- United States

- /

- Metals and Mining

- /

- NYSE:B

Barrick Gold (NYSE:GOLD): Evaluating Valuation Following Strong Share Price Momentum

Reviewed by Kshitija Bhandaru

Barrick Mining (NYSE:B) shares have seen strong movement recently, catching the attention of investors who are tracking gold prices and shifting demand in the commodities sector. The company’s stock performance over the past month raises some important questions about its underlying valuation and outlook.

See our latest analysis for Barrick Mining.

The latest run-up in Barrick Mining’s share price, now at $32.74, has invigorated bullish sentiment. Gold market momentum and a 105% year-to-date share price return are turning heads. While the past month’s 11% gain is impressive, the real story is Barrick’s broader trend. A one-year total shareholder return of almost 67% and an eye-catching 149% over three years highlight surging long-term confidence, driven by renewed demand for precious metals and well-timed strategic moves.

If Barrick’s momentum has you curious about where else opportunity is building, consider expanding your radar to discover fast growing stocks with high insider ownership

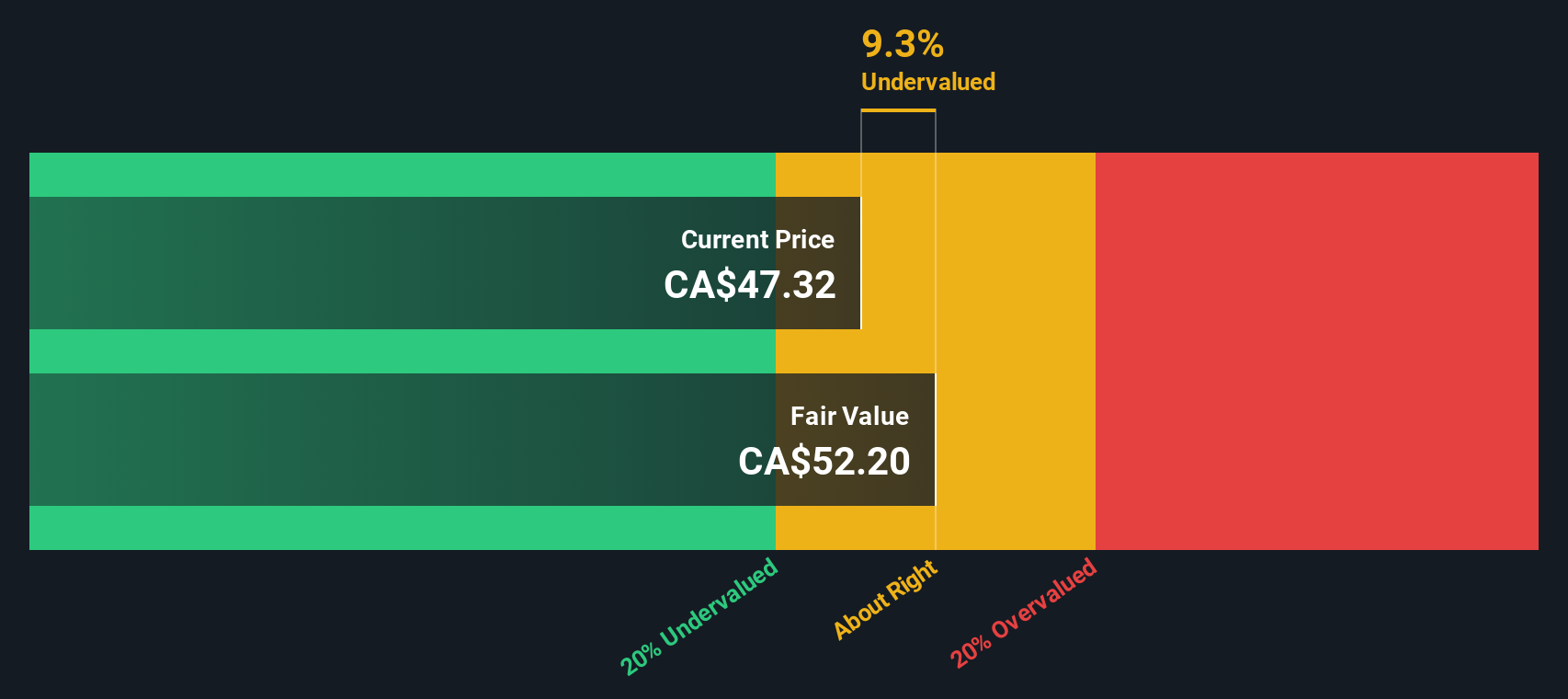

Yet with shares near their recent highs, investors are left to wonder if Barrick Mining is still undervalued or if the market has already accounted for all its future growth. Is now the right moment to buy, or not?

Most Popular Narrative: 63.7% Overvalued

The fair value estimated in the most-followed narrative sits at $20, which is notably lower than Barrick Mining’s recent price of $32.74. Understanding why the narrative prices Barrick this way requires digging into the core drivers shaping its outlook.

The key catalyst driving Barrick’s upside is the significant growth in gold and copper reserves, underscoring its exploration success and long-term sustainability. The company reported a 23% increase in attributable proven and probable gold reserves, equivalent to 17.4 million ounces, and added 24 million tonnes of measured and indicated copper resources, further diversifying its earnings mix.

Beneath the headline numbers lies a bold formula for Barrick’s future. This narrative pulls together an intricate mix of revenue projections, ambitious production goals and margin leaps. What is the linchpin for such a sharp gap between fair value and market price? Get the inside scoop on exactly which fundamentals tilt the calculation and where the biggest surprises lie.

Result: Fair Value of $20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, geopolitical instability in key operating regions and sharp swings in commodity prices remain significant risks that could rapidly alter Barrick’s outlook.

Find out about the key risks to this Barrick Mining narrative.

Another View: Market Metrics Tell a Different Story

While the popular narrative suggests Barrick Mining is overvalued, our DCF model offers a different angle. By estimating the present value of future cash flows, the SWS DCF model puts Barrick’s fair value at $36.32, just above its current trading price. So is the market missing something, or is sentiment already ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Barrick Mining Narrative

If you see things differently or want to dive into your own research, you can easily craft a personal Barrick Mining narrative in just a few minutes. Do it your way

A great starting point for your Barrick Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors stay ahead by keeping an eye on fresh opportunities. Give yourself an edge and don’t miss what others might overlook. Start right here.

- Capture tomorrow’s financial leaders by checking out these 898 undervalued stocks based on cash flows with high potential, backed by sound fundamentals and attractive valuations.

- Ride the digital wave and benefit from the surge in finance technology when you scan these 79 cryptocurrency and blockchain stocks. These innovations are shaping how transactions and data security are transforming markets.

- Supercharge your income potential and tap into these 19 dividend stocks with yields > 3% offering stable yields above 3% while maintaining growth discipline and balance sheet strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barrick Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:B

Barrick Mining

Engages in the exploration, development, production, and sale of mineral properties.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives