- United States

- /

- Chemicals

- /

- NYSE:ECL

Ecolab (ECL) Unveils AI-Powered RushReady To Revolutionize Restaurant Operations

Reviewed by Simply Wall St

Ecolab (ECL) recently launched the AI-driven RushReady™ program aimed at enhancing restaurant operations, which could be a contributing factor to its 14% share price increase over the last quarter. This rise aligns with the broader market, as the S&P 500 reached record highs amid trade deal optimism and strong corporate earnings expectations. Alongside RushReady™, Ecolab introduced the Purolite AP+50 resin for cost-effective antibody manufacturing and the innovative 3D TRASAR Technology for data center cooling, both bolstering its product lineup. These developments might have supported the company's performance within a broadly positive market trend.

Ecolab has 1 warning sign we think you should know about.

The recent initiatives by Ecolab, such as RushReady™ and Purolite AP+50, may complement the company's One Ecolab initiative by broadening market reach and enhancing efficiency in operations. These moves could bolster revenue by expanding into new sectors, potentially supporting the existing narrative of targeted growth and profit margin improvement.

Over a longer period, Ecolab's total shareholder return was 76.73% over three years. This contrasts with its recent one-year performance, where Ecolab lagged the US market's 13.7% return but outperformed the average -3.5% return of the US Chemicals industry. Such historical performance shows the potential volatility and cyclical nature of the sector.

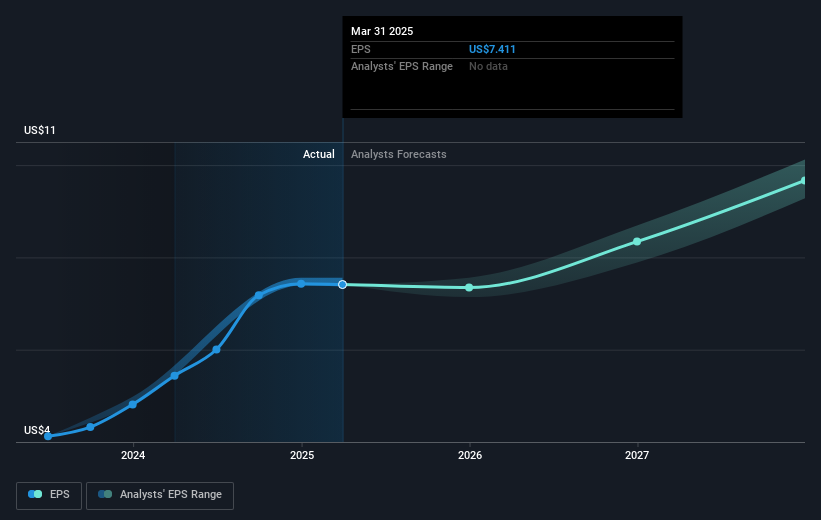

The addition of AI-driven technology and specialized product development might impact upcoming revenue and earnings forecasts, aligning with the projected annual revenue growth rate of 4.8% and an increase in profit margins to 15% over the next three years. Given the current share price of US$270.55, Ecolab trades close to the consensus price target of US$276.21, suggesting limited room for short-term price appreciation. Each of these elements helps shape an understanding of Ecolab's strategic position and financial outlook.

Unlock comprehensive insights into our analysis of Ecolab stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ecolab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ECL

Ecolab

Provides water, hygiene, and infection prevention solutions and services in the United States and internationally.

Outstanding track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives