- United States

- /

- Packaging

- /

- NYSE:CCK

Market Participants Recognise Crown Holdings, Inc.'s (NYSE:CCK) Revenues

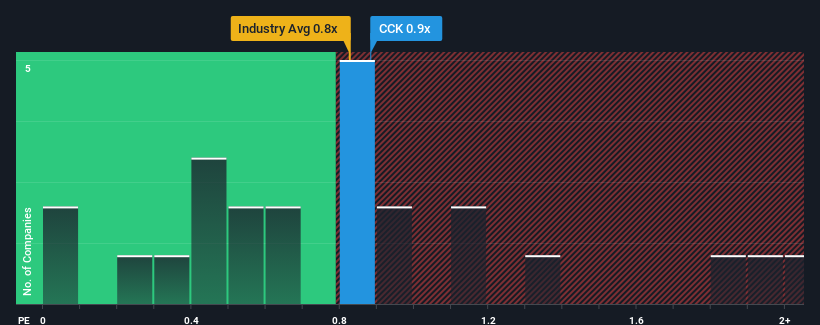

It's not a stretch to say that Crown Holdings, Inc.'s (NYSE:CCK) price-to-sales (or "P/S") ratio of 0.9x right now seems quite "middle-of-the-road" for companies in the Packaging industry in the United States, where the median P/S ratio is around 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Crown Holdings

How Crown Holdings Has Been Performing

Crown Holdings' negative revenue growth of late has neither been better nor worse than most other companies. It seems that few are expecting the company's revenue performance to deviate much from most other companies, which has held the P/S back. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. At the very least, you'd be hoping that revenue doesn't accelerate downwards if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Crown Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Crown Holdings' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Crown Holdings' is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 6.3%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 25% overall rise in revenue. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 3.2% per annum during the coming three years according to the analysts following the company. That's shaping up to be similar to the 2.8% per year growth forecast for the broader industry.

With this in mind, it makes sense that Crown Holdings' P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Crown Holdings' P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Crown Holdings maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Crown Holdings that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CCK

Crown Holdings

Engages in the packaging business in the United States and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives