- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Can Agnico Eagle’s 118% Rally Continue After Latest Gold Price Surge in 2025?

Reviewed by Bailey Pemberton

Thinking about what to do with Agnico Eagle Mines stock? You are not alone. This gold miner has been on quite the run lately, drawing attention from both longtime shareholders and newcomers eager to get a piece of the action. In just the last week, Agnico Eagle’s share price climbed 5.4%, pushing its 30-day return to an impressive 16.2%. If we zoom out, the gains look even more striking: up 118% year-to-date and an eye-popping 120.7% over the past year. For those who stuck with the company in the longer term, the three-year return stands at 376.8%, while the five-year gain is 148.8%.

Part of this momentum has been fueled by broader optimism across the gold sector, following renewed volatility in global markets. As investors look for stable havens, companies like Agnico Eagle with strong operational track records have come back into focus. But whenever a rally like this happens, it is only natural to ask: are shares still trading at a fair price, or has the excitement pushed them too high?

According to standard valuation checks, Agnico Eagle scores a 1 out of 6 for undervaluation. This means only one measure currently suggests the stock is undervalued. That might raise some eyebrows, especially for those who prefer a margin of safety. But as you will see, valuation is not a one-size-fits-all discussion, and the numbers tell only part of the story. Let’s break down the different ways analysts weigh a company’s value, and later, I will share what might be the most insightful way to judge Agnico Eagle’s price tag.

Agnico Eagle Mines scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Agnico Eagle Mines Discounted Cash Flow (DCF) Analysis

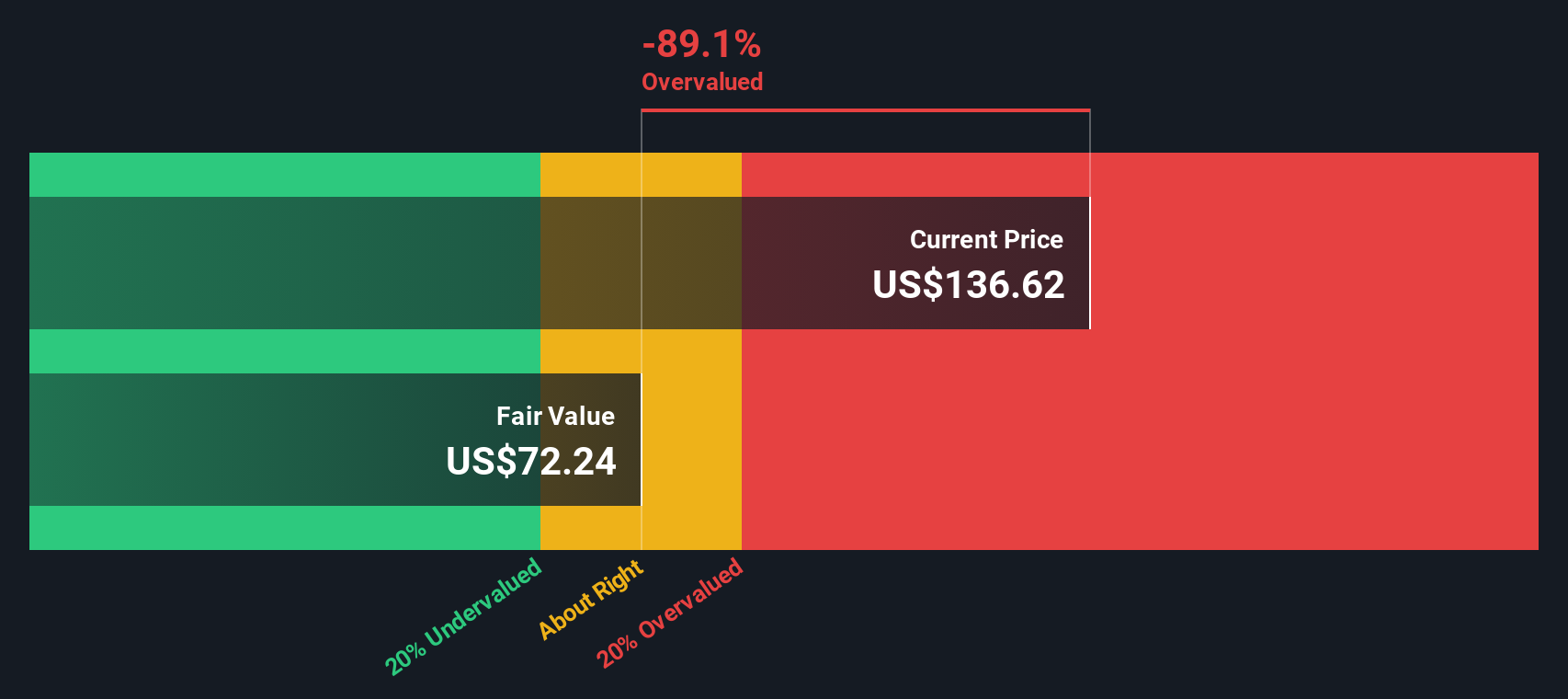

A Discounted Cash Flow (DCF) model estimates what a company is truly worth by projecting its future cash flows and discounting them back to today’s value. For Agnico Eagle Mines, this approach uses recent and forecasted Free Cash Flow figures, providing a sense of how much cash the business can realistically generate for shareholders over time.

Currently, Agnico Eagle Mines is generating $2.88 Billion in Free Cash Flow annually. Analyst projections see this figure climbing in the next few years, reaching a forecasted $4.35 Billion by 2026. It is then projected to moderate to $2.07 Billion in 2029 and trend slightly lower in the decade that follows. These estimates combine analyst insights for the near term with longer-term forecasts from Simply Wall St's extrapolations.

With all these future cash flows discounted back to present value, the DCF valuation implies a fair value of $74.69 per share. In comparison, the current share price is substantially higher. The DCF calculation indicates Agnico Eagle Mines stock is about 139.3% above its fair value using this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Agnico Eagle Mines may be overvalued by 139.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Agnico Eagle Mines Price vs Earnings

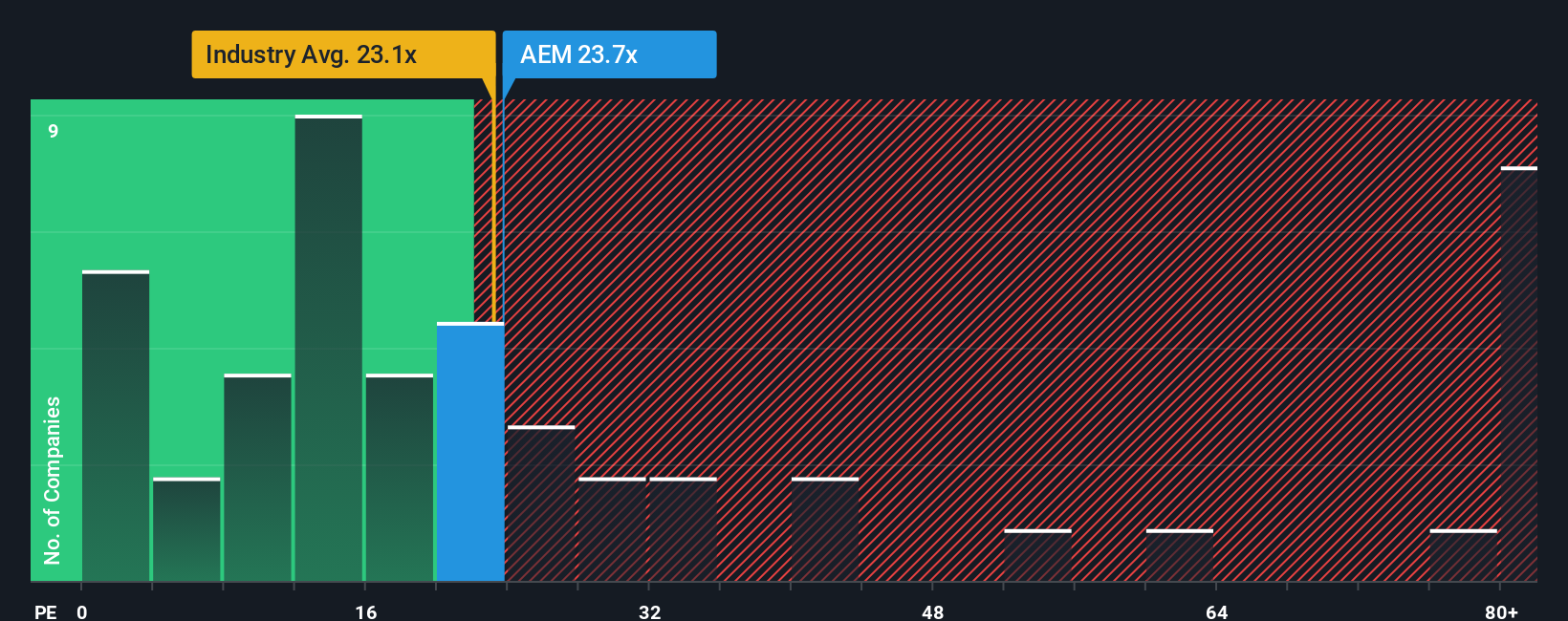

For established, profitable companies like Agnico Eagle Mines, the Price-to-Earnings (PE) ratio is often seen as the most direct and insightful gauge of shareholder value. The PE ratio allows investors to quickly see how much they are paying for each dollar of a company’s profits, making it easier to compare companies across the same sector.

What counts as a “fair” PE ratio varies depending on factors such as how quickly a company is expected to grow, and the risks in its business model or sector. Generally, companies with stronger growth prospects, higher profit margins, and lower risks usually trade at higher PE multiples. More mature or riskier businesses tend to trade at lower levels.

Agnico Eagle Mines currently trades at a PE of 30.3x, which is below its peer average of 35.6x and above the Metals and Mining industry average of 25.5x. But rather than relying solely on these benchmarks, Simply Wall St provides a “Fair Ratio” that incorporates not just industry comparisons, but also Agnico Eagle’s own earnings growth, profit margins, market capitalization, and unique risk profile. For Agnico Eagle, the Fair Ratio stands at 23.4x, which is notably below the current PE. This means that, once the company’s fundamentals are properly accounted for, its stock looks somewhat expensive relative to its true, risk-adjusted earning power.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Agnico Eagle Mines Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, a powerful tool that lets you build your own story about a company and connect it with the financials that matter most to you.

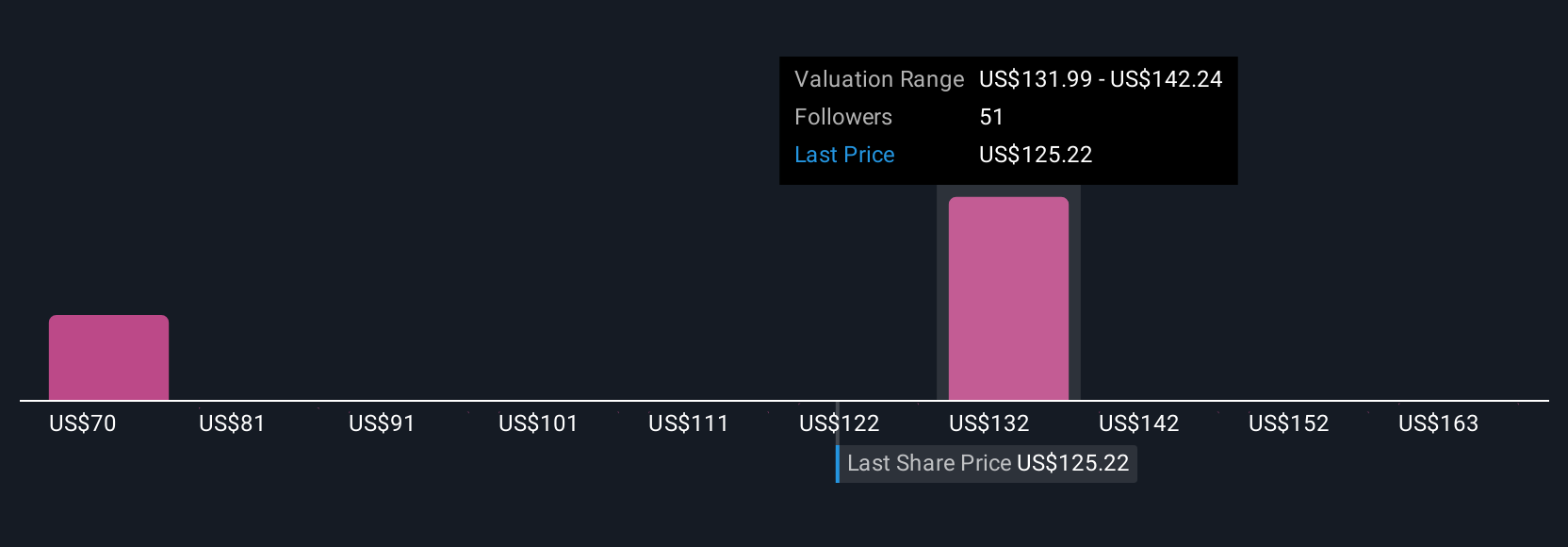

A Narrative takes your perspective on Agnico Eagle Mines, whether you see elevated gold prices, reserve expansion, or improved efficiency as key growth drivers, or if you believe falling gold prices and project risks will dampen results, and links it directly to your assumptions about future earnings, profit margins, and fair value.

This approach brings the numbers to life, making it easy for any investor to test scenarios and compare their personal Fair Value against the latest share price. Narratives are available and easy to use on Simply Wall St's Community page, allowing millions of investors to update and revisit their investment story as news or earnings reports are released.

For example, one Narrative for Agnico Eagle Mines sees a bullish price target of $209 per share based on optimistic earnings growth, while a cautious Narrative projects just $66 per share. This shows how different investor stories shape very different valuations and helps you decide when to buy or sell with greater confidence.

Do you think there's more to the story for Agnico Eagle Mines? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives