- United States

- /

- Chemicals

- /

- NYSE:DOW

Dow (DOW) Profitability Forecast Challenges Bearish Narratives Despite Five Years of Rising Losses

Reviewed by Simply Wall St

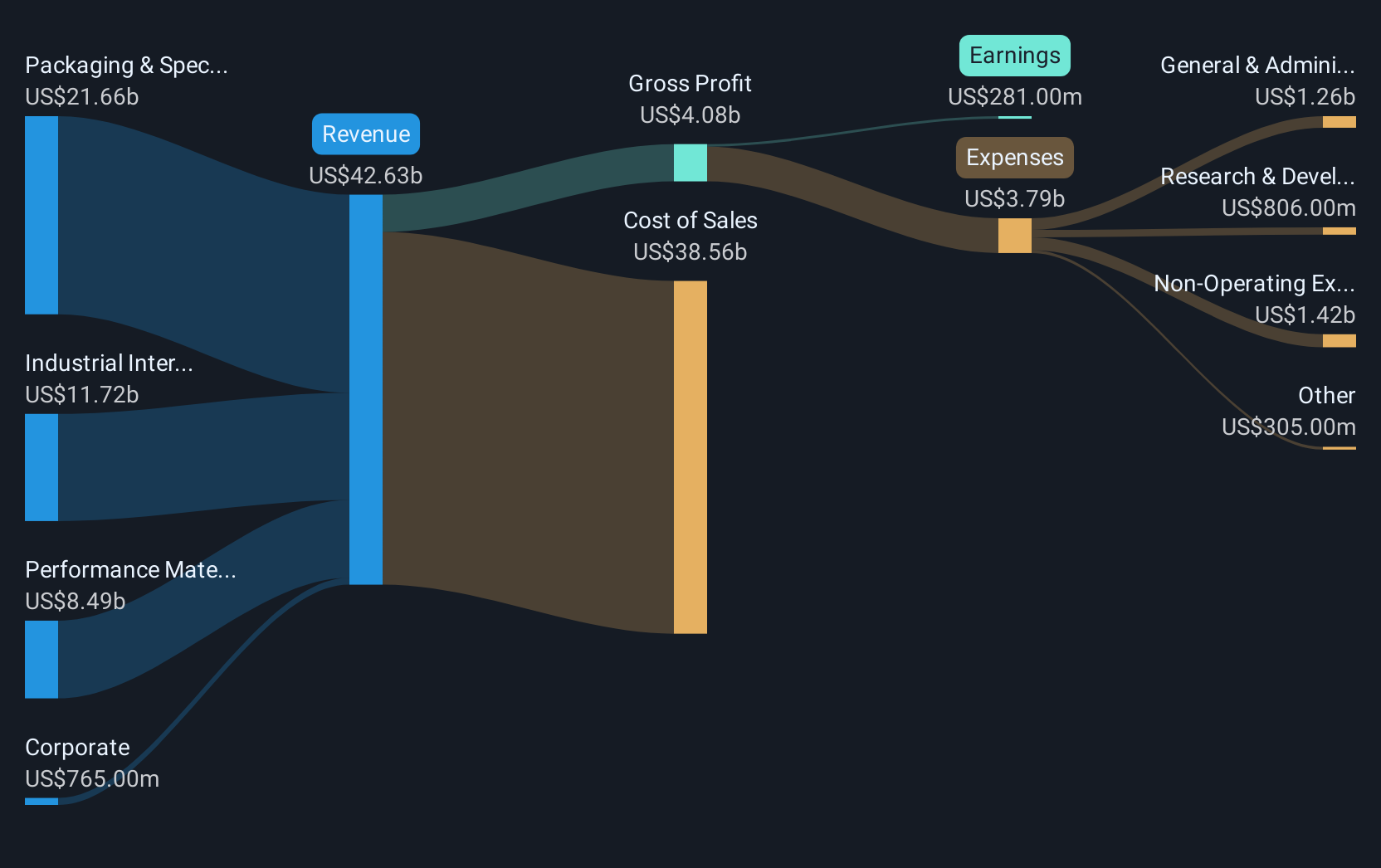

Dow (DOW) remains in the red, with net losses accelerating at an average rate of 27.6% per year over the last five years. Despite the ongoing unprofitability, investors are eyeing a potential turnaround as earnings are forecast to grow by 69.97% annually. A return to profitability is expected within the next three years. In contrast, revenue is projected to edge up by just 1.9% per year, trailing the broader US market’s 10.1% average growth. With shares trading at $24.81, well above the estimated fair value of $14.5, Dow’s modest sales growth and widening losses are sparking debate about the sustainability of its recovery story.

See our full analysis for Dow.Up next, we’ll see how these headline results stack up against the market’s most widely followed narratives, highlighting where expectations are met and where surprises might be brewing.

See what the community is saying about Dow

Margins Poised to Swing Positive by 2026

- Analysts expect profit margins to reverse from -2.4% now to +3.3% within the next three years, aiming for $1.5 billion in earnings by September 2028.

- According to the analysts' consensus view, this margin turnaround is supported mainly by cost-cutting and asset optimization strategies.

- Dow targets at least $1 billion in annual cost reductions by 2026; these efforts are expected to reinforce margin recovery even if revenue rises slowly.

- Strategic asset reviews, including idling or shutting down three European assets, aim to improve near-term cash flow and reduce excess capacity. These moves are designed to directly tackle macroeconomic and regulatory headwinds.

- While margin improvement is in focus, consensus analysts still see the need for Dow to navigate energy and feedstock cost pressures that may challenge the expected pace of recovery.

- If cost savings and divestiture proceeds materialize as planned, analysts expect these factors could help overcome delays in growth projects like Path2Zero.

- Unexpected increases in global energy costs or longer-than-expected project delays would leave Dow more exposed to below-average GDP growth, especially in its European operations.

Cash Flow Gets a Boost From Asset Sales

- Dow anticipates a $2.4 billion inflow from selling selected US Gulf Coast infrastructure stakes and more than $1 billion from litigation. Both are set to strengthen its liquidity this year.

- The consensus narrative suggests that these one-off windfalls give Dow near-term breathing room for capital allocation and cash management.

- Analysts note that asset sales and legal proceeds can fund CapEx, help manage rising labor and feedstock costs, and support targeted investments in higher-margin operations.

- However, sustained improvement in recurring cash flow will still depend on margin expansion and cost control, since slow 1.9% annual revenue growth limits organic cash generation opportunities.

Valuation Discount Stands Out Despite Profit Headwinds

- Dow’s price-to-sales ratio of 0.4x is well below the US Chemicals industry average of 1.2x and the peer group average of 0.7x, even as it trades over DCF fair value ($24.81 vs. $14.50).

- The analysts' consensus view highlights that while the discounted valuation attracts value-oriented investors, the company’s ability to justify a target price of $27.76 hinges on achieving projected margin and earnings recovery within three years.

- Peer and industry multiples suggest Dow offers valuation upside if it meets consensus profit targets; otherwise, the share price could revert to nearer DCF fair value.

- Analysts encourage cross-checking assumptions on future margins, as ongoing unprofitability and modest revenue outlook remain material concerns for those weighing an entry at today’s price.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Dow on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a unique take on the numbers? Share your own analysis and shape the story with a fresh perspective in just a few minutes. Do it your way

A great starting point for your Dow research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

With Dow facing persistent losses, modest revenue growth, and limited cash generation, concerns remain about its ability to deliver a sustainable turnaround.

If you’re seeking companies with less valuation risk and greater upside, check out these 877 undervalued stocks based on cash flows to find investments trading below their intrinsic value and offering stronger fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOW

Dow

Through its subsidiaries, provides various materials science solutions for packaging, infrastructure, mobility, and consumer applications in the United States, Canada, Europe, the Middle East, Africa, India, the Asia Pacific, and Latin America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)