- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Agnico Eagle Mines (NYSE:AEM): Assessing Valuation Following Analyst Upgrades and Improved Earnings Outlook

Reviewed by Kshitija Bhandaru

Recent analyst upgrades and rising earnings estimates have put Agnico Eagle Mines (NYSE:AEM) in the spotlight, as the company benefits from strong gold prices and growing optimism about its development projects.

See our latest analysis for Agnico Eagle Mines.

After a string of high-profile deals and analyst endorsements, Agnico Eagle Mines has witnessed share price momentum accelerate. Its 90-day share price return sits at an impressive 38%, driving a remarkable 109% total shareholder return over the past year. The rally has been fueled by optimism around new mine projects, surging gold prices, and fresh strategic investments, all of which are spotlighting Agnico Eagle’s growth prospects and boosting investor confidence.

If the excitement around gold miners has you thinking bigger, this could be the perfect moment to discover fast growing stocks with high insider ownership.

With shares already up more than 100% over the past year and analysts revising price targets higher, the key question now is whether Agnico Eagle Mines is trading above its intrinsic value or if there is still room for new investors to participate in further upside.

Most Popular Narrative: 10.7% Overvalued

The narrative consensus places Agnico Eagle Mines' fair value below the current market price, highlighting ambitious assumptions about continued growth and profitability. This frames a dramatic debate on whether the recent surge can truly last.

Exploration success and rapid reserve expansion near key long-life assets (notably Detour Lake, Canadian Malartic, and Hope Bay) position Agnico Eagle for significant organic production growth. This supports a long runway of high-quality, low-risk volume expansion that can drive top-line revenue growth and production leverage.

Want a closer look at the growth logic behind this elevated valuation? The narrative is built on bold projections about project execution and organic expansion. But how ambitious are the underlying financial forecasts? Dive in to uncover which assumptions are fueling the fair value call and whether they might surprise you.

Result: Fair Value of $148.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharp drop in gold prices or project execution setbacks could quickly undermine the bullish outlook for Agnico Eagle Mines.

Find out about the key risks to this Agnico Eagle Mines narrative.

Another View: Sizing Up the DCF Model

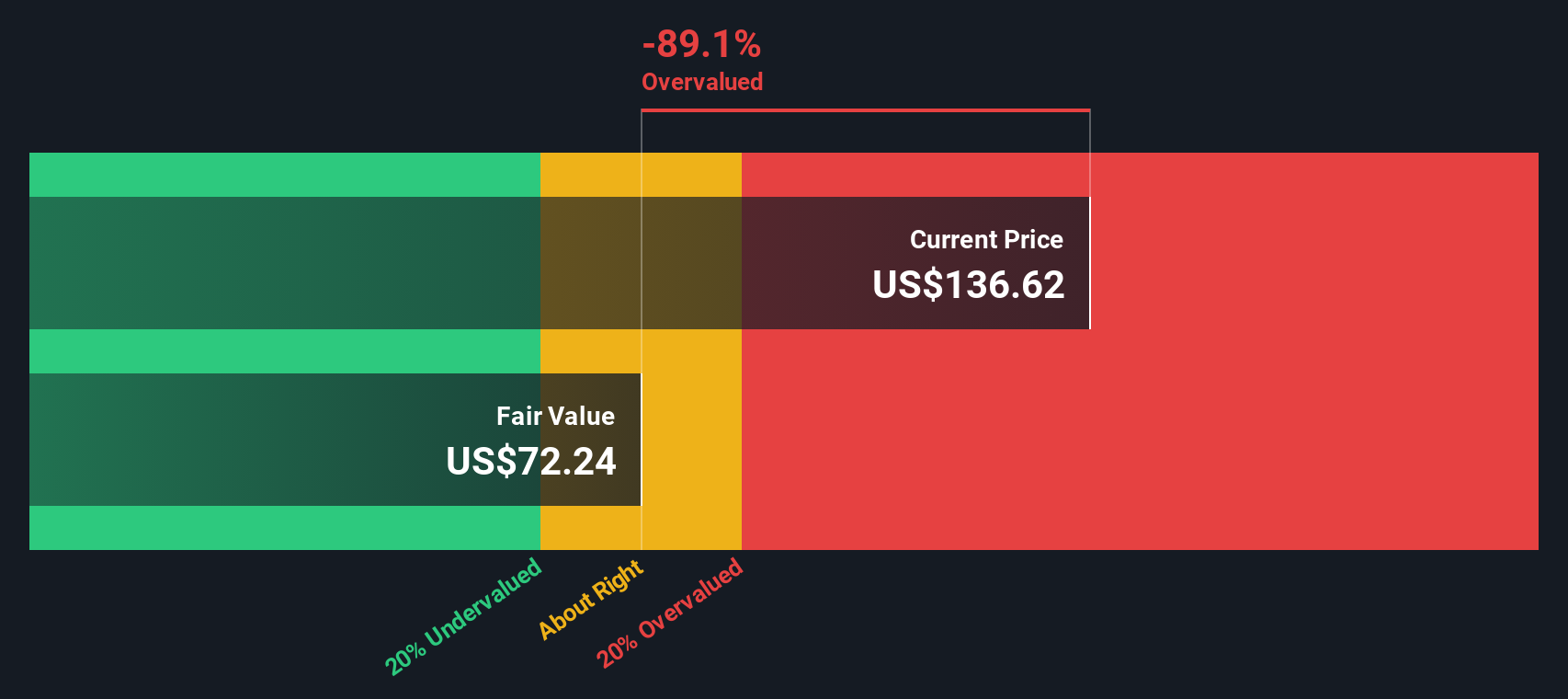

While the market values Agnico Eagle Mines above what many see as its fair value, our DCF model paints an even more cautious picture. According to this method, the shares are trading well above the estimate of fair value. This suggests that the price may reflect high growth expectations. Could the fundamentals truly live up to such optimism?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Agnico Eagle Mines Narrative

If you have a different viewpoint or want to dive into the numbers for yourself, you can build your own narrative in just a few minutes. Shape the story your way with Do it your way.

A great starting point for your Agnico Eagle Mines research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit their horizons. If you want to stay ahead, seize this moment to find opportunities others overlook with our top handpicked lists.

- Uncover hidden value when you compare fundamentals and cash flows among these 893 undervalued stocks based on cash flows, revealing what the crowd often misses on Wall Street.

- Capitalize on the AI revolution by focusing on these 24 AI penny stocks to catch powerful trends in automation, machine learning, and digital disruption before mainstream momentum hits.

- Secure cash flow with stability by reviewing these 19 dividend stocks with yields > 3%, where you’ll identify companies delivering robust yields and consistent shareholder returns above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives