s push to advance high-value innovation, supporting its shift away from commodity offerings and helping strengthen its R&D pipeline, which is expected to be a growth driver over the coming years.

By contrast, investors should also be mindful of ongoing pricing and volume headwinds facing the Fragrance Ingredients business, especially as...

Read the full narrative on International Flavors & Fragrances (it's free!)

International Flavors & Fragrances is expected to reach $11.4 billion in revenue and $784.4 million in earnings by 2028. This outlook assumes an annual revenue decline of 0.3% and a $1,177.4 million increase in earnings from the current loss of $393.0 million.

Uncover how International Flavors & Fragrances' forecasts yield a $84.25 fair value, a 24% upside to its current price.

Exploring Other Perspectives

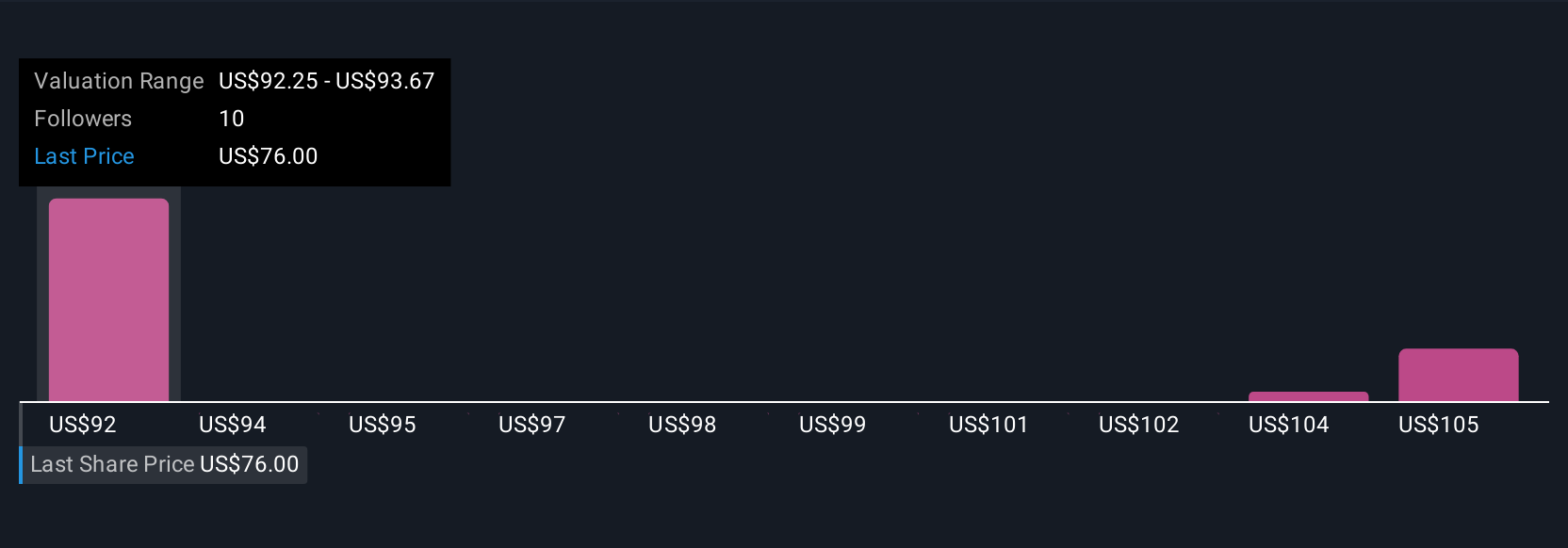

The Simply Wall St Community contributed four fair value estimates for IFF ranging from US$84.25 to US$108.03 per share. While investor confidence is mixed, ongoing margin pressures in legacy businesses remain a key area to watch for changes in sentiment.

Explore 4 other fair value estimates on International Flavors & Fragrances - why the stock might be worth as much as 59% more than the current price!

Build Your Own International Flavors & Fragrances Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Flavors & Fragrances research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free International Flavors & Fragrances research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Flavors & Fragrances' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IFF

International Flavors & Fragrances

Manufactures and markets food, beverage, health and biosciences, scent, pharma solutions, and complementary adjacent products in the United States, Europe, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026