- United States

- /

- Chemicals

- /

- NYSE:FMC

FMC (NYSE:FMC) Declares US$0.58 Quarterly Dividend Payable in April 2025

Reviewed by Simply Wall St

FMC Corporation (NYSE:FMC) recently reaffirmed its dividend, with a declaration of a regular quarterly dividend of 58 cents per share, payable April 17, 2025. Despite this, the company's share price declined by 3.5% over the past week. This price movement comes amid broader market conditions where major indexes like the Nasdaq and S&P 500 experienced declines of up to 3.5% amidst an uncertain economic climate marked by trade-related tensions and inflation data. The company's setback during the week contrasts with the market's initial positive reaction to eased inflation concerns, potentially influenced by overall market volatility and investor sentiment adjusting to wider economic pressures, including President Trump's tariff announcements. While the market noted some relief from inflation pressures, FMC's price move highlights the complex interplay of market dynamics influencing individual stocks.

See the full analysis report here for a deeper understanding of FMC.

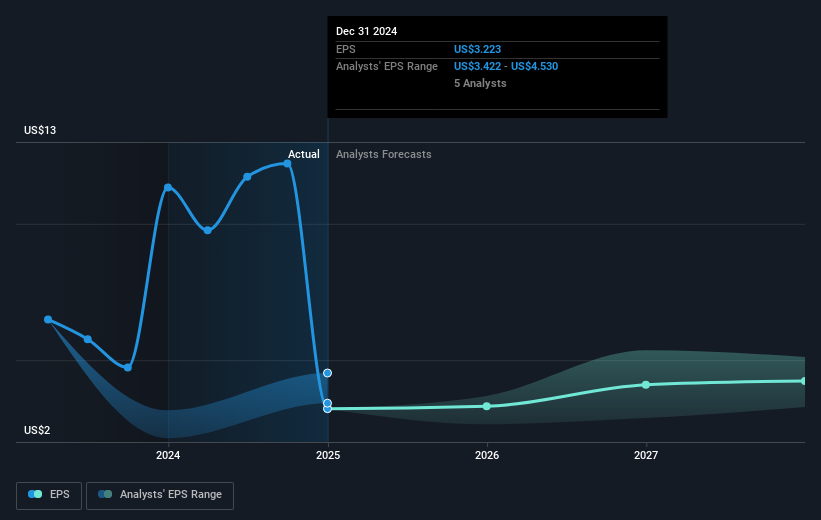

Over the last year, FMC Corporation's total shareholder return, which encompasses both share price and dividends, was a decline of 32.96%. This underperformance starkly contrasts with the US market and US Chemicals industry, which returned 14.7% and a slight decline of 1.6% respectively. Numerous factors have influenced FMC's share performance during this period. In early 2025, a class action lawsuit was filed, impacting investor sentiment. Additionally, FMC faced a one-off net loss of US$238 million due to a large non-recurring expense, contributing to weaker profit margins and a substantial drop in earnings.

Throughout the year, FMC's share price volatility was notable, influenced by mixed earnings results. For instance, the Q1 2024 earnings revealed a decline in revenue to US$918 million, compared to US$1,344.3 million the previous year. Moreover, the late 2024 CEO transition could have added to the uncertainty surrounding the stock. Despite these challenges, FMC's dividends remained strong, providing some support to total returns.

- Learn how FMC's intrinsic value compares to its market price with our detailed valuation report.

- Assess the potential risks impacting FMC's growth trajectory—explore our risk evaluation report.

- Is FMC part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FMC

FMC

An agricultural sciences company, provides crop protection, plant health, and professional pest and turf management products.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives