- United States

- /

- Packaging

- /

- NYSE:AVY

A Look at Avery Dennison's Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Avery Dennison (AVY) shares have recently seen movement, catching the eye of investors looking for value opportunities. Over the past month, the stock has gained 8%, outpacing its losses earlier this year and sparking fresh interest in its performance.

See our latest analysis for Avery Dennison.

While Avery Dennison’s recent 1-month share price return of 7.6% hints at growing optimism, the stock’s longer-term total shareholder return tells a more cautious story, with a 1-year decline of 13.4%. The recent momentum suggests renewed interest as investors re-evaluate its value and growth prospects in the current market environment.

If Avery Dennison’s rebound has you watching for other opportunities, now’s a great time to discover fast growing stocks with high insider ownership

The big question now, with shares still trading 15% below analyst targets and company fundamentals showing steady growth, is whether Avery Dennison remains undervalued or if the market has already priced in its future prospects.

Most Popular Narrative: 7.8% Undervalued

With Avery Dennison’s fair value calculated at $189.67 against a last close of $174.89, the most closely followed market narrative sees more upside ahead. This gap has analysts watching whether recent momentum can persist as the company leans into high-growth, tech-driven segments.

The company's leadership position and expanded innovation pipeline in high-value differentiated products (including new RFID/IL offerings and proprietary technologies) enables above-market growth rates in premium categories like graphics, reflectives, and team sports, providing mix improvement for operating margins.

Want to know what’s driving this bullish outlook? There is one earnings forecast, profit assumption, and analyst consensus that could flip your perspective on what Avery Dennison is worth. Don’t miss the numbers that build this forecast. Find out how future profit margins and market expansion play into the narrative.

Result: Fair Value of $189.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the bull case faces real tests. Ongoing trade tensions and softening apparel demand could both limit growth and pressure margins.

Find out about the key risks to this Avery Dennison narrative.

Another View: Market-Based Valuation Sends Mixed Signals

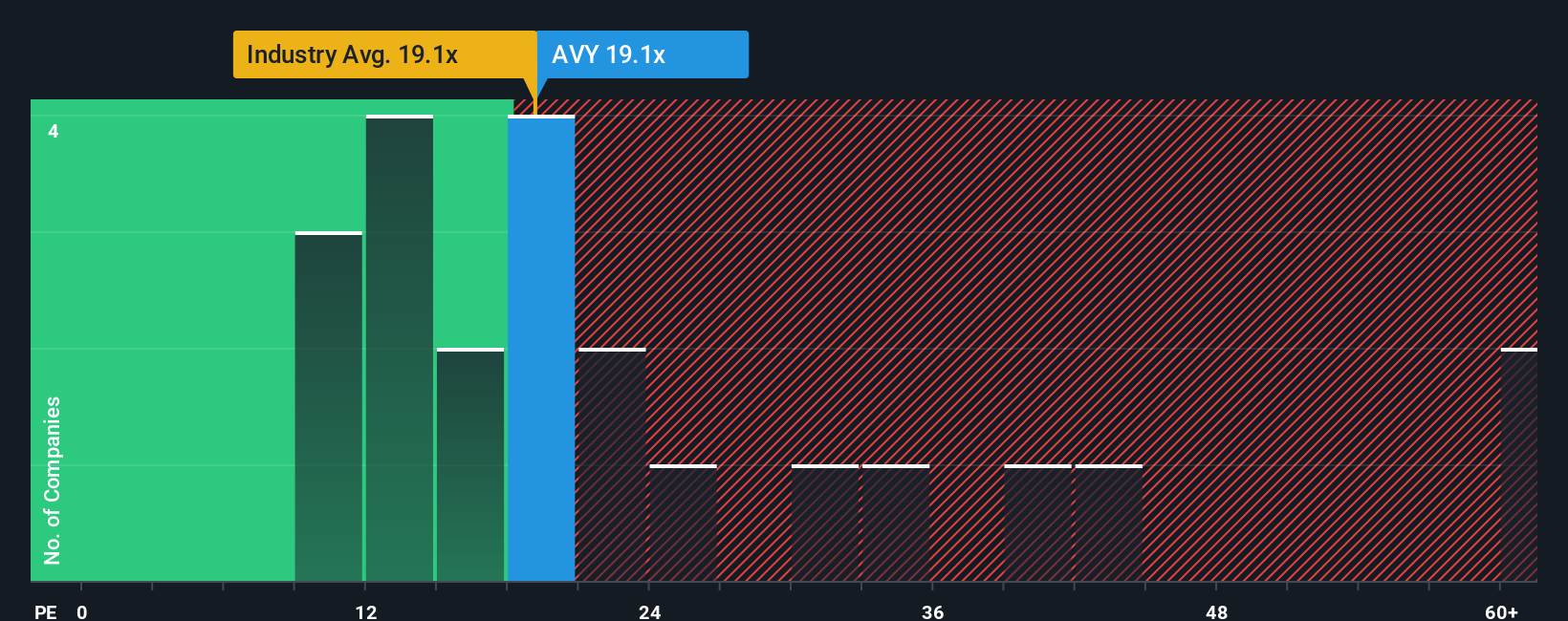

While the fair value points to a significant upside, a look at the price-to-earnings ratio raises questions. Avery Dennison's ratio of 19.4x is higher than the global packaging industry average of 15.7x and just above its fair ratio of 19.3x. This suggests the stock may be on the expensive side relative to industry norms and the broader market. Could investor optimism be running ahead of fundamentals, or is the premium justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Avery Dennison Narrative

Whether you have a different perspective or simply prefer hands-on research, you can quickly shape your own narrative in just a few minutes. Do it your way

A great starting point for your Avery Dennison research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let a single opportunity define your research. The smartest investors keep their watchlists fresh with new picks from the markets’ most exciting areas.

- Tap into the momentum of rapidly growing startups and see which of them are considered these 3584 penny stocks with strong financials with strong financial potential.

- Capture future tech trends by reviewing the innovators making headlines in artificial intelligence and checking out these 26 AI penny stocks.

- Lock in potential yield boosts and stable cash flow by targeting these 22 dividend stocks with yields > 3% offering market-beating dividend payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVY

Avery Dennison

Operates as a materials science and digital identification solutions company in the United States, Europe, the Middle East, North Africa, Asia, Latin America, and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)