- United States

- /

- Metals and Mining

- /

- NYSE:CLF

There Is A Reason Cleveland-Cliffs Inc.'s (NYSE:CLF) Price Is Undemanding

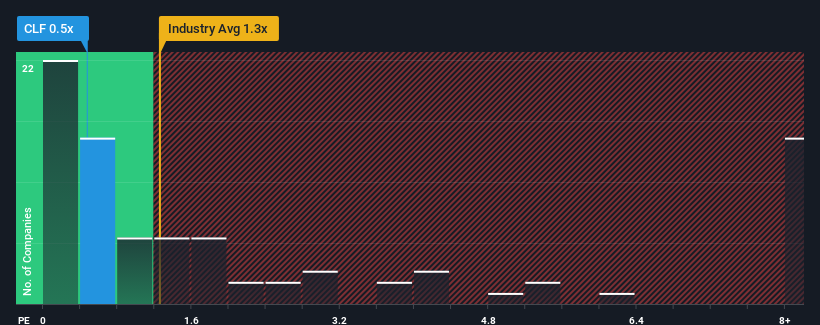

Cleveland-Cliffs Inc.'s (NYSE:CLF) price-to-sales (or "P/S") ratio of 0.5x might make it look like a buy right now compared to the Metals and Mining industry in the United States, where around half of the companies have P/S ratios above 1.3x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Cleveland-Cliffs

What Does Cleveland-Cliffs' Recent Performance Look Like?

There hasn't been much to differentiate Cleveland-Cliffs' and the industry's retreating revenue lately. One possibility is that the P/S ratio is low because investors think the company's revenue may begin to slide even faster. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders may feel hopeful about the share price if the company's revenue continues tracking the industry.

Want the full picture on analyst estimates for the company? Then our free report on Cleveland-Cliffs will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Cleveland-Cliffs would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 5.9% decrease to the company's top line. In spite of this, the company still managed to deliver immense revenue growth over the last three years. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 0.8% as estimated by the eight analysts watching the company. That's not great when the rest of the industry is expected to grow by 9.6%.

With this in consideration, we find it intriguing that Cleveland-Cliffs' P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Cleveland-Cliffs' P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Cleveland-Cliffs' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Cleveland-Cliffs' poor outlook justifies its low P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Cleveland-Cliffs (of which 1 is significant!) you should know about.

If you're unsure about the strength of Cleveland-Cliffs' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives