- United States

- /

- Metals and Mining

- /

- NYSE:DRD

Is DRDGOLD Still a Smart Pick After Stunning 179.9% Price Surge in 2025?

Reviewed by Bailey Pemberton

Trying to decide what to do with your DRDGOLD stock or thinking about jumping in? You are not alone. Over the past year, DRDGOLD’s price has been anything but boring, rising a stunning 179.9% over the last 12 months and delivering a massive 218.8% year-to-date. In just the last month, the stock has added another 25.6%, leaving most of the sector in the dust. Even in the last week, it edged up a solid 0.5%, showing resilience as investors weigh shifting signals in the gold market. Part of this story is bigger picture market sentiment. Renewed interest in gold as a safe haven, continued uncertainty in global markets, and steadier costs on the production front are bringing in new buyers and ramping up excitement.

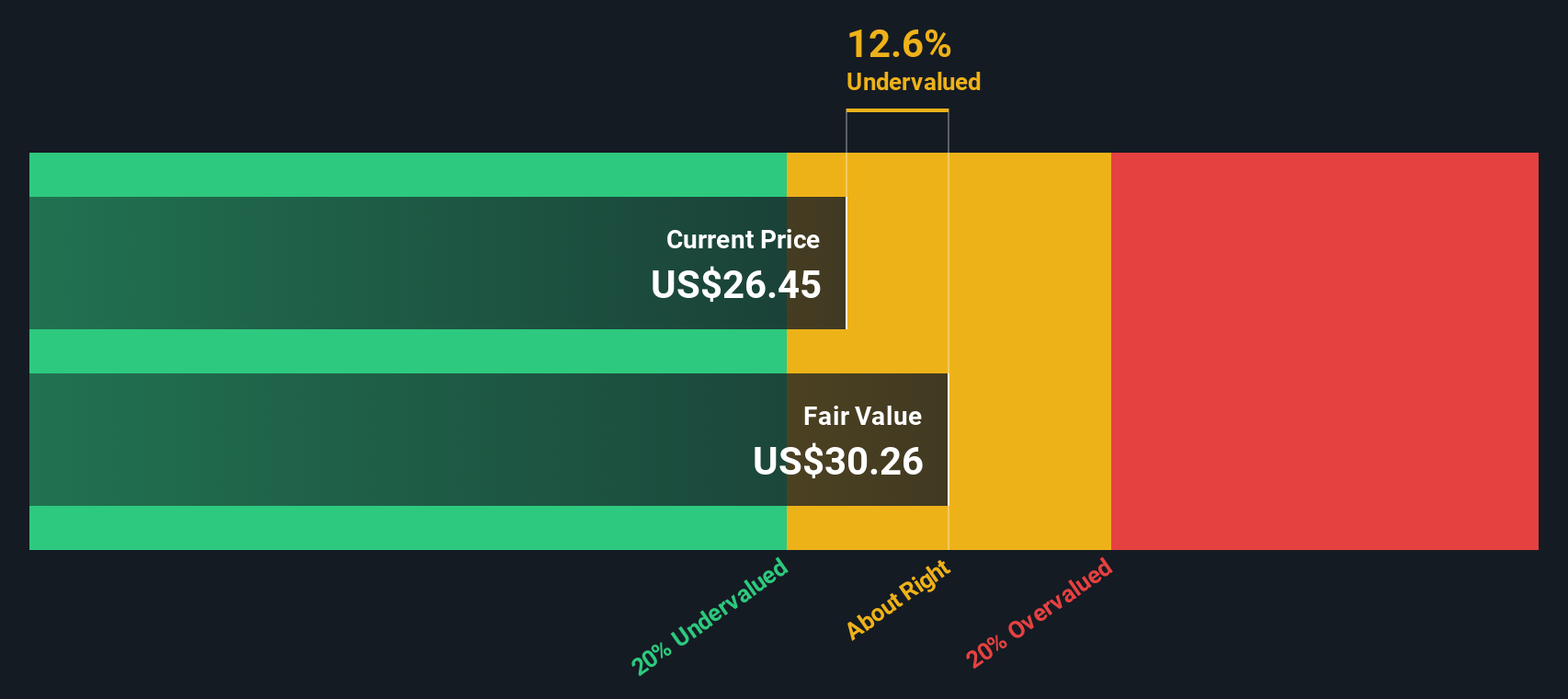

With price gains like these, you are right to wonder: is DRDGOLD still a good value, or are we entering overbought territory? Our initial look at the company’s valuation shows a strong value score of 4 out of 6, meaning DRDGOLD is undervalued in most of the key checks we analyze. Whether you are considering an entry point or holding out for another climb, understanding what is behind this score is essential.

Let’s break down the different approaches analysts use to value DRDGOLD. Stick around to the end, because there is an even clearer way to put these numbers in perspective that you will not want to miss.

Approach 1: DRDGOLD Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular tool that estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach helps investors look beyond current market noise and focus on DRDGOLD's true earning potential over time.

For DRDGOLD, the latest reported Free Cash Flow (FCF) stands at ZAR 946.2 Million. Analyst projections show this number growing quickly, and by 2028, the expected annual FCF reaches ZAR 5.90 Billion. Looking further out, extrapolated estimates suggest FCF could rise even higher by 2035. All these projections are based on cash flows denominated in ZAR, the company’s reporting currency.

The results of this DCF analysis show that DRDGOLD’s fair value per share is estimated at $61.66. Compared to its current price, the DCF model implies the stock is 53.4% undervalued. This indicates that the market price is considerably below what the company’s long-term cash flows suggest it is worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DRDGOLD is undervalued by 53.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: DRDGOLD Price vs Earnings (PE)

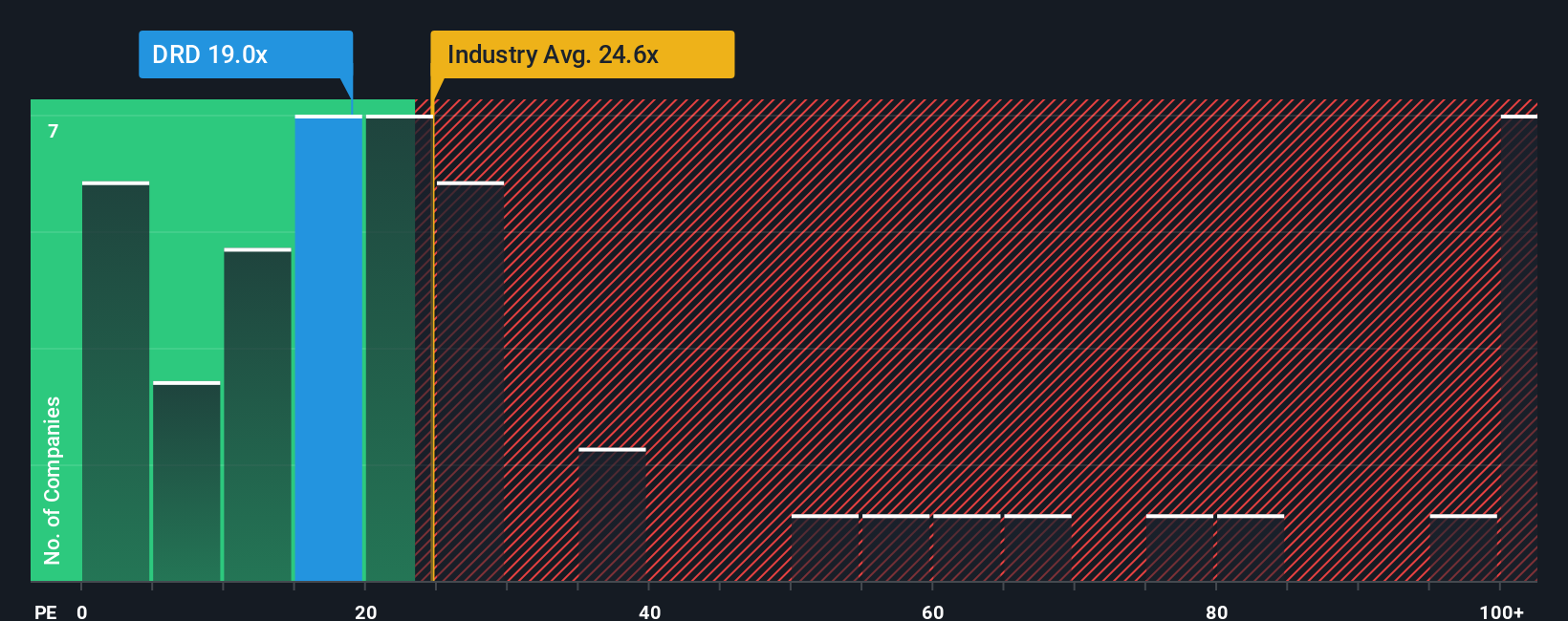

The Price-to-Earnings (PE) ratio is a go-to metric for valuing profitable companies because it ties a company’s current share price to how much net profit it generates. Since DRDGOLD is solidly in the black, the PE ratio gives investors a direct sense of what they are paying for each dollar of earnings, which is a key decision point when comparing investment opportunities.

It’s important to know that what counts as a "fair" PE ratio is shaped by expectations for future growth and the risks a business faces. High-growth companies typically command a higher PE, whereas a higher-risk or slower-growing stock might trade at a discount. That is why comparing DRDGOLD to the right benchmarks is crucial.

Currently, DRDGOLD’s PE ratio is 19.33x. For context, the Metals and Mining industry average stands at 24.58x and the average for DRDGOLD’s selected peers is even higher at 31.21x. On the surface, this suggests DRDGOLD is trading at a discount to both its sector and competitor group.

Instead of relying solely on industry or peer averages, it is more insightful to look at Simply Wall St’s proprietary “Fair Ratio.” This takes into account not just broad metrics, but also company-specific factors like DRDGOLD’s earnings growth outlook, profit margins, risks unique to its business, and even its market cap. This approach offers a more complete and nuanced picture of valuation that goes beyond surface-level comparisons.

Comparing DRDGOLD’s actual PE of 19.33x to its Fair Ratio shows a notable gap. Since the difference is clearly more than 0.10, it reinforces that based on this approach, the stock is undervalued against what its fundamentals would justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DRDGOLD Narrative

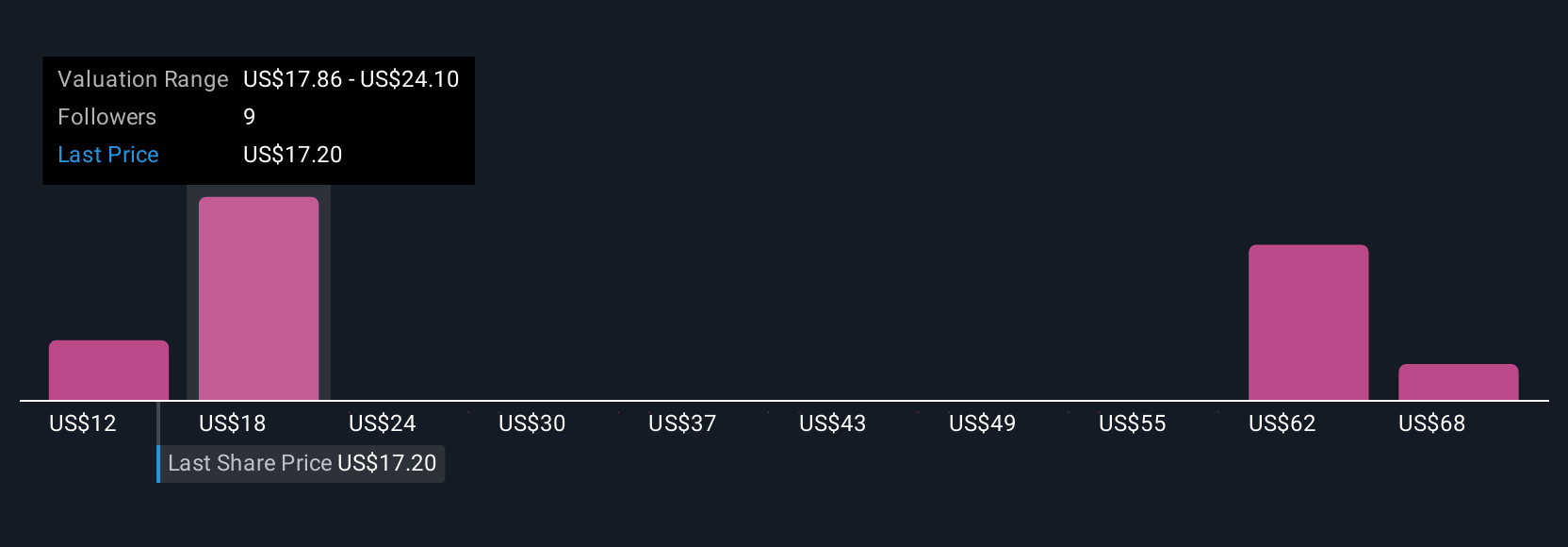

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a powerful, user-friendly tool that lets you craft your own story behind the numbers by combining your assumptions about DRDGOLD’s fair value, future earnings, and margins with real-world insights about the business.

Think of a Narrative as a bridge that connects the company’s business outlook to a financial forecast, and then to a calculated fair value. Instead of viewing stocks as just numbers on a screen, Narratives allow you to bring your perspective to the table, making valuation both personal and meaningful.

On Simply Wall St's platform, millions of investors use Narratives on the Community page to instantly visualize how their forecasts stack up against the current market price. This helps them decide not only if DRDGOLD is undervalued or overvalued, but also if it is the right time to buy or sell.

What makes Narratives truly dynamic is their ability to update automatically whenever there is relevant news or earnings releases, so your view always stays current.

- One investor may set a fair value for DRDGOLD at $75 amid bullish gold price forecasts

- Another may opt for $40, factoring in higher risks and lower future margins

Do you think there's more to the story for DRDGOLD? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DRD

DRDGOLD

A gold mining company, engages in the extraction of gold from the retreatment of surface mine tailings in South Africa.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026