- United States

- /

- Packaging

- /

- NYSE:AMCR

What Amcor (AMCR)'s CFO Transition Means for Shareholders and Future Operational Direction

Reviewed by Sasha Jovanovic

- Amcor announced the appointment of Stephen R. Scherger as Chief Financial Officer and Executive Vice President, effective November 10, 2025, succeeding Michael Casamento, who will remain as an advisor until June 30, 2026 to support the transition.

- Scherger brings over three decades of industry expertise, having led major integration and transformation initiatives at Graphic Packaging, which could shape Amcor’s future transformation and operational direction.

- We’ll now examine how Scherger’s extensive experience in large-scale packaging integrations may influence Amcor’s investment narrative and growth outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Amcor Investment Narrative Recap

For anyone considering Amcor, the investment case hinges on management successfully capturing synergies from the Berry Global integration, improving efficiency and driving earnings growth, while addressing ongoing volume weakness and margin pressure from underperforming businesses. The appointment of Stephen R. Scherger as CFO is a positive step for operational credibility, but does not materially change the most important near-term catalyst, realizing cost and procurement synergies, or the largest risk: slow portfolio optimization and North American beverage segment challenges.

Among recent announcements, Amcor's reaffirmation of fiscal 2026 earnings guidance stands out. Maintaining this outlook, despite ongoing executive changes, reflects management's confidence in the integration process and planned synergy capture, both critical to short-term investor expectations.

But with ongoing margin pressure from weaker North American operations, investors should also be aware that...

Read the full narrative on Amcor (it's free!)

Amcor's narrative projects $24.3 billion revenue and $1.7 billion earnings by 2028. This requires 17.5% yearly revenue growth and a $1.19 billion earnings increase from $510 million today.

Uncover how Amcor's forecasts yield a $10.59 fair value, a 34% upside to its current price.

Exploring Other Perspectives

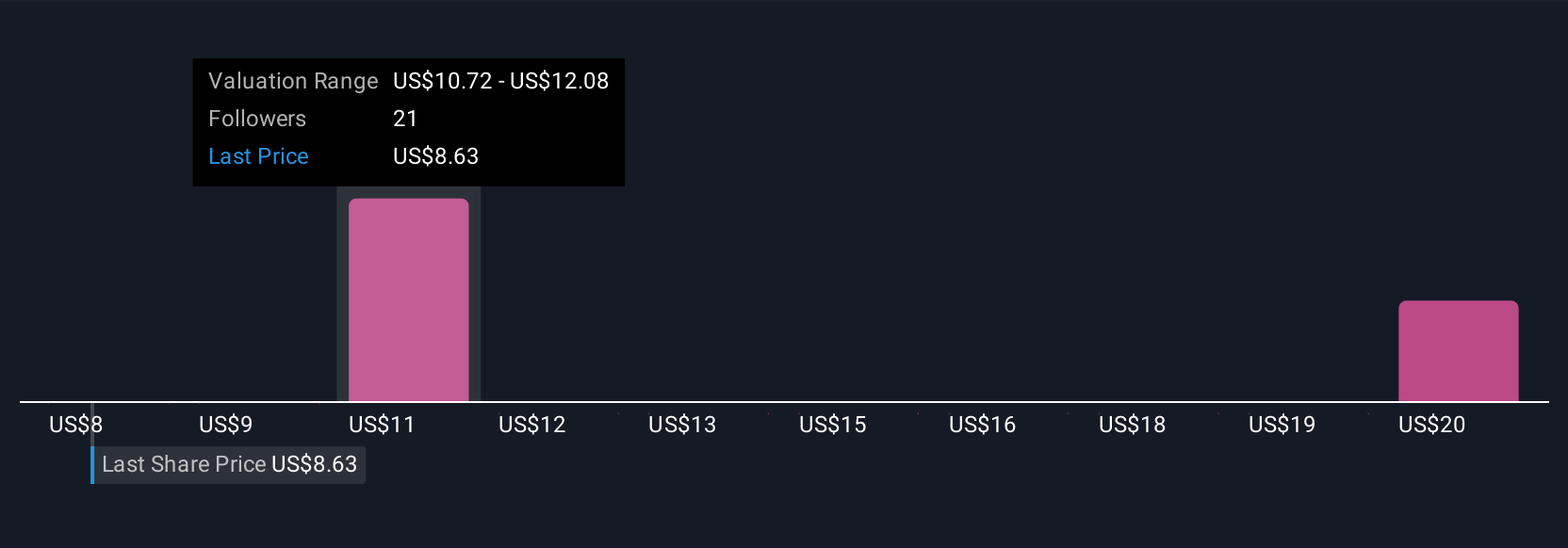

Four fair value estimates from the Simply Wall St Community range from US$8.53 to US$10.59 per share. While opinions vary, persistent volume declines and portfolio restructuring challenges could weigh on Amcor’s future results, making it crucial to explore several viewpoints before acting.

Explore 4 other fair value estimates on Amcor - why the stock might be worth as much as 34% more than the current price!

Build Your Own Amcor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amcor research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Amcor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amcor's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMCR

Amcor

Engages in the production and sale of packaging products in Europe, North America, Latin America, and the Asia Pacific.

Moderate risk with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives