- United States

- /

- Chemicals

- /

- NYSE:CE

Could Citibank’s Auto Sector Optimism Mark a Turning Point for Celanese (CE)’s Long-Term Strategy?

Reviewed by Sasha Jovanovic

- Citibank analysts recently upgraded Celanese, highlighting expectations for improved auto production through 2026 and potential catalysts such as supply-side reforms and interest rate cuts for the acetyl supply chain.

- This upgrade stands out against a generally cautious view of the North American commodity chemicals sector due to weaker demand, bringing renewed investor focus directly to Celanese.

- We'll explore how Citibank's optimism about auto sector trends could reshape Celanese's longer-term investment narrative and growth prospects.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Celanese Investment Narrative Recap

To be a shareholder in Celanese, you need to believe that end markets, especially automotive and engineered materials, will rebound in both demand and pricing power, helping the company overcome margin pressure and persistent inventory destocking. The recent Citibank upgrade reflects renewed optimism around auto production and potential macro tailwinds, but it does not materially change the principal short-term catalyst, which remains a sustained demand recovery. The biggest risk continues to be prolonged overcapacity and weak demand, potentially suppressing volumes and margins.

Among Celanese's recent announcements, the Q2 2025 earnings update is most relevant, as ongoing inventory destocking led to a 13% drop in share price and increased scrutiny of the Engineered Materials segment. The backdrop of analyst focus, despite cautious sector positioning, places heightened importance on how management addresses these supply-demand imbalances, especially as any near-term improvement in auto or industrial demand could accelerate recovery prospects. Meanwhile, new investigations into sales practices add another layer of uncertainty to the near-term outlook.

In contrast to analyst optimism for auto markets, investors should be aware that the ongoing Hagens Berman investigation introduces new questions regarding...

Read the full narrative on Celanese (it's free!)

Celanese's narrative projects $10.2 billion revenue and $799.9 million earnings by 2028. This requires a 1.0% annual revenue decline and a $2.4 billion increase in earnings from the current -$1.6 billion.

Uncover how Celanese's forecasts yield a $54.69 fair value, a 21% upside to its current price.

Exploring Other Perspectives

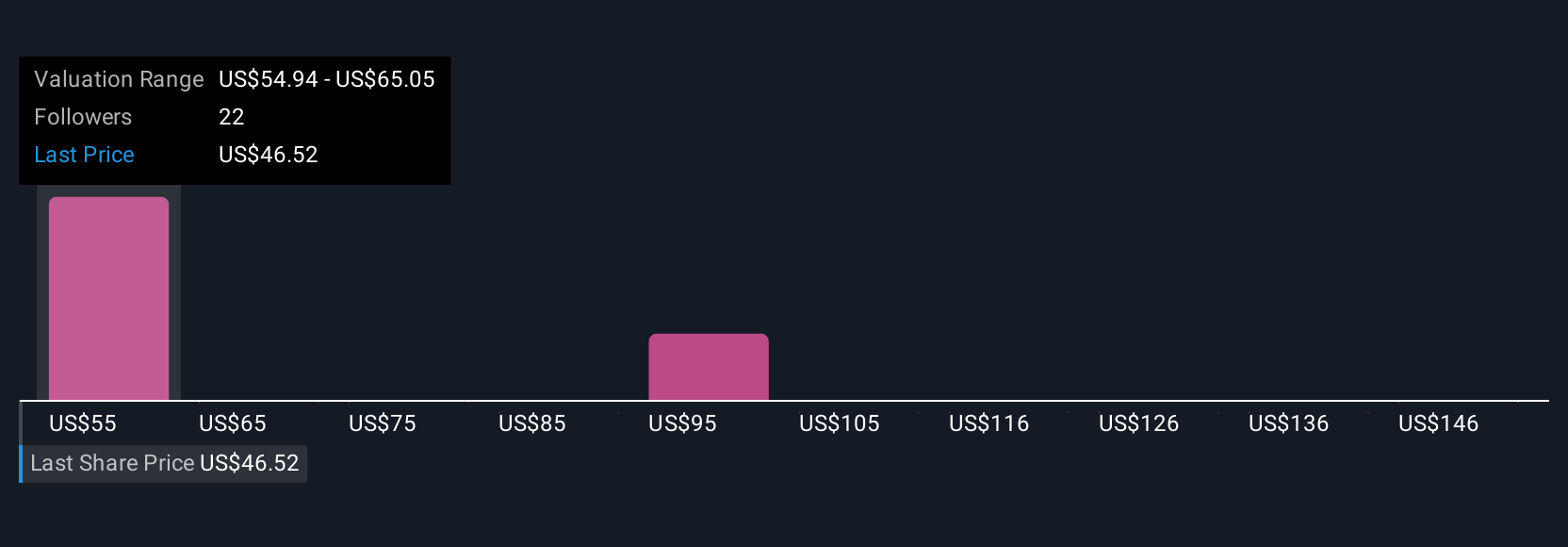

Simply Wall St Community contributors have published 9 fair value estimates for Celanese, with opinions ranging from US$50 to US$156.05 per share. With ongoing concerns about overcapacity and unpredictable revenue streams, these varied perspectives highlight how investor views on potential recovery and risk can differ significantly.

Explore 9 other fair value estimates on Celanese - why the stock might be worth over 3x more than the current price!

Build Your Own Celanese Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celanese research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Celanese research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celanese's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CE

Celanese

A chemical and specialty materials company, manufactures and sells engineered polymers worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives