- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Agnico Eagle Mines (NYSE:AEM) Margin Surge Challenges Slower Growth Narrative in Latest Earnings

Reviewed by Simply Wall St

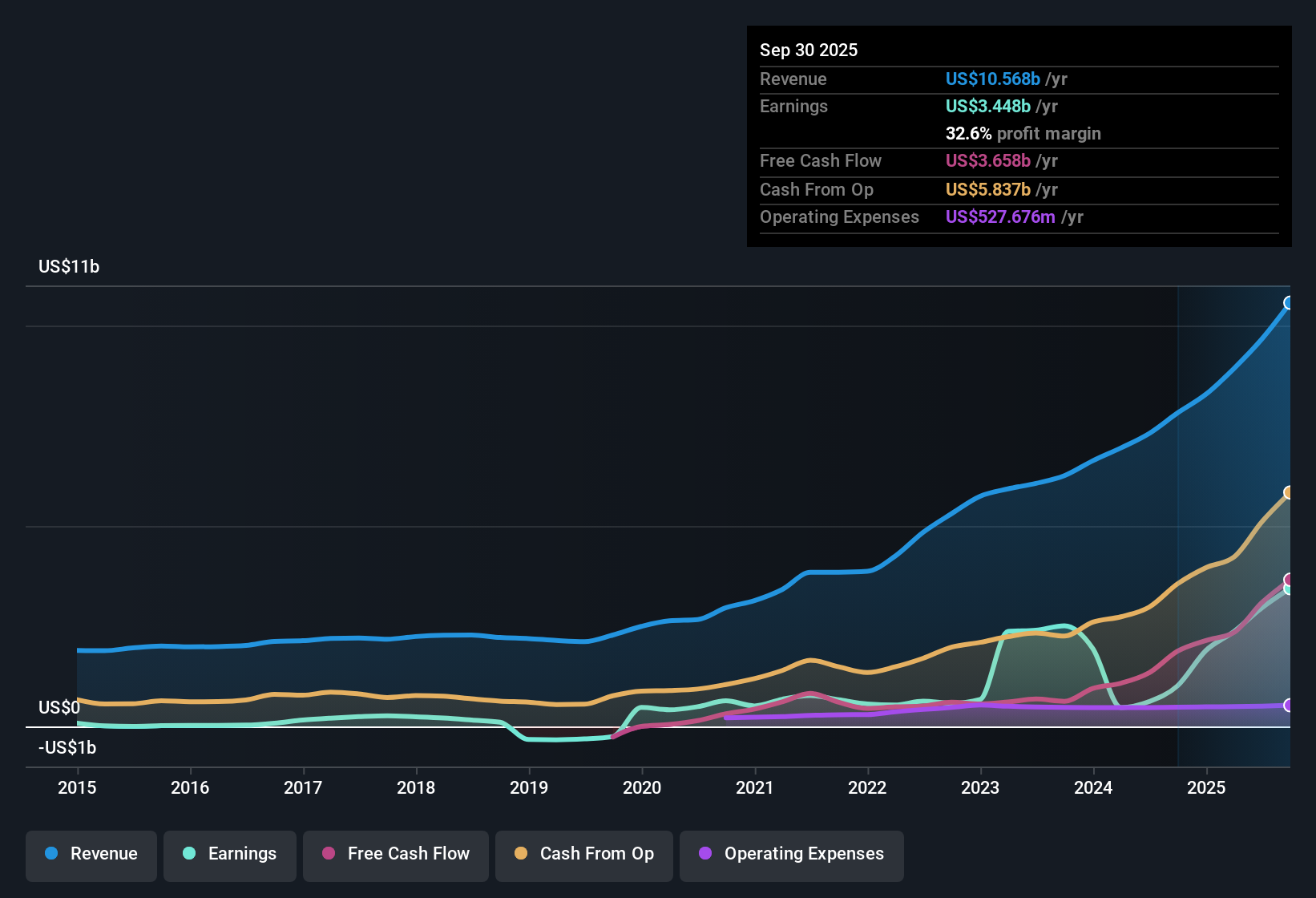

Agnico Eagle Mines (NYSE:AEM) posted current net profit margins of 32.6%, notably higher than last year’s 12.9%, with year-over-year earnings growth coming in at an impressive 240.6% compared to its five-year average annual growth rate of 32.1%. Despite this surge in profitability, revenue is forecast to grow at just 2.5% per year, trailing the broader US market’s 10.3% annual projection. Earnings are expected to decline at a rate of -0.4% per year over the next three years. This mix of surging margins and cautious forecasts sets the tone for how investors might weigh Agnico’s improving bottom line against a more subdued outlook for top-line growth.

See our full analysis for Agnico Eagle Mines.Next, we’ll see how these headline results compare with the most widely followed narratives about Agnico Eagle Mines and whether the numbers reinforce or challenge market expectations.

See what the community is saying about Agnico Eagle Mines

Margin Expansion Drives Record Profitability

- Agnico Eagle Mines achieved a current net profit margin of 32.6%, significantly higher than last year’s 12.9%. This highlights strengthened operational efficiency even as revenue growth lags the US market average.

- According to the analysts' consensus view, operational efficiency programs and innovation, such as underground fleet management and digitalization, have already produced measurable productivity gains and cost savings.

- This backdrop, combined with a focus on stable jurisdictions like Canada and Finland, is credited with improving margins and reducing regulatory risk.

- Consensus notes that these drivers may help offset the impact of slower revenue growth by supporting sustained profitability and attracting long-term investment capital.

Revenue Growth Lags Market Even With High Gold Prices

- Despite robust profits, analysts project Agnico’s revenue to grow at just 2.5% per year, well below the US market’s 10.3% forecast. This suggests challenges in scaling top-line growth even amid strong gold price conditions.

- Consensus narrative highlights that while elevated gold prices and recent reserve expansion should position Agnico Eagle for stronger revenue and shareholder returns,

- heavy reliance on sustained high gold prices and successful project execution creates significant vulnerability if gold prices fall or if project timelines and costs slip.

- This tension reveals that, although current results benefit from historic price tailwinds, future growth is not guaranteed without continuous project success and favorable market conditions.

Analyst Price Target Shows Modest Downside

- With Agnico Eagle’s current share price at $162.61, the consensus analyst price target sits at $186.37. This indicates analysts on average see about 15% upside for the stock from recent levels.

- Consensus narrative believes this relatively narrow gap supports the view that the company is roughly fairly valued right now,

- though meaningful analyst disagreement remains, with bullish targets as high as $209.00 and bearish targets at just $66.00. This shows not everyone is convinced by the current trajectory.

- This spread in price targets reminds investors to double-check whether growth assumptions and gold price expectations truly justify further upside from today’s levels.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Agnico Eagle Mines on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the results? Add your viewpoint and build a custom narrative. It only takes a couple of minutes. Do it your way

A great starting point for your Agnico Eagle Mines research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Agnico Eagle Mines’ limited revenue growth and heavy reliance on high gold prices suggest future performance may not match its current profitability.

For investors wanting steadier growth stories, discover companies with a strong record of consistent expansion and stability by using our stable growth stocks screener (2112 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)