- United States

- /

- Metals and Mining

- /

- NYSE:HCC

How Warrior Met Coal's (HCC) Shelf Registration Could Shape Expansion Plans and Capital Flexibility

Reviewed by Sasha Jovanovic

- In September 2025, Warrior Met Coal filed an omnibus shelf registration with the SEC to potentially issue debt securities, common stock, preferred stock, depositary shares, warrants, and purchase contracts.

- This filing may enable the company to access additional capital for future expansion, operational flexibility, or potential acquisitions as industry conditions evolve.

- We'll explore how the shelf registration could support Blue Creek expansion and affect Warrior Met Coal's long-term investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Warrior Met Coal Investment Narrative Recap

Owning Warrior Met Coal requires confidence in a cyclical, capital-intensive business where the ability to finance growth, especially the Blue Creek expansion, is key to capturing high-margin market opportunities. While the recent shelf registration expands Warrior’s funding options, its immediate impact on the crucial Blue Creek ramp-up and current risk of compressed margins due to weak coal pricing appears limited for now.

Of the recent announcements, the amendment and extension of Warrior's asset-based lending facility most directly supports the company’s liquidity ahead of Blue Creek’s volume ramp, reinforcing the near-term catalyst tied to higher production and cost efficiency. This enhanced access to capital, combined with the shelf registration, positions the company to manage spend and operations as market conditions shift. Despite these strengths, investors should also consider that if steel demand remains subdued and price gaps for lower-grade coal widen, Warrior’s returns could be pressured by...

Read the full narrative on Warrior Met Coal (it's free!)

Warrior Met Coal's outlook anticipates $2.0 billion in revenue and $636.5 million in earnings by 2028. This is based on analysts' expectations of 18.8% annual revenue growth and an increase in earnings of about $596 million from the current $40.3 million.

Uncover how Warrior Met Coal's forecasts yield a $67.33 fair value, a 5% upside to its current price.

Exploring Other Perspectives

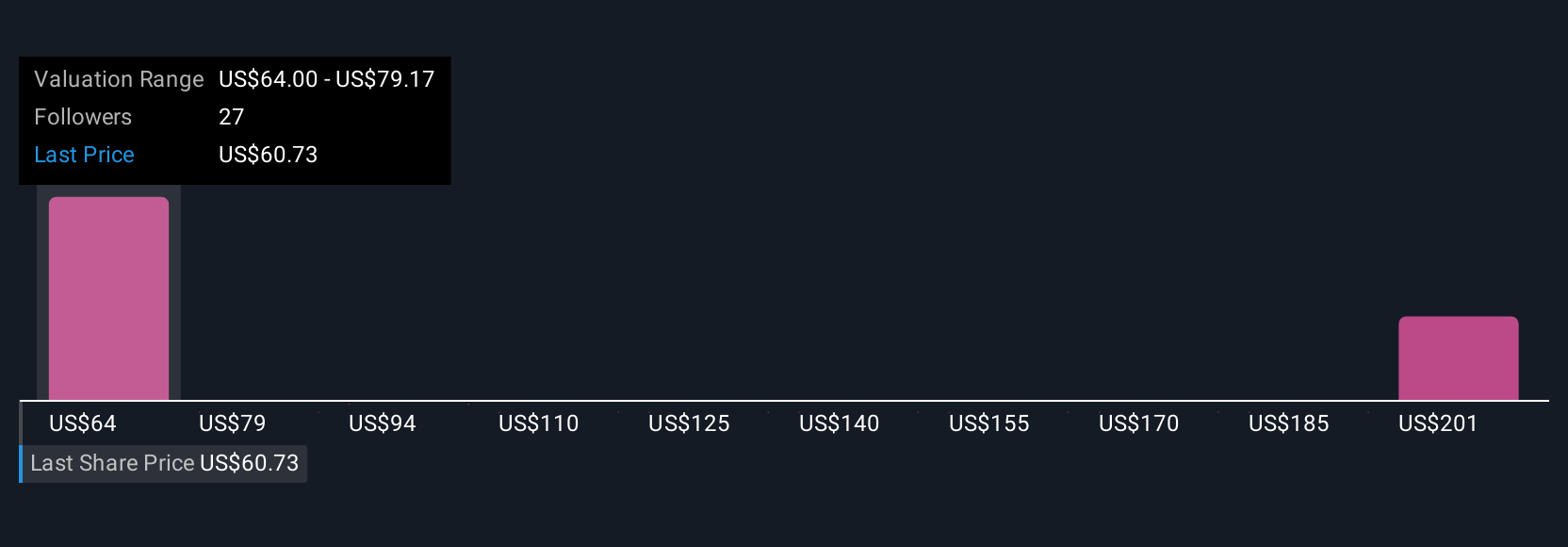

Five Simply Wall St Community valuations of Warrior Met Coal range widely from US$67.33 to US$206.05 per share. With ongoing margin risks from fluctuating Asian demand and coal pricing, you should see how others weigh the company’s future.

Explore 5 other fair value estimates on Warrior Met Coal - why the stock might be worth over 3x more than the current price!

Build Your Own Warrior Met Coal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Warrior Met Coal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Warrior Met Coal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Warrior Met Coal's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warrior Met Coal might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HCC

Warrior Met Coal

Engages in the production and export of non-thermal steelmaking coal for the steel production by metal manufacturers in Europe, South America, and Asia.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives