- United States

- /

- Metals and Mining

- /

- NYSE:AU

Evaluating AngloGold Ashanti (NYSE:AU): How Upgraded Earnings Forecasts Are Shaping Its Current Valuation

Reviewed by Kshitija Bhandaru

AngloGold Ashanti (NYSE:AU) has caught investors’ attention as momentum and investor sentiment continue to build, supported by positive earnings estimate revisions. The company’s operational outlook remains a key driver for recent stock activity.

See our latest analysis for AngloGold Ashanti.

Momentum is clearly on AngloGold Ashanti's side, with the share price up nearly 195% so far this year after a stellar 49.95% run over the past quarter. A recent board appointment adds operational depth, but the story remains focused on strong earnings momentum and the company’s ability to sustain these gains, especially as markets keep a close eye on valuation signals and broader gold sector shifts. Both short- and long-term total shareholder returns have outpaced most peers, making this a stock investors are watching closely as sentiment builds.

If you're ready to see what else is capturing attention in fast-growing corners of the market, broaden your search horizons with our fast growing stocks with high insider ownership.

But given the recent surge, is AngloGold Ashanti still trading below its true value? Or has its rally already factored in all the potential upside, leaving little room for further gains?

Most Popular Narrative: 7% Overvalued

AngloGold Ashanti’s current share price sits above the most popular narrative’s fair value estimate, implying an outlook that may be a step ahead of fundamentals. This gap sets the stage for a closer look at the assumptions driving recent sentiment.

Ongoing optimization of asset portfolio toward lower-risk jurisdictions, combined with disciplined cost control (notably, stable cash cost and AISC in real terms despite sectoral inflation) is improving production stability and supporting structurally stronger net margins. Organic production growth from brownfield projects (Obuasi ramp-up, Cuiabá, Siguiri, Geita, and upcoming Nevada developments) is set to increase output volumes and extend mine life, driving future revenue and earnings growth over the next decade.

Craving the details behind this premium price? The heart of the narrative is a bold forecast linking sustained margin strength to lasting production gains. Find out how a blend of operational improvements and optimistic growth projections shape this valuation.

Result: Fair Value of $67.17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflationary pressures and stricter regulatory hurdles could undermine margin expansion and delay project growth, acting as important factors to monitor.

Find out about the key risks to this AngloGold Ashanti narrative.

Another View: Multiples Send a Different Signal

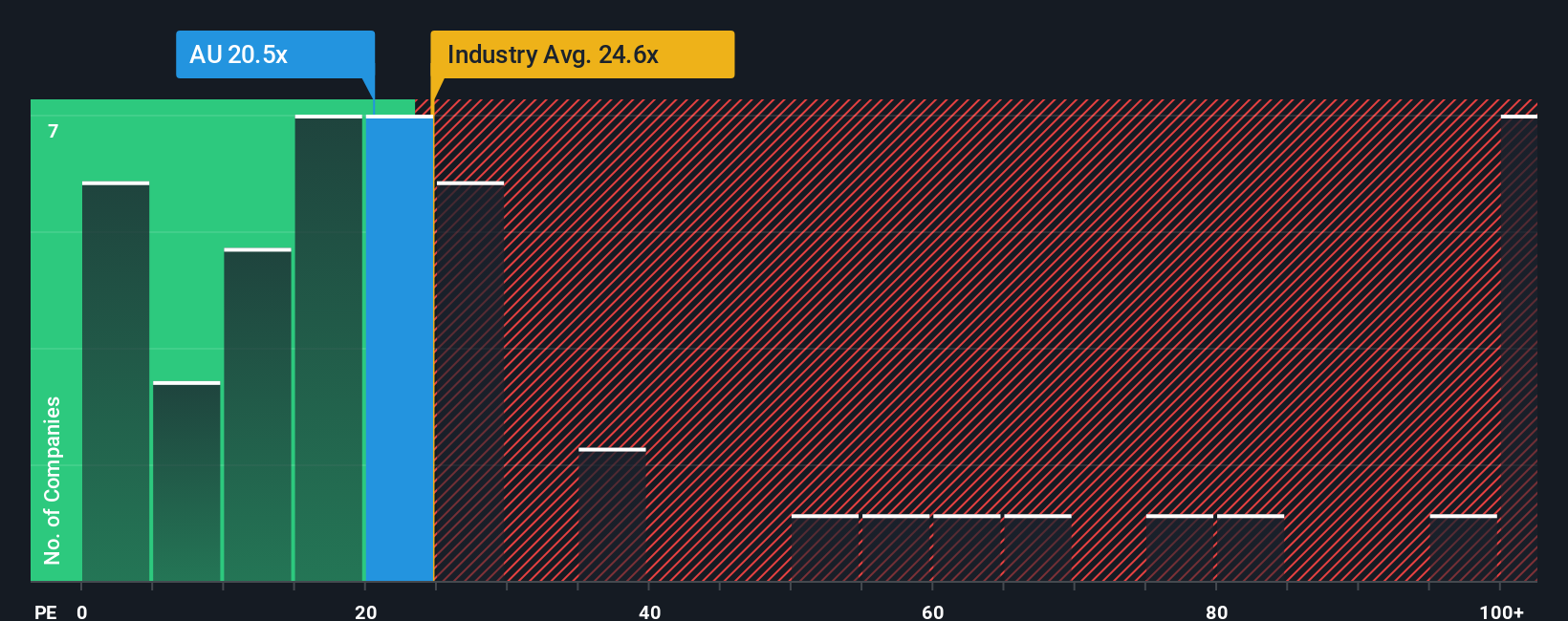

Looking through the lens of earnings multiples, AngloGold Ashanti trades at 20.1 times earnings, which is noticeably below both the US Metals and Mining industry average of 24.6 and the peer average of 34.3. Even compared to a fair ratio of 30.7, the current level points to compelling relative value. Does this suggest the market is missing long-term potential, or is it simply cautious for a reason?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AngloGold Ashanti Narrative

If the numbers or outlook presented don’t match your perspective, consider taking a closer look at the figures and forming your own opinion. It only takes a few minutes. Do it your way

A great starting point for your AngloGold Ashanti research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunities rarely wait. Set yourself up for success by checking out these handpicked ways to target exciting trends and resilient returns before the market catches on.

- Capture growth potential in key health tech sectors by searching for leaders within these 33 healthcare AI stocks.

- Maximize your earning power with steady payouts by targeting these 19 dividend stocks with yields > 3% offering yields above 3%.

- Position yourself at the forefront of the digital finance revolution by scanning these 79 cryptocurrency and blockchain stocks for companies innovating in cryptocurrency and blockchain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AU

AngloGold Ashanti

Operates as a gold mining company in Africa, Australia, and the Americas.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives