- United States

- /

- Metals and Mining

- /

- NYSE:FCX

Will HSBC’s Commodity Price Upgrade Shift Freeport-McMoRan’s (FCX) Long-Term Outlook?

Reviewed by Sasha Jovanovic

- HSBC recently upgraded Freeport-McMoRan, highlighting expectations that robust copper and gold prices will help counter ongoing operational disruptions at its Grasberg mine in Indonesia.

- The upgrade underscores how analyst sentiment can shift quickly in response to commodity price movements, even amid significant production and legal challenges at major assets.

- We'll examine how HSBC’s increased confidence, driven by higher copper and gold prices, impacts Freeport-McMoRan’s longer-term investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Freeport-McMoRan Investment Narrative Recap

To be a shareholder in Freeport-McMoRan, you need to believe in sustained strength for copper and gold prices, as well as the company’s ability to manage complex operations at its Indonesian assets, particularly the Grasberg mine. While HSBC’s upgrade highlights confidence in metal prices offsetting recent operational setbacks at Grasberg, the short-term catalyst remains the mine’s return to full production and legal clarity around ongoing investigations; recent news doesn’t materially alter that immediate focus or the biggest risk tied to Grasberg’s reliability and regulatory exposure.

Among recent announcements, Freeport’s planned dividend of US$0.15 per share stands out, underscoring its commitment to returning capital to shareholders even as operational and legal challenges emerge. This balance between rewarding investors and addressing mine disruptions frames the upcoming earnings report as a crucial indicator for how the company navigates its core risks and opportunities.

But on the flip side, investors should be aware that legal and operational risks from incidents at Grasberg remain unresolved and...

Read the full narrative on Freeport-McMoRan (it's free!)

Freeport-McMoRan's outlook anticipates $31.1 billion in revenue and $3.3 billion in earnings by 2028. This is based on a projected revenue growth rate of 6.4% per year and reflects a $1.4 billion increase in earnings from the current level of $1.9 billion.

Uncover how Freeport-McMoRan's forecasts yield a $46.59 fair value, a 10% upside to its current price.

Exploring Other Perspectives

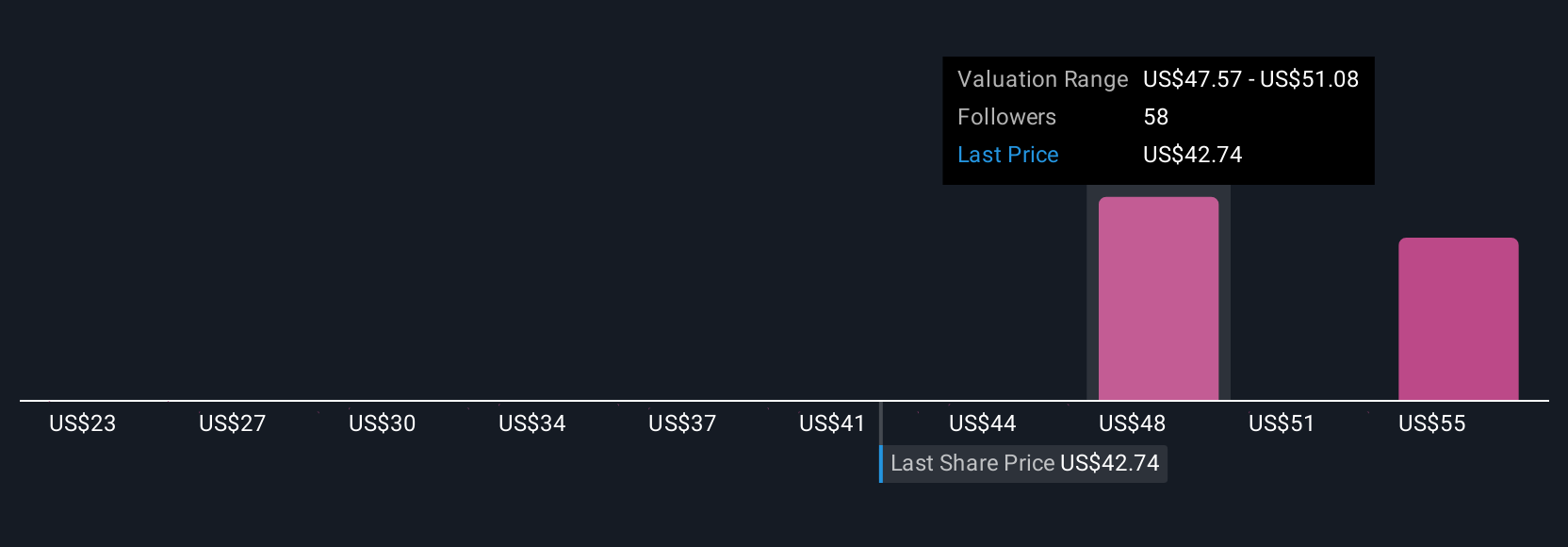

Simply Wall St Community members provided 11 fair value estimates for Freeport-McMoRan, ranging widely from US$25.20 to US$75.21 per share. With Grasberg mine risks back in focus, you’ll find plenty of distinct perspectives worth considering.

Explore 11 other fair value estimates on Freeport-McMoRan - why the stock might be worth 40% less than the current price!

Build Your Own Freeport-McMoRan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freeport-McMoRan research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Freeport-McMoRan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freeport-McMoRan's overall financial health at a glance.

No Opportunity In Freeport-McMoRan?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FCX

Freeport-McMoRan

Engages in the mining of mineral properties in North America, South America, and Indonesia.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives