- United States

- /

- Life Sciences

- /

- NYSE:DNA

Loss-making Ginkgo Bioworks Holdings (NYSE:DNA) sheds a further US$1.5b, taking total shareholder losses to 72% over 1 year

As every investor would know, you don't hit a homerun every time you swing. But it should be a priority to avoid stomach churning catastrophes, wherever possible. So we hope that those who held Ginkgo Bioworks Holdings, Inc. (NYSE:DNA) during the last year don't lose the lesson, in addition to the 72% hit to the value of their shares. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. Because Ginkgo Bioworks Holdings hasn't been listed for many years, the market is still learning about how the business performs. On top of that, the share price is down 23% in the last week.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Ginkgo Bioworks Holdings

Given that Ginkgo Bioworks Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Ginkgo Bioworks Holdings grew its revenue by 340% over the last year. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price down 72% over twelve months. There's clearly something unusual going on here such as an acquisition that hasn't delivered expected profits. What is clear is that the market is not judging the company on its revenue growth right now. Of course, markets do over-react so share price drop may be too harsh.

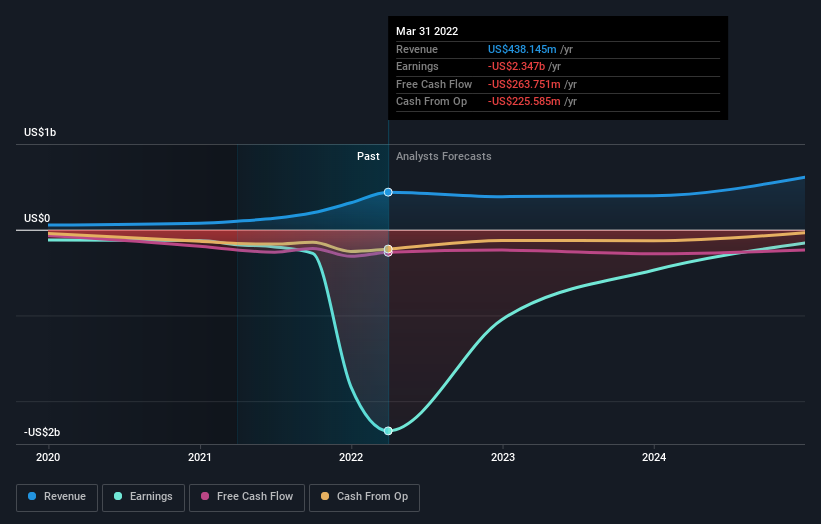

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Ginkgo Bioworks Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Ginkgo Bioworks Holdings shareholders are down 72% for the year, even worse than the market loss of 16%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. The share price decline has continued throughout the most recent three months, down 0.4%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Ginkgo Bioworks Holdings you should know about.

But note: Ginkgo Bioworks Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DNA

Ginkgo Bioworks Holdings

Develops a platform for cell programming in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026