- United States

- /

- Metals and Mining

- /

- NYSE:BVN

Does New Production Guidance and H1 Results Change The Bull Case For Buenaventura (BVN)?

Reviewed by Simply Wall St

- Compañía de Minas Buenaventura released its operating and sales results for the first half of 2025, along with updated full-year production guidance for gold, silver, lead, zinc, and copper.

- The detailed production and sales figures, paired with forward-looking targets, give investors more insight into the company's near-term operating performance and expectations.

- We’ll assess how Buenaventura’s new production guidance and first-half output may influence expectations for the San Gabriel project as a growth driver.

Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

Compañía de Minas BuenaventuraA Investment Narrative Recap

To be a shareholder in Compañía de Minas Buenaventura, you generally need to believe in the company’s ability to ramp up gold production, especially as the San Gabriel project nears its planned first gold bar in late 2025. The latest production and guidance update is in line with near-term expectations and does not suggest a material shift to the San Gabriel project timeline or current risk profile, including possible cost overruns or execution delays.

Of the recent company updates, the 2025 production guidance stands out as most relevant. By providing clear targets for gold, silver, copper, lead, and zinc output amidst the year’s first half results, Buenaventura puts a spotlight on how actual performance is tracking versus expectations, which matters for confidence in the San Gabriel project as the main catalyst.

By contrast, the biggest risk investors should be aware of remains the potential for higher all-in sustaining costs if ore grades fall or exploration costs rise…

Read the full narrative on Compañía de Minas BuenaventuraA (it's free!)

Compañía de Minas BuenaventuraA's outlook projects $1.4 billion in revenue and $505.1 million in earnings by 2028. This scenario assumes 5.6% annual revenue growth and a $101.4 million increase in earnings from the current level of $403.7 million.

Exploring Other Perspectives

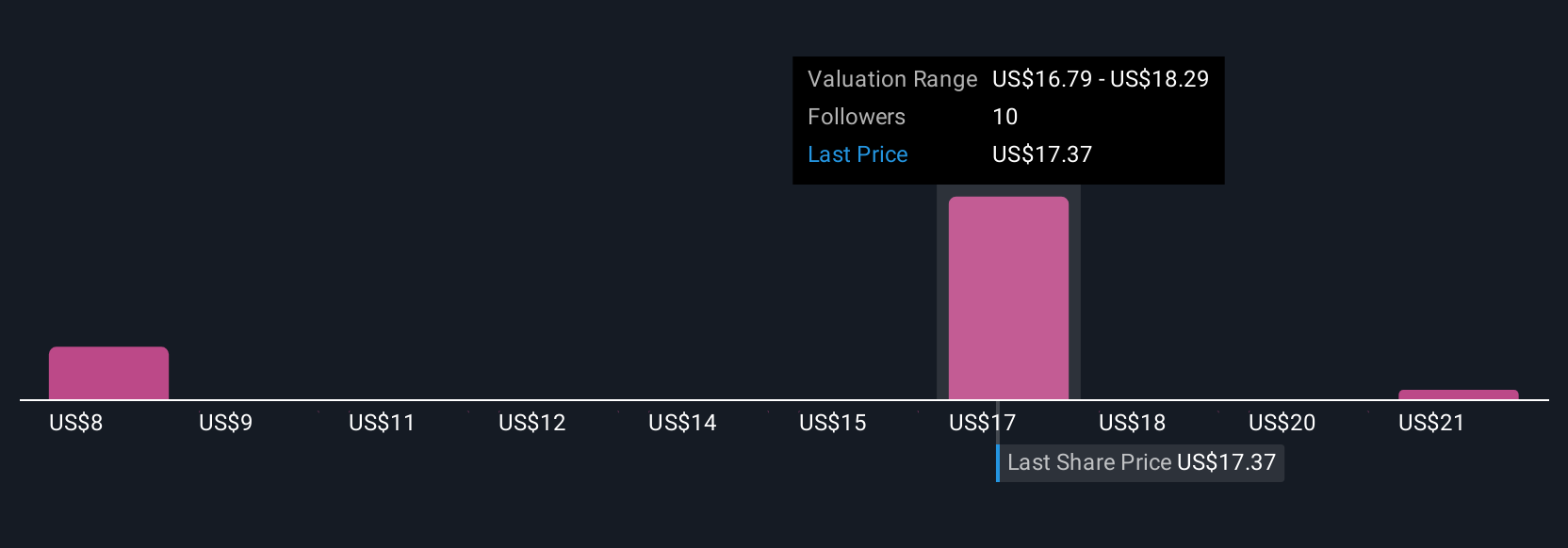

Simply Wall St Community valuations for Buenaventura range from US$7.76 to US$22.78 across four estimates. With ongoing focus on San Gabriel’s execution, you can see how different outlooks reflect varied expectations for the project’s overall impact.

Build Your Own Compañía de Minas BuenaventuraA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Compañía de Minas BuenaventuraA research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Compañía de Minas BuenaventuraA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Compañía de Minas BuenaventuraA's overall financial health at a glance.

No Opportunity In Compañía de Minas BuenaventuraA?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BVN

Compañía de Minas BuenaventuraA

Engages in the exploration, mining, concentration, smelting, and marketing of polymetallic ores and metals in Peru.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives