- United States

- /

- Packaging

- /

- NYSE:ATR

Evaluating AptarGroup After 25% Drop and Recent Innovation Highlights

Reviewed by Bailey Pemberton

- Curious if AptarGroup could finally offer great value for your portfolio? Let’s take a close look at what’s driving this company’s current price and how its valuation stacks up.

- The stock has slipped recently, down 4.4% over the past week and off 19.4% year-to-date, with a notable decline of 25.5% in the last 12 months, despite having climbed over the past three years.

- Recent headlines have put the spotlight on AptarGroup’s innovation efforts and market expansion, as well as shifts in industry demand. Together, these developments help explain the stock’s recent volatility and investors’ changing risk appetite.

- On our valuation checks, AptarGroup scores a 2 out of 6, meaning it is considered undervalued in two key areas. You can see the full breakdown here. We will dig into what goes into these valuation results next, but stick with us for a more insightful way to judge value before you make your next move.

AptarGroup scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AptarGroup Discounted Cash Flow (DCF) Analysis

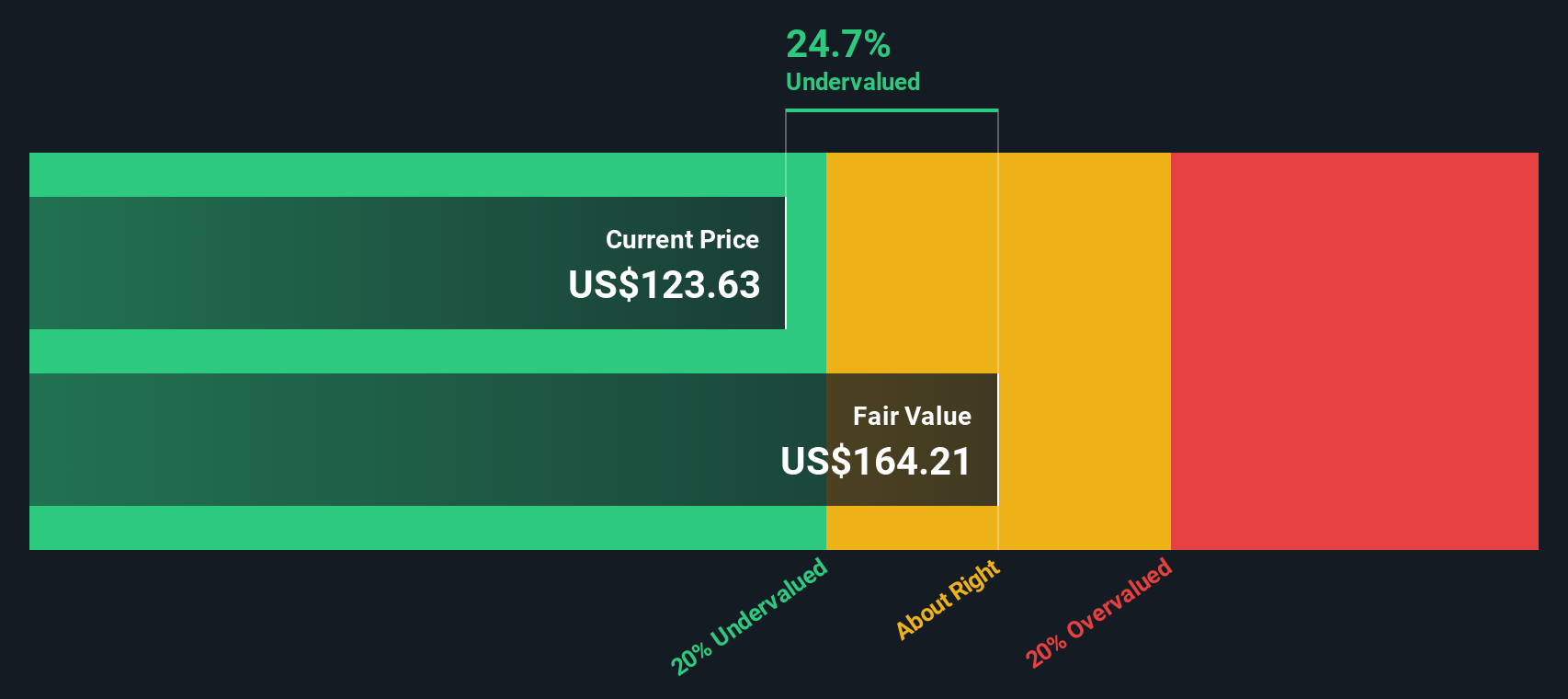

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's value. This method helps investors understand what a business is fundamentally worth based on its ability to generate cash in the years ahead.

For AptarGroup, the model uses its latest Free Cash Flow (FCF) of $306.6 million and forecasts steady growth over the next decade. According to analyst projections and further extrapolations, AptarGroup’s FCF is expected to rise to about $438.4 million by 2035. Dollar values throughout the analysis refer to USD.

Based on these projections and applying the 2 Stage Free Cash Flow to Equity model, AptarGroup's estimated intrinsic value is $138.22 per share. This figure suggests the current share price is about 10.1% below its intrinsic value, indicating the stock is undervalued according to this approach.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AptarGroup is undervalued by 10.1%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: AptarGroup Price vs Earnings (PE Ratio)

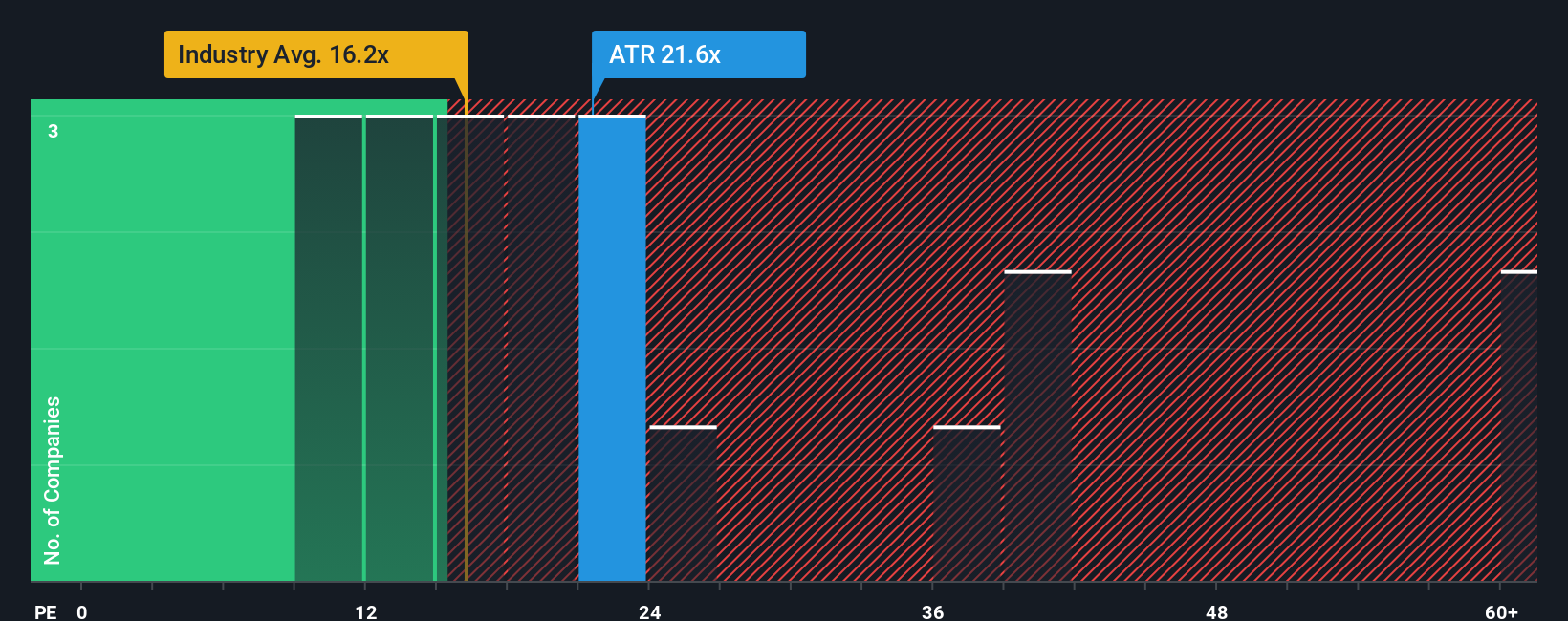

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like AptarGroup, as it relates a company's share price to its earnings per share. For businesses with steady profits, the PE ratio provides insight into how much investors are willing to pay for each dollar of earnings, making it a practical tool for comparison within the sector.

Growth expectations and perceived risks have a direct impact on what is considered a "normal" or "fair" PE ratio. Companies expected to grow earnings faster typically command higher PE ratios, while greater business risk or market uncertainty tends to put downward pressure on this multiple.

Currently, AptarGroup trades at a PE ratio of 20.9x, notably above the packaging industry average of 15.9x and the peer average of 16.7x. While this premium might seem high at first glance, it's important to dig deeper than simple averages.

This is where the Simply Wall St "Fair Ratio" comes in. The Fair Ratio, calculated at 17.0x for AptarGroup, is a tailored estimate of where the company’s PE should be, considering not just profit and growth expectations but also factors like risk profile, profit margins, and company size. This makes it a more reliable yardstick than broad-brush comparisons to peers or the overall industry.

Comparing AptarGroup’s actual PE of 20.9x to its Fair Ratio of 17.0x, the stock appears overvalued relative to its fundamentals and outlook based on this approach.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1382 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AptarGroup Narrative

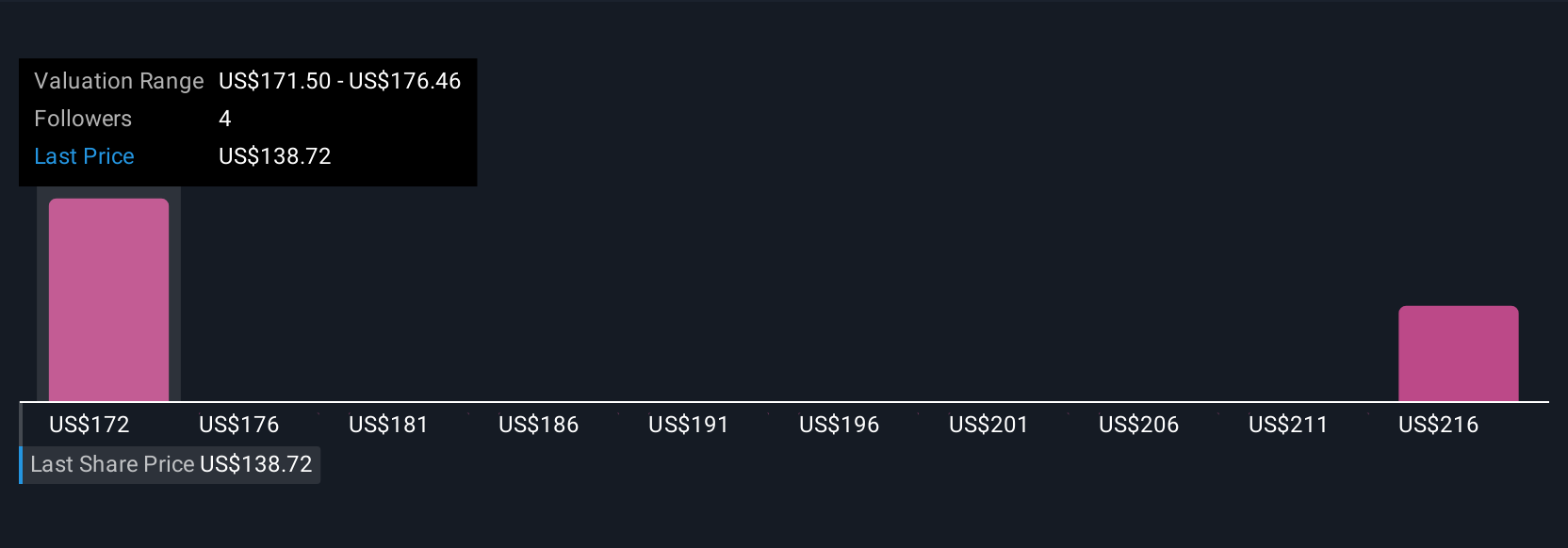

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about AptarGroup. It connects the company's journey, strengths, risks, and future opportunities into a forecast for revenue, earnings, and margins, which in turn generates your own fair value estimate.

This approach bridges the gap between financial models and real-world thinking, making it easy for investors to turn their perspective into numbers that can be compared directly with the current share price. Narratives are accessible and intuitive, and you can create or follow them right on Simply Wall St's platform through the Community page, used by millions of investors globally.

Narratives are updated in real time whenever fresh news, analyst estimates, or earnings numbers are released, ensuring your conclusions remain relevant. For example, a bullish Narrative on AptarGroup might anticipate higher growth from new drug delivery technologies and sustainable packaging, resulting in a fair value near $220. A cautious Narrative might highlight regulatory risks and legal costs, with a fair value estimate closer to $153.

By comparing your Narrative’s fair value with the latest share price, you can quickly decide if AptarGroup looks like a buy, hold, or sell, with your own story at the center.

Do you think there's more to the story for AptarGroup? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATR

AptarGroup

Designs and manufactures a range of drug delivery, consumer product dispensing, and active material science solutions and services for the pharmaceutical, beauty, personal care, home care, and food and beverage markets.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)