- United States

- /

- Chemicals

- /

- NYSE:CTVA

Does the Recent Corteva Pullback Signal an Opportunity Amidst Agri-Business Volatility?

Reviewed by Bailey Pemberton

If you’re trying to figure out what to do with Corteva stock right now, you’re not alone. Over the last year, the company has posted a modest 6.1% return, and the gains get even more impressive as you zoom out. Investors who bought five years ago are sitting on a nearly 100% return. Still, not everything has been smooth sailing lately. The stock’s dropped nearly 12% over the last month, and it’s slipped about 2% in just the past week. For anyone watching from the sidelines, these swings probably look like both an opportunity and a risk.

Part of what’s driving these moves are shifts in the broader agri-business landscape. Recent market focuses on input cost inflation and shifting global crop demand have pushed sentiment back and forth, translating into short-term volatility for companies like Corteva. Yet, despite the recent cooling-off, the year-to-date chart still shows the stock up by 9.9%. That consistency hints at underlying strength.

So what about valuation? Using our scorecard that measures undervaluation across six key checks, Corteva earns a value score of 3 out of 6. That’s not a screaming bargain, but it does suggest that there could be pockets of opportunity here, especially for those who dig a little deeper.

To really figure out whether Corteva deserves a spot in your portfolio, let’s break down the main valuation approaches. Stick around, because at the end I’ll share a perspective on value that often gets overlooked.

Approach 1: Corteva Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the true worth of a company by projecting its future cash flows and discounting them back to today’s dollars. This method considers how much cash the company is expected to generate each year, then calculates what that stream of cash is actually worth right now, factoring in time and risk.

Corteva’s latest reported Free Cash Flow stands at $2.58 billion. Analysts forecast steady growth in these numbers, with projections calling for Free Cash Flow of approximately $2.62 billion by the end of 2028. Beyond that, additional extrapolation puts Corteva’s Free Cash Flow at about $3.66 billion ten years into the future. These projections are important, as most analyst estimates only look five years out. Further numbers are derived by extending the underlying trends.

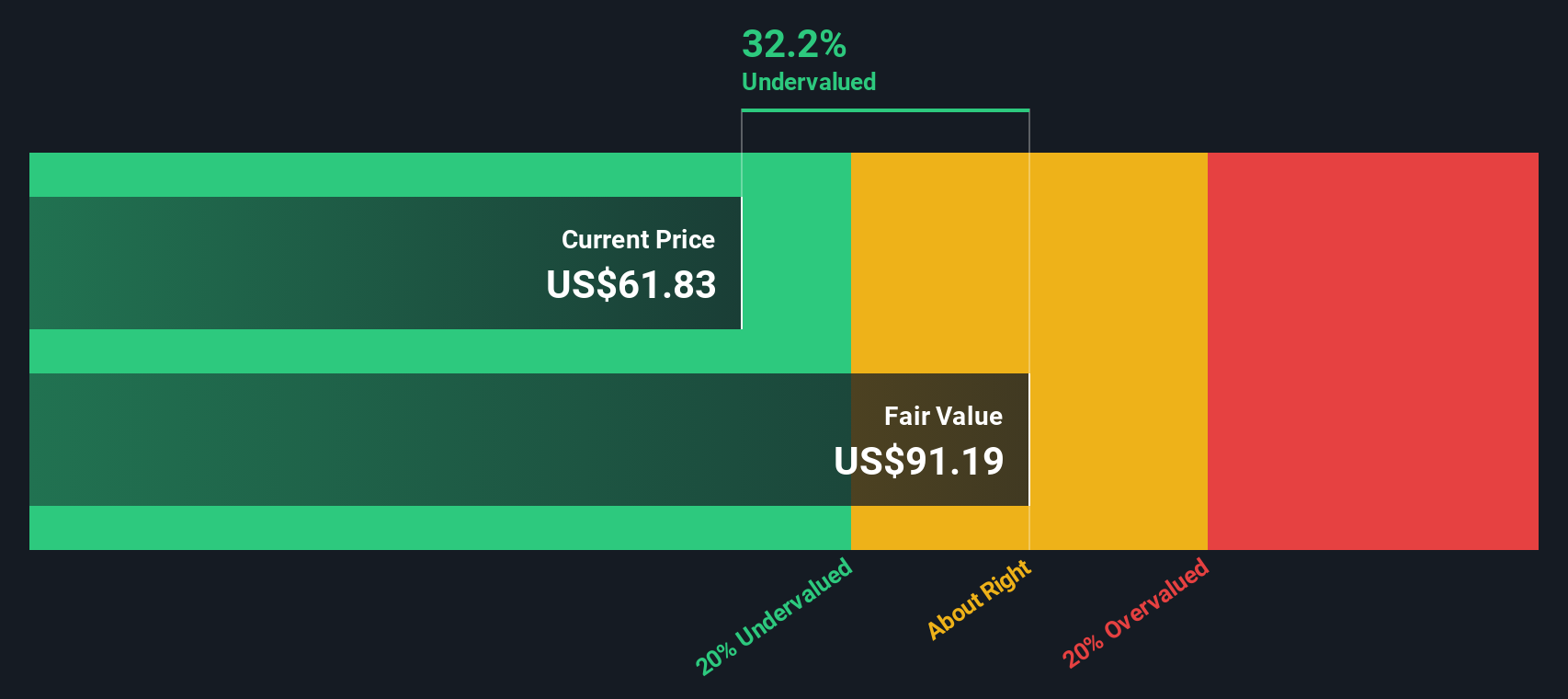

Based on the DCF model, the estimated intrinsic value of Corteva stock is $91.06. At the moment, this implies the stock is trading at a 32.0% discount to its intrinsic value, signaling a significant opportunity for investors who believe in the company’s long-term cash-generating potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Corteva is undervalued by 32.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Corteva Price vs Earnings

For profitable companies like Corteva, the Price-to-Earnings (PE) ratio is a widely used metric because it directly ties the company’s share price to its net profits, giving investors a familiar way to gauge value based on actual earnings power. The "right" PE ratio for a stock is not one-size-fits-all. It is shaped by factors such as growth expectations, business risks, and how stable or cyclical the company’s profits tend to be.

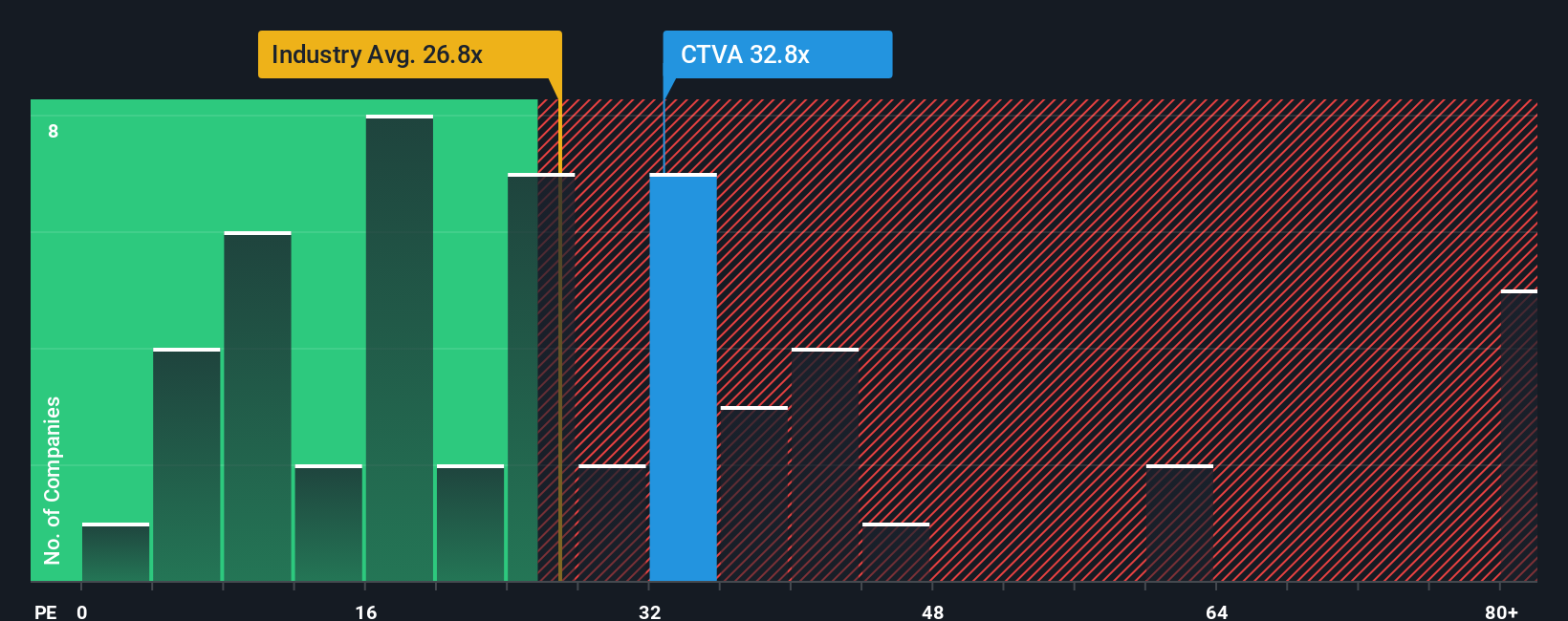

Right now, Corteva trades at a PE ratio of 28.6x. For context, that is a bit higher than the Chemicals industry average of 25.0x, and it is above the average for its selected peers, which sits at roughly 25.8x. If you were to just line those numbers up, it might seem like Corteva’s trading at a premium.

However, Simply Wall St’s proprietary “Fair Ratio” model goes deeper by factoring in Corteva’s actual growth rate, profit margin, scale, and even risk profile, alongside its industry and market cap. This gives a more tailored benchmark. In Corteva’s case, the Fair Ratio is 25.0x. By considering not just what the company is, but also what it is likely to achieve, the Fair Ratio provides a truer reflection of what investors should be paying when all key risks and opportunities are on the table.

Comparing the Fair Ratio to Corteva’s current PE ratio, the difference is about 3.6 points, which suggests the stock is trading a touch above where fundamentals would suggest. On this measure, Corteva appears somewhat overvalued on earnings alone.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Corteva Narrative

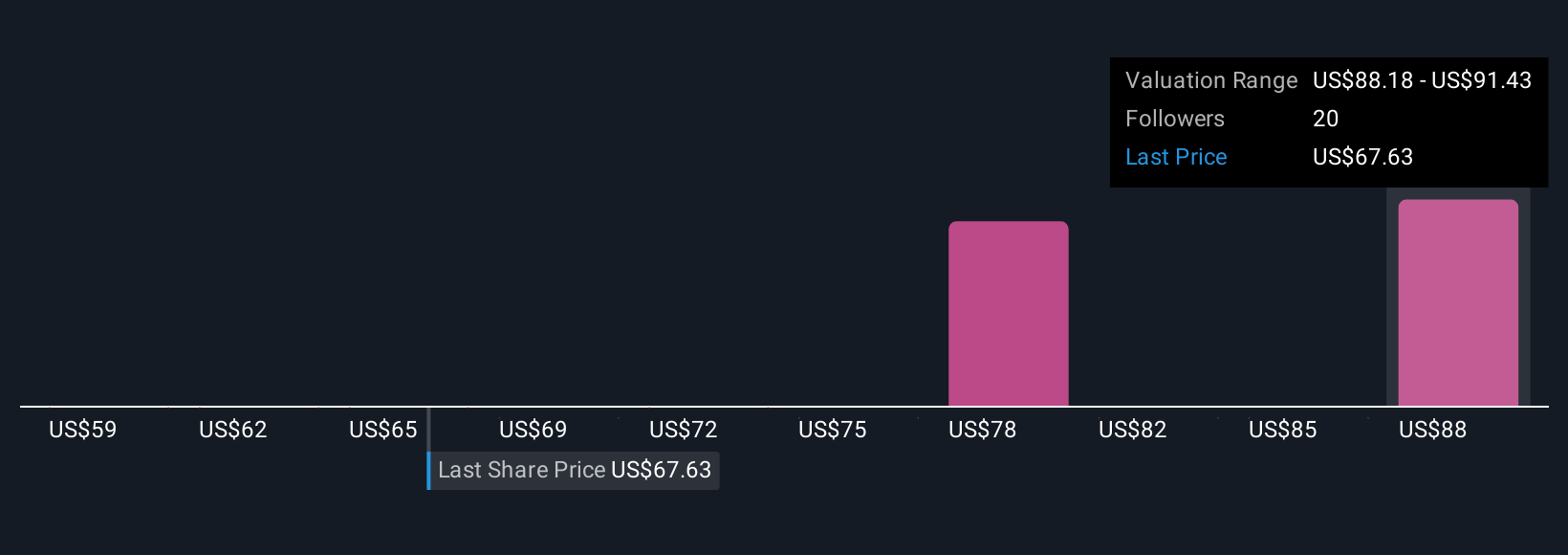

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear, concise story that lets you combine your view of Corteva’s business outlook, such as anticipated revenue, earnings, and margins, with your fair value estimate, connecting your perspective directly to the company’s numbers. Narratives are a powerful tool available to anyone on Simply Wall St’s Community page and are used by millions of investors to anchor decisions in real stories, not just abstract metrics.

When you craft a Narrative, it brings together Corteva’s story and your financial model, resulting in a personalized fair value estimate that you can compare to the current share price. This makes it much easier to decide if now is the right time to buy or sell. What sets Narratives apart is their dynamic nature. They automatically update as new news, earnings, or company events roll in, so your investment case never goes stale.

For example, one investor might focus on strong demand for high-yield seeds and see a fair value of $92.00, arguing that innovation and global expansion justify a premium. Another, more cautious investor may cite crop protection headwinds and set their fair value at $68.00, believing risks outweigh potential gains. Narratives let you see, compare, and refine these perspectives in real time, giving you a smarter, more adaptive way to invest.

Do you think there's more to the story for Corteva? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTVA

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives