- United States

- /

- Chemicals

- /

- NYSE:ECVT

Ecovyst (ECVT) Discusses Sale Of Advanced Materials & Catalysts To Technip Energies

Reviewed by Simply Wall St

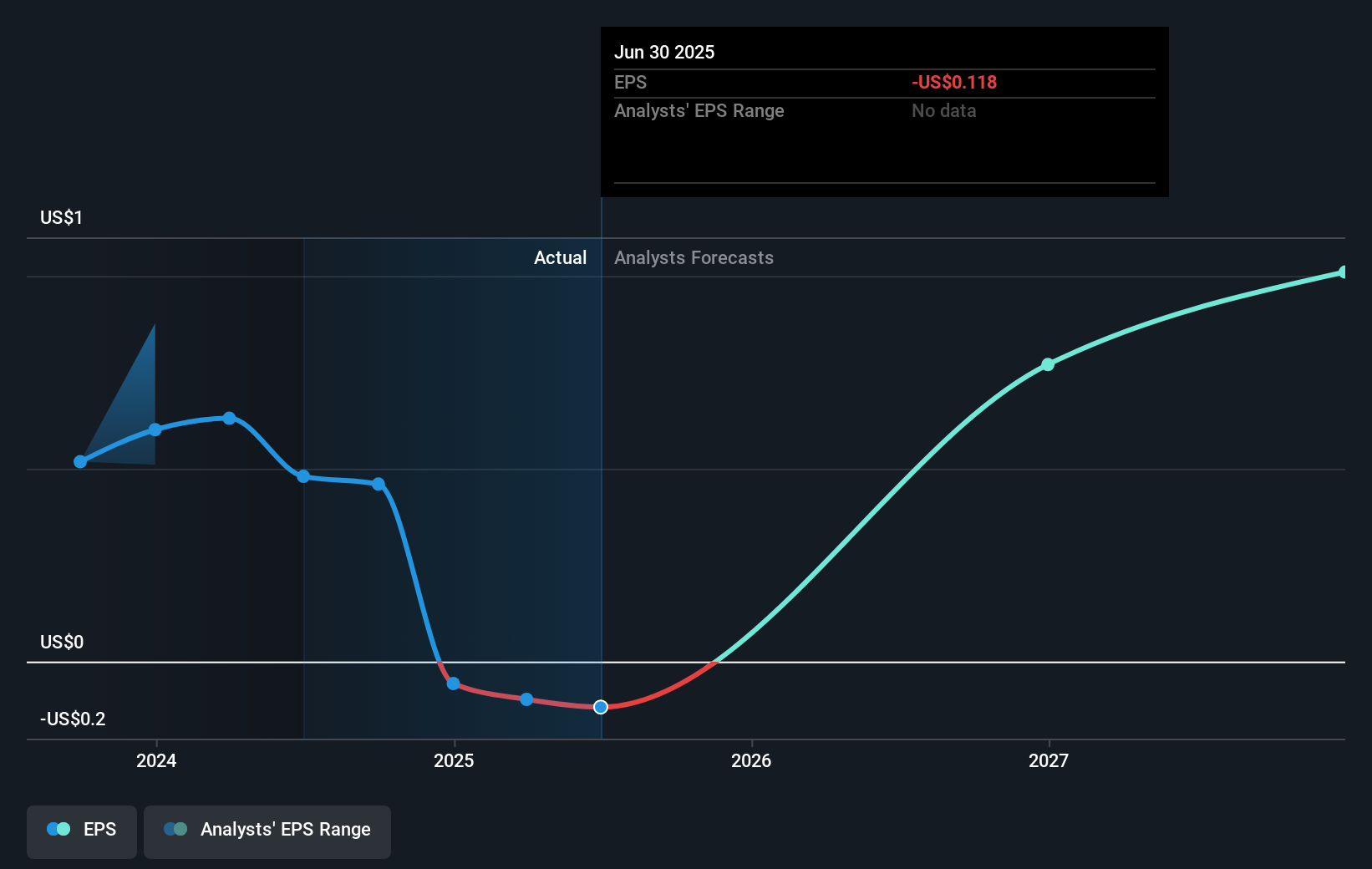

Ecovyst (ECVT) recently grabbed attention with Technip Energies N.V.'s planned acquisition of its Advanced Materials & Catalysts business, a significant factor likely influencing its stock price move of 15% over the last quarter. This development highlights potential strategic shifts for the company in the materials sector. Despite reporting mixed Q2 earnings with increased sales but lower net income, Ecovyst's updated guidance and substantial stock buybacks underscore company confidence. Amidst these internal changes, broader market enthusiasm—fueled by rising U.S. indexes anticipating potential Federal Reserve rate cuts—provided additional support to Ecovyst's price performance.

We've discovered 1 risk for Ecovyst that you should be aware of before investing here.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

The recent announcement of Technip Energies N.V.'s acquisition of Ecovyst's Advanced Materials & Catalysts business could significantly shift the company's revenue and earnings forecasts. This divestment may allow Ecovyst to sharpen its focus on core areas such as renewable diesel and mining, potentially driving long-term revenue growth. However, the short-term earnings might be affected due to the initial transition phase and the reduced contribution from the divested business. The strategic focus on renewable diesel and clean energy aligns with broader industry trends, possibly boosting Ecovyst's future revenue streams.

Over the last year, Ecovyst's shares delivered a total return of 44.50%, a substantial increase that reflects both internal strategic moves and favorable market conditions. Comparatively, Ecovyst outperformed the US Chemicals industry, which posted a decline of 5.1% during the same period. This strong performance juxtaposes its current unprofitability and challenges, such as customer concentration and industry overcapacity.

Currently trading at US$9.19, Ecovyst's share price shows a 13.2% gap to the analyst consensus price target of US$10.33. While this price target suggests potential upside, it is contingent on the company's ability to successfully navigate operational synergies and tap into new revenue avenues from the clean energy sector. The upcoming Kansas City expansion and Waggaman facility acquisition are pivotal projects expected to bolster Ecovyst’s capacity and long-term profitability. Investors should continue to monitor these developments closely as they could substantially impact Ecovyst's earnings trajectory and valuation.

Evaluate Ecovyst's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Ecovyst might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECVT

Ecovyst

Offers specialty catalysts and services in the United States and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)