- United States

- /

- Metals and Mining

- /

- NYSE:BVN

Unpleasant Surprises Could Be In Store For Compañía de Minas Buenaventura S.A.A.'s (NYSE:BVN) Shares

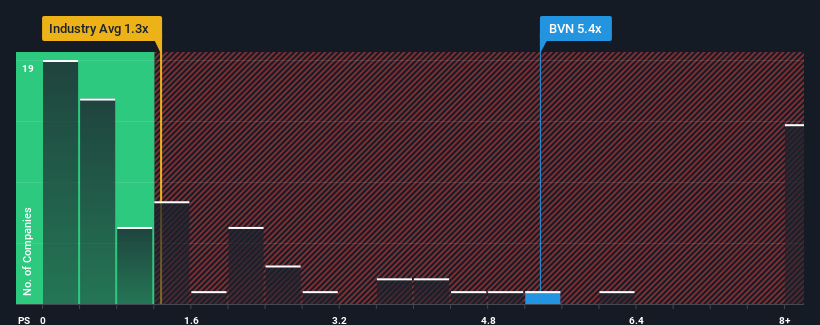

When you see that almost half of the companies in the Metals and Mining industry in the United States have price-to-sales ratios (or "P/S") below 1.3x, Compañía de Minas Buenaventura S.A.A. (NYSE:BVN) looks to be giving off strong sell signals with its 5.4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Compañía de Minas BuenaventuraA

What Does Compañía de Minas BuenaventuraA's Recent Performance Look Like?

The recently shrinking revenue for Compañía de Minas BuenaventuraA has been in line with the industry. It might be that many expect the company's revenue to strengthen positively despite the tough industry conditions, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Compañía de Minas BuenaventuraA.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Compañía de Minas BuenaventuraA would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Fortunately, a few good years before that means that it was still able to grow revenue by 22% in total over the last three years. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 8.8% per annum over the next three years. That's shaping up to be similar to the 9.3% per annum growth forecast for the broader industry.

In light of this, it's curious that Compañía de Minas BuenaventuraA's P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Analysts are forecasting Compañía de Minas BuenaventuraA's revenues to only grow on par with the rest of the industry, which has lead to the high P/S ratio being unexpected. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. A positive change is needed in order to justify the current price-to-sales ratio.

You should always think about risks. Case in point, we've spotted 2 warning signs for Compañía de Minas BuenaventuraA you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BVN

Compañía de Minas BuenaventuraA

Engages in the exploration, development, construction, and operation of mineral processing business.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives