- United States

- /

- Chemicals

- /

- NYSE:AVD

Insider Sellers Might Regret Selling American Vanguard Shares at a Lower Price Than Current Market Value

American Vanguard Corporation's (NYSE:AVD) stock price has dropped 10% in the previous week, but insiders who sold US$617k in stock over the past year have had less luck. Insiders might have been better off holding onto their shares, given that the average selling price of US$5.71 is still below the current share price.

While insider transactions are not the most important thing when it comes to long-term investing, we do think it is perfectly logical to keep tabs on what insiders are doing.

See our latest analysis for American Vanguard

The Last 12 Months Of Insider Transactions At American Vanguard

Over the last year, we can see that the biggest insider sale was by the insider, Eric Wintemute, for US$572k worth of shares, at about US$5.75 per share. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. The silver lining is that this sell-down took place above the latest price (US$4.55). So it may not shed much light on insider confidence at current levels.

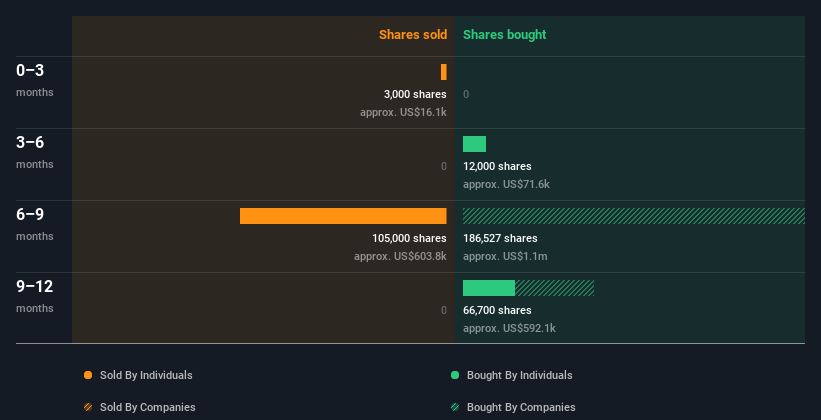

Happily, we note that in the last year insiders paid US$308k for 38.70k shares. But they sold 108.00k shares for US$617k. Over the last year we saw more insider selling of American Vanguard shares, than buying. The chart below shows insider transactions (by companies and individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

American Vanguard Insiders Are Selling The Stock

Over the last three months, we've seen a bit of insider selling at American Vanguard. insider Peter Eilers divested only US$16k worth of shares in that time. Neither the lack of buying nor the presence of selling is heartening. But the volume sold is so low that it really doesn't bother us.

Does American Vanguard Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. It appears that American Vanguard insiders own 7.3% of the company, worth about US$10m. While this is a strong but not outstanding level of insider ownership, it's enough to indicate some alignment between management and smaller shareholders.

So What Does This Data Suggest About American Vanguard Insiders?

While there has not been any insider buying in the last three months, there has been selling. But given the selling was modest, we're not worried. We're a little cautious about the insider selling at American Vanguard. The modest level of insider ownership is, at least, some comfort. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing American Vanguard. While conducting our analysis, we found that American Vanguard has 2 warning signs and it would be unwise to ignore them.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:AVD

American Vanguard

Through its subsidiaries, develops, manufactures, and markets specialty chemicals for agricultural, commercial, and consumer uses in the United States and internationally.

Undervalued with moderate growth potential.