- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Agnico Eagle Mines (NYSE:AEM): Reviewing Valuation After Earnings Beat, Growth Projects and Strong Gold Price Tailwinds

Reviewed by Simply Wall St

Agnico Eagle Mines (NYSE:AEM) has been on investors radar after a strong jump in revenue and earnings, beating expectations and riding higher gold prices while advancing big growth projects like Odyssey and Detour Lake.

See our latest analysis for Agnico Eagle Mines.

At a latest share price of $168.27, Agnico Eagle’s strong operational updates, upbeat conference presence, and its role in the Kivalliq Hydro-Fibre Link have fed into powerful momentum, with a roughly 105% year to date share price return and a 3 year total shareholder return above 250% underscoring how sentiment has shifted decisively in its favor.

If this kind of momentum has you wondering what else is working in the market, it could be a good time to explore fast growing stocks with high insider ownership.

With earnings surging, gold near highs, and the stock already more than doubling this year, the key question now is whether Agnico Eagle still trades below its true worth or if the market is already pricing in its next phase of growth.

Most Popular Narrative Narrative: 13.7% Undervalued

With Agnico Eagle closing at $168.27 against a narrative fair value near $195, the current setup leans toward upside if the core assumptions hold.

Exploration success and rapid reserve expansion near key long life assets (notably Detour Lake, Canadian Malartic, and Hope Bay) position Agnico Eagle for significant organic production growth; this supports a long runway of high quality, low risk volume expansion that can drive top line revenue growth and production leverage.

Curious how this growth runway turns into that higher price tag? The narrative leans on measured expansion, firmer margins, and a richer future earnings multiple. Want to see exactly how those moving pieces combine into the fair value math?

Result: Fair Value of $195.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case hinges on gold staying elevated and major projects avoiding delays or cost overruns that could quickly erode those margin gains.

Find out about the key risks to this Agnico Eagle Mines narrative.

Another Angle on Valuation

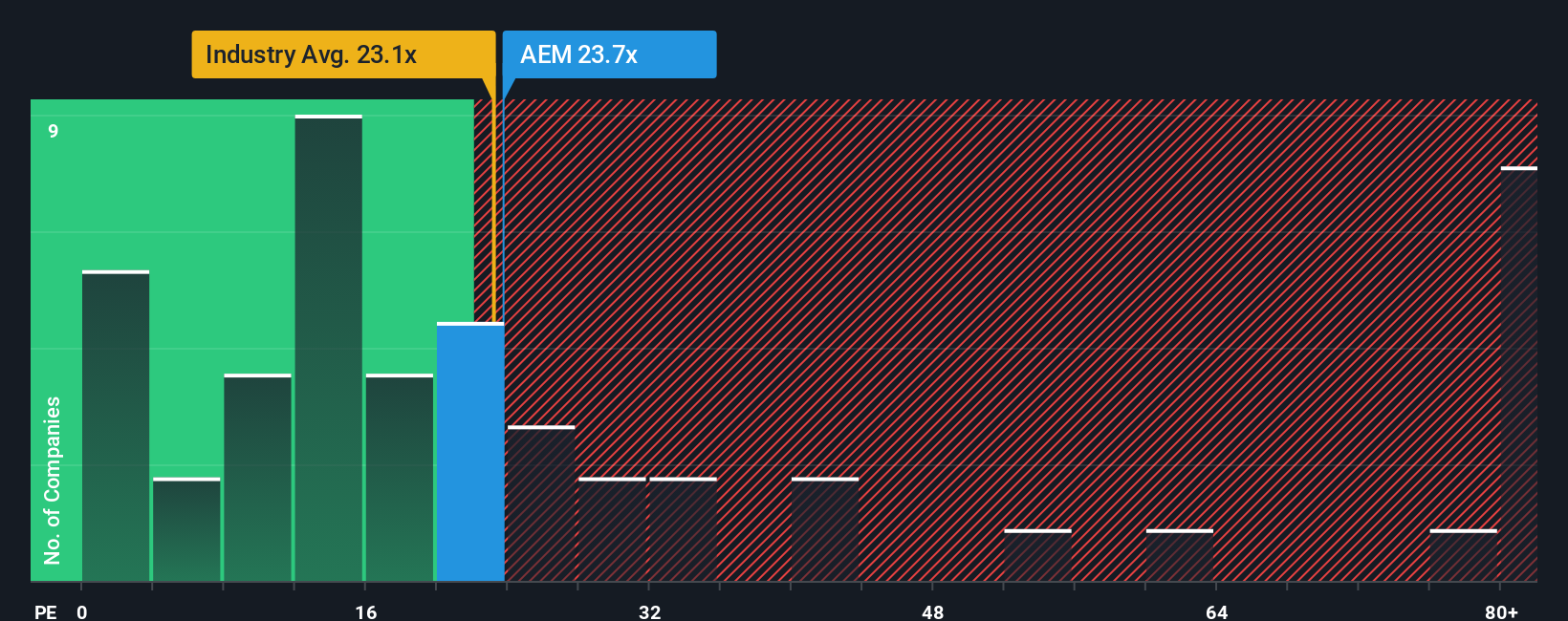

On a simple price to earnings lens, the picture is less forgiving. Agnico Eagle trades on about 24.5 times earnings, slightly richer than its own 23.8 times fair ratio and broadly in line with the US metals and mining average, hinting more at valuation risk than a clear bargain. Could momentum still overpower that caution in the near term?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Agnico Eagle Mines Narrative

If you are not convinced by this view or would rather dig into the numbers yourself, you can build a personalized thesis in just a few minutes: Do it your way.

A great starting point for your Agnico Eagle Mines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop with one great story when the market is full of them. Use the Simply Wall St Screener to spot your next smart opportunity today.

- Capture income potential early by reviewing these 13 dividend stocks with yields > 3% and focus on companies that can keep paying you even when markets turn volatile.

- Position yourself ahead of the next major tech wave by scanning these 26 AI penny stocks for businesses turning artificial intelligence into durable earnings power.

- Strengthen your portfolio’s long term growth engine by targeting these 908 undervalued stocks based on cash flows, where cash flow strength and attractive prices work in your favor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)