- United States

- /

- Metals and Mining

- /

- NYSE:FCX

Here's Why We Think Freeport-McMoRan (NYSE:FCX) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Freeport-McMoRan (NYSE:FCX). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Freeport-McMoRan

How Quickly Is Freeport-McMoRan Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Recognition must be given to the that Freeport-McMoRan has grown EPS by 38% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

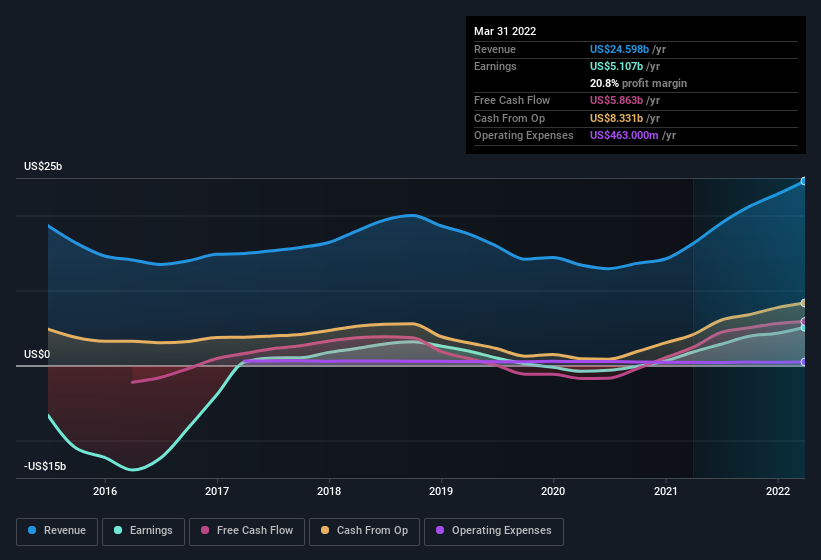

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Freeport-McMoRan is growing revenues, and EBIT margins improved by 14.0 percentage points to 39%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Freeport-McMoRan?

Are Freeport-McMoRan Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Insider selling of Freeport-McMoRan shares was insignificant compared to the one buyer, over the last twelve months. To be exact, company insider Hugh Grant put their money where their mouth is, paying US$501k at an average of price of US$40.75 per share That can definitely be seen as a sign of conviction.

On top of the insider buying, it's good to see that Freeport-McMoRan insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth US$200m. This comes in at 0.4% of shares in the company, which is a fair amount of a business of this size. This still shows shareholders there is a degree of alignment between management and themselves.

Should You Add Freeport-McMoRan To Your Watchlist?

Freeport-McMoRan's earnings per share growth have been climbing higher at an appreciable rate. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Freeport-McMoRan deserves timely attention. Still, you should learn about the 3 warning signs we've spotted with Freeport-McMoRan (including 1 which is significant).

The good news is that Freeport-McMoRan is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FCX

Freeport-McMoRan

Engages in the mining of mineral properties in North America, South America, and Indonesia.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives