- United States

- /

- Chemicals

- /

- NYSE:CC

A Fresh Look at Chemours’s Valuation After Strategic Supply Chain Partnership with SRF Limited

Reviewed by Simply Wall St

If you have been tracking Chemours (NYSE:CC), the strategic agreements just announced with SRF Limited might have you pausing to consider your next move. Chemours is teaming up with a well-established manufacturer to secure increased capacity for its fluoropolymer and fluoroelastomer lines, materials that serve everything from semiconductors to automotive and beyond. Significantly, Chemours accomplishes this supply chain boost without any upfront capital outlay, giving it flexibility with little immediate financial tradeoff.

This move follows several developments, including Chemours’ successful qualification of its immersion cooling fluid with Samsung Electronics. This validation could spark further applications in high-growth tech markets. Still, the stock’s journey this year has been a mixed bag. Chemours is up nearly 45% in the past three months after a stretch of losses, but it remains down 8% year-to-date and sits about 18% lower compared to last year. Momentum appears to be shifting as the market weighs operational gains against a longer-term backdrop of volatility.

With shares bouncing back alongside these supply chain wins, the question remains whether the market is catching on to genuinely renewed growth prospects or if Chemours’ improved outlook is already reflected in today’s price.

Most Popular Narrative: 1.7% Overvalued

According to community narrative, Chemours is considered to be trading close to its intrinsic value, with only a slight premium over fair value based on analyst consensus about the company’s future growth potential and operational outlook.

“Acceleration in regulatory-driven adoption of low global warming potential (GWP) refrigerants is boosting sustained demand for Chemours' Opteon franchise. Recent strong net sales and high margins signal that continued market share gains and capacity expansions will drive robust revenue and EBITDA growth through and beyond the 2025 and 2026 transition periods.”

Curious how Chemours justifies this near-fair price? The analysts anchor their view on bold growth strategies and ambitious margin improvements. But which future metric moves the needle most? Unlock the secret analytics fueling this valuation and find out exactly what could tip the scales next.

Result: Fair Value of $15.11 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, unresolved PFAS litigation or strict new regulations could quickly undermine Chemours’ margin outlook and challenge today’s fair value thesis.

Find out about the key risks to this Chemours narrative.Another View: Discounted Cash Flow Says Undervalued

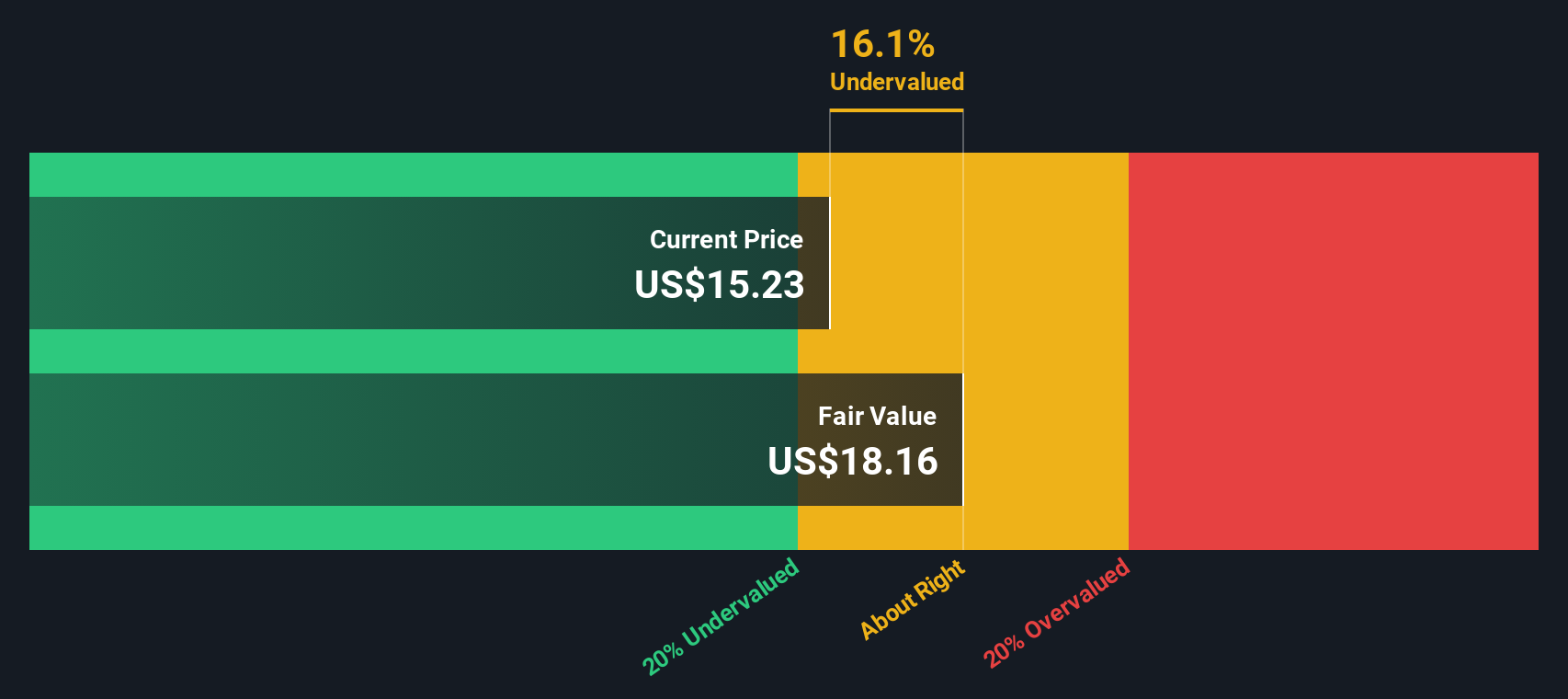

Looking at Chemours through the lens of our DCF model, the picture shifts. Unlike market-based multiples, this approach suggests Chemours is trading below its fair value. This could indicate possible upside from today’s levels. Which view do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Chemours Narrative

If you see things differently or want to dive into the numbers on your own, you can piece together your own story in just a few minutes, and do it your way.

A great starting point for your Chemours research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Now is a good time to look beyond Chemours and consider what could come next. Don’t let potential winners pass by while others move ahead. Use the Simply Wall Street Screener to discover stocks making moves in today’s market. Here are three new ideas to spark your portfolio:

- Find reliable income streams by searching for dividend stocks with yields over 3% using dividend stocks with yields > 3%.

- Gain an investing edge by exploring AI-powered companies driving innovation in healthcare with healthcare AI stocks.

- Identify undervalued opportunities by looking for stocks trading below their intrinsic value based on cash flows with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CC

Chemours

Provides performance chemicals in North America, the Asia Pacific, Europe, the Middle East, Africa, and Latin America.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives