- United States

- /

- Chemicals

- /

- NYSE:ASPN

The Price Is Right For Aspen Aerogels, Inc. (NYSE:ASPN) Even After Diving 25%

Aspen Aerogels, Inc. (NYSE:ASPN) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 56% loss during that time.

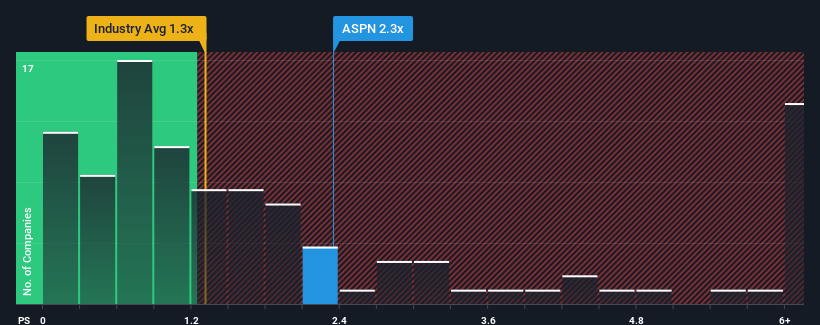

Although its price has dipped substantially, you could still be forgiven for thinking Aspen Aerogels is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.3x, considering almost half the companies in the United States' Chemicals industry have P/S ratios below 1.3x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Aspen Aerogels

How Has Aspen Aerogels Performed Recently?

Recent times have been advantageous for Aspen Aerogels as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Aspen Aerogels' future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Aspen Aerogels?

The only time you'd be truly comfortable seeing a P/S as high as Aspen Aerogels' is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 30% last year. The latest three year period has also seen an excellent 41% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 58% per year over the next three years. With the industry only predicted to deliver 8.1% per year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Aspen Aerogels' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Aspen Aerogels' P/S

Despite the recent share price weakness, Aspen Aerogels' P/S remains higher than most other companies in the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Aspen Aerogels maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Chemicals industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for Aspen Aerogels that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:ASPN

Aspen Aerogels

An aerogel technology company, designs, develops, manufactures, and sells aerogel materials primarily for use in the energy industrial, sustainable insulation materials, and electric vehicle (EV) markets in the United States, Canada, Asia, Europe, and Latin America.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives