- United States

- /

- Chemicals

- /

- NYSE:CTVA

A Look at Corteva’s Valuation as Spin-Off Plans Reshape Its Future Strategy

Reviewed by Kshitija Bhandaru

Corteva (CTVA) has unveiled plans to split its crop protection and seed businesses into two separate, publicly traded companies. The move signals a major shift in strategy and has already sparked considerable interest among investors.

See our latest analysis for Corteva.

Following the news of the breakup, Corteva’s share price dropped sharply, reflecting the market’s initial uncertainty about how each standalone business will be valued and perform over time. While the one-year total shareholder return sits just above flat, momentum has clearly faded this year as the company has reaffirmed its guidance and continued to implement strategic changes.

If you’re curious about what else could be gaining traction in the market right now, this is the perfect moment to discover fast growing stocks with high insider ownership

Yet with shares now trading well below recent analyst targets and the company planning a major break-up, the key question is whether Corteva is undervalued today or if all the upside is already priced in.

Most Popular Narrative: 21.4% Undervalued

Corteva’s last close at $63.49 sits notably below the most widely followed narrative's fair value of $80.76. The setup: analysts believe margin expansion and long-term growth are not yet reflected in the current price, fueling speculation about where the true upside could lie.

Accelerated adoption of sustainable and eco-friendly agricultural inputs, supported by favorable policy shifts in gene editing and biofuels, positions Corteva for outsized growth as regulatory and consumer preferences move toward biological and reduced-chemical solutions. This can expand both revenue and addressable market over the long term.

Want to know which targets and bold assumptions put Corteva in this rare “undervalued” zone? The blueprint relies on significant improvements in future profit margins and a multiple typically reserved for the market’s top growers. Curious about the exact numbers these analysts are betting on? Dive deeper to see what’s really driving that premium fair value.

Result: Fair Value of $80.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressures in Crop Protection and ongoing currency volatility may still challenge the bullish thesis regarding Corteva’s margin expansion and revenue growth.

Find out about the key risks to this Corteva narrative.

Another View: Looking at Multiples

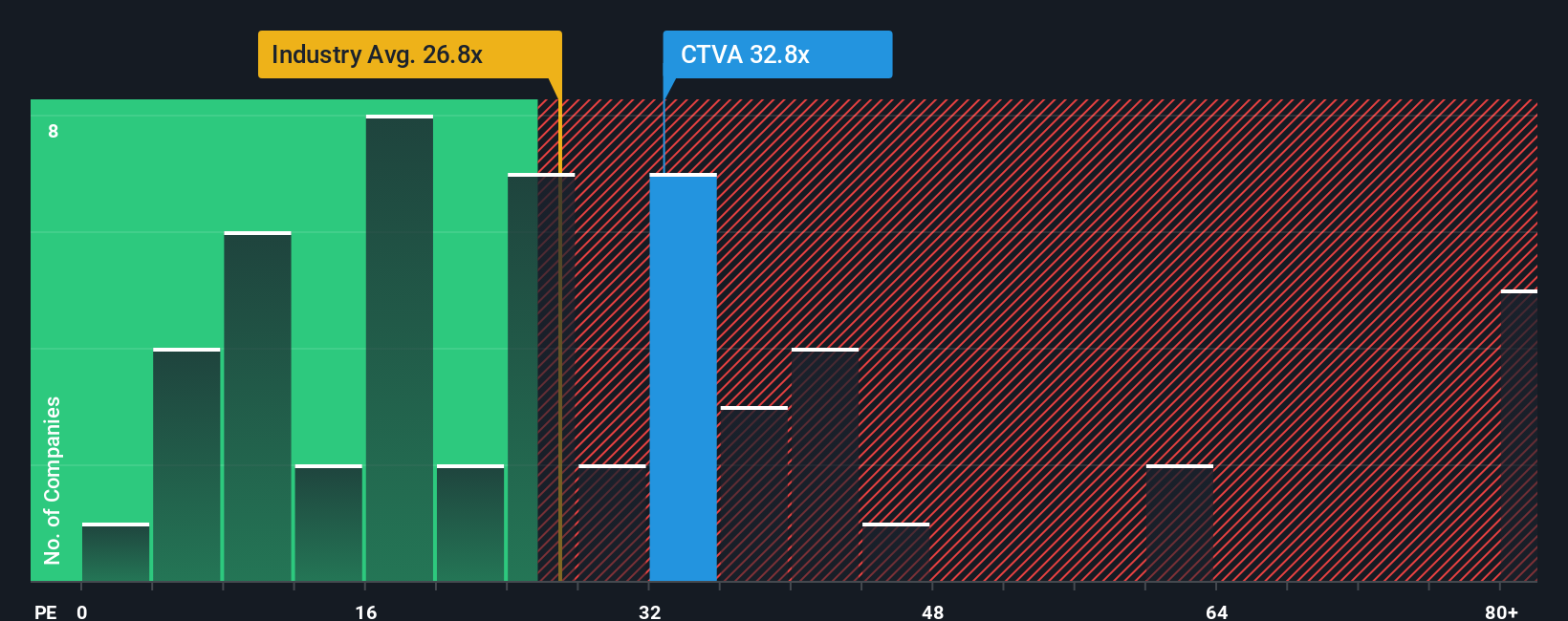

While the narrative approach paints Corteva as undervalued, a closer look at its price-to-earnings ratio tells a different story. At 29.4x, Corteva trades above both the US Chemicals industry average of 25.9x and its peer average of 18.8x, as well as its own fair ratio of 24.9x. This premium suggests investors are already paying up for growth expectations, raising the stakes if those outcomes fall short. Is this market confidence justified, or a risk if the growth narrative stalls?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Corteva Narrative

If you have a different perspective or want to dig into the numbers first-hand, you can build your own Corteva scenario from scratch in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Corteva.

Looking for More Investment Ideas?

Don’t miss out on unique opportunities beyond the obvious choices. The market constantly evolves, so arm yourself with standout investments that others might overlook.

- Unlock hidden potential by checking out these 909 undervalued stocks based on cash flows, featuring companies trading well below their intrinsic value based on future cash flows.

- Capitalize on double-digit yields with these 19 dividend stocks with yields > 3%, which highlights stocks offering impressive dividend returns even in volatile markets.

- Ride the momentum of innovation and growth in technology by investigating these 24 AI penny stocks, where AI disruptors could reshape entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTVA

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives