- United States

- /

- Metals and Mining

- /

- NYSE:HCC

Warrior Met Coal (NYSE:HCC) Might Become A Compounding Machine

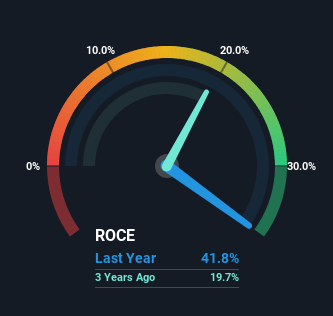

There are a few key trends to look for if we want to identify the next multi-bagger. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. With that in mind, the ROCE of Warrior Met Coal (NYSE:HCC) looks attractive right now, so lets see what the trend of returns can tell us.

Understanding Return On Capital Employed (ROCE)

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Warrior Met Coal, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.42 = US$845m ÷ (US$2.2b - US$128m) (Based on the trailing twelve months to March 2023).

So, Warrior Met Coal has an ROCE of 42%. That's a fantastic return and not only that, it outpaces the average of 12% earned by companies in a similar industry.

View our latest analysis for Warrior Met Coal

In the above chart we have measured Warrior Met Coal's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

SWOT Analysis for Warrior Met Coal

- Earnings growth over the past year exceeded the industry.

- Debt is not viewed as a risk.

- Dividends are covered by earnings and cash flows.

- Dividend is low compared to the top 25% of dividend payers in the Metals and Mining market.

- Good value based on P/E ratio and estimated fair value.

- Annual earnings are forecast to decline for the next 3 years.

What Does the ROCE Trend For Warrior Met Coal Tell Us?

Warrior Met Coal deserves to be commended in regards to it's returns. The company has employed 71% more capital in the last five years, and the returns on that capital have remained stable at 42%. With returns that high, it's great that the business can continually reinvest its money at such appealing rates of return. If these trends can continue, it wouldn't surprise us if the company became a multi-bagger.

In Conclusion...

In summary, we're delighted to see that Warrior Met Coal has been compounding returns by reinvesting at consistently high rates of return, as these are common traits of a multi-bagger. And since the stock has risen strongly over the last five years, it appears the market might expect this trend to continue. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

One final note, you should learn about the 2 warning signs we've spotted with Warrior Met Coal (including 1 which doesn't sit too well with us) .

Warrior Met Coal is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

Valuation is complex, but we're here to simplify it.

Discover if Warrior Met Coal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:HCC

Warrior Met Coal

Engages in the production and export of non-thermal steelmaking coal for the steel production by metal manufacturers in Europe, South America, and Asia.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives