- United States

- /

- Basic Materials

- /

- NYSE:CRH

CRH (NYSE:CRH) Valuation in Focus Following Major Buyback and Rising Infrastructure Demand

Reviewed by Kshitija Bhandaru

CRH (NYSE:CRH) recently announced a sizable share buyback program, signaling confidence in its balance sheet and a commitment to shareholder value. This move comes as the company benefits from strong infrastructure demand and positive sector trends.

See our latest analysis for CRH.

Beyond the buyback, CRH has attracted fresh optimism thanks to rising infrastructure demand, its $2.1 billion Eco Material acquisition in North America, and ongoing capital investments linked to the AI-powered data center boom. Recent moves, like the appointment of Patrick Decker to the board, reinforce a sense of momentum. Momentum is clearly building: CRH’s 90-day share price return sits at 22.3%, and its one-year total shareholder return is 27.9%, a level that speaks to how investors are rewarding both earnings growth and capital efficiency.

If you want to keep up this discovery streak, consider exploring fast growing stocks with high insider ownership for other fast-moving opportunities catching investors’ attention right now.

With these robust gains and bullish forecasts in mind, investors might wonder if CRH is still undervalued at current levels or if the market has already priced in its next wave of growth.

Most Popular Narrative: 10.6% Undervalued

With CRH trading at $116.03 and the most closely followed narrative estimating its fair value at $129.86, the stock is trading well below what analysts consider justified. This creates a compelling outlook, especially when taking into account recent margin improvements and sector momentum.

Strategic reinvestment into production automation, operational efficiencies, and capacity expansions at key aggregate and cement facilities is enabling CRH to achieve consecutive margin expansion (Q2 margins up 70bps YoY), increasing overall profitability and underpinning robust earnings growth.

Want to know what’s fueling this bullish valuation? There is a surprising blend of steady growth projections and a future profit multiple more commonly found in high-growth industries. Discover which numbers and assumptions are quietly driving this premium fair value estimate and see what might really power CRH’s next chapter.

Result: Fair Value of $129.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in U.S. infrastructure funding or integration risks from recent acquisitions could quickly change the outlook for CRH’s growth story.

Find out about the key risks to this CRH narrative.

Another View: Multiples Suggest a Premium

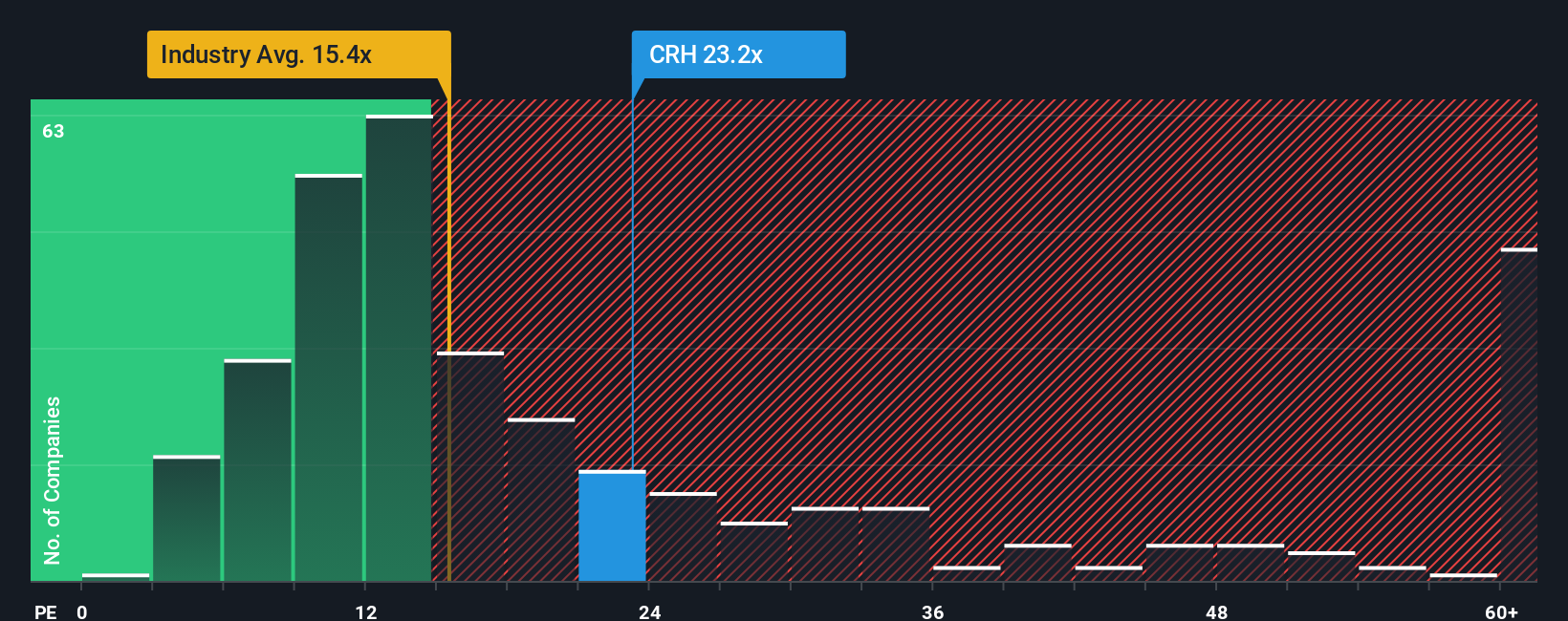

While our fair value estimate indicates CRH is undervalued, the stock actually trades at a price-to-earnings ratio of 23.8x, which is high compared to the global industry average of 15.6x and even above most peers. Its fair ratio is closer to 26.8x, which implies investors are paying up for its future prospects but not betting on irrational exuberance either. Does this premium mean further gains, or could lofty expectations add extra risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CRH Narrative

If you see the story differently or want to dive deeper on your own, you can build a custom narrative in just a few minutes. Do it your way.

A great starting point for your CRH research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Take your strategy to the next level with these hand-picked avenues and stay a step ahead of the market’s next move.

- Boost your portfolio with consistent income by checking out these 19 dividend stocks with yields > 3%, which offers yields above 3% for steady returns.

- Catch the momentum in the hottest growth themes and explore what is possible with these 24 AI penny stocks, which are transforming entire industries with artificial intelligence.

- Get ahead of the curve by targeting potential bargains found in these 891 undervalued stocks based on cash flows, selected based on strong fundamentals and compelling cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRH

CRH

Provides building materials solutions in Ireland, the United States, the United Kingdom, rest of Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives