- United States

- /

- Chemicals

- /

- NYSE:FMC

FMC (NYSE:FMC) Urges Shareholders To Reject Proposal On Special Meeting Requirements

Reviewed by Simply Wall St

FMC Corporation (NYSE:FMC) has recently been in the spotlight due to a preliminary proxy statement opposing a shareholder proposal aimed at lowering the threshold for calling special meetings, an initiative that management views as a potential conflict with current governance practices. This development, alongside FMC's affirmation of a regular quarterly dividend of 58 cents per share, coincides with a 4.29% decline in the company’s share price over the past week. This dip is noteworthy given the backdrop of broader market volatility, where major indexes like the Dow Jones experienced slight gains and losses amid ongoing discussions about tariffs and economic data concerns. The general market downturn, with the market dropping 3.1% over the same period, further contextualizes FMC’s price movements, highlighting external pressures in addition to internal governance challenges that influenced the company's share performance.

Get an in-depth perspective on FMC's performance by reading our analysis here.

Over the past year, FMC Corporation has experienced a total shareholder return of 36.18% decline. This performance has lagged significantly behind the broader US market, which recorded a return of 13.1% over the same period. FMC also underperformed the US Chemicals industry, which saw a 3.9% decline, highlighting the company's struggles amidst challenging conditions.

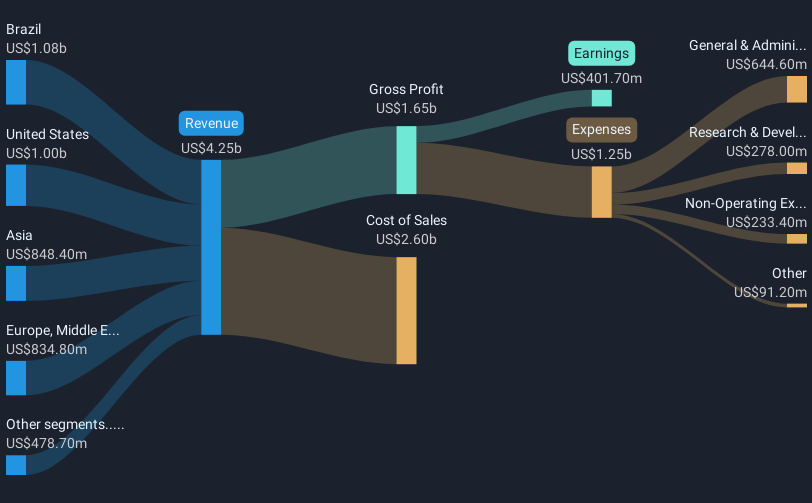

Several events over the past year played critical roles in FMC's share performance. Notably, the company reported a full-year net income of US$341.1 million, a stark decrease from the previous year's US$1.32 billion. In February, a class action lawsuit alleged misleading statements about company performance, potentially impacting investor sentiment. Additionally, FMC settled to pay US$56.1 million as part of an environmental claims resolution. Despite sustaining a high dividend payout, these challenges were compounded by a significant one-off loss of US$146.8 million, casting a shadow over its financial health and influencing investor perceptions.

- See how FMC measures up with our analysis of its intrinsic value versus market price.

- Understand the uncertainties surrounding FMC's market positioning with our detailed risk analysis report.

- Have a stake in FMC? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FMC

FMC

An agricultural sciences company, provides crop protection solutions to farmers in Latin America, North America, Europe, the Middle East, Africa, and Asia.

6 star dividend payer and undervalued.