- United States

- /

- Metals and Mining

- /

- NasdaqCM:YDDL

US Undiscovered Gems To Watch This December 2025

Reviewed by Simply Wall St

As December 2025 unfolds, the United States stock market is experiencing a notable upswing, with major indexes like the S&P 500 and Nasdaq posting weekly gains driven by a renewed tech rally. This positive momentum highlights the potential for small-cap stocks to shine, especially those that are well-positioned to capitalize on evolving economic conditions and investor sentiment.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Southern Michigan Bancorp | 113.59% | 8.48% | 3.73% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 114.54% | 2.38% | -28.53% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

One and one Green Technologies (YDDL)

Simply Wall St Value Rating: ★★★★★★

Overview: One and one Green Technologies Inc is a waste materials and scrap metal recycling company that focuses on the recycling, production, and trading of recycled scrap metals in the Philippines, with a market cap of $322.54 million.

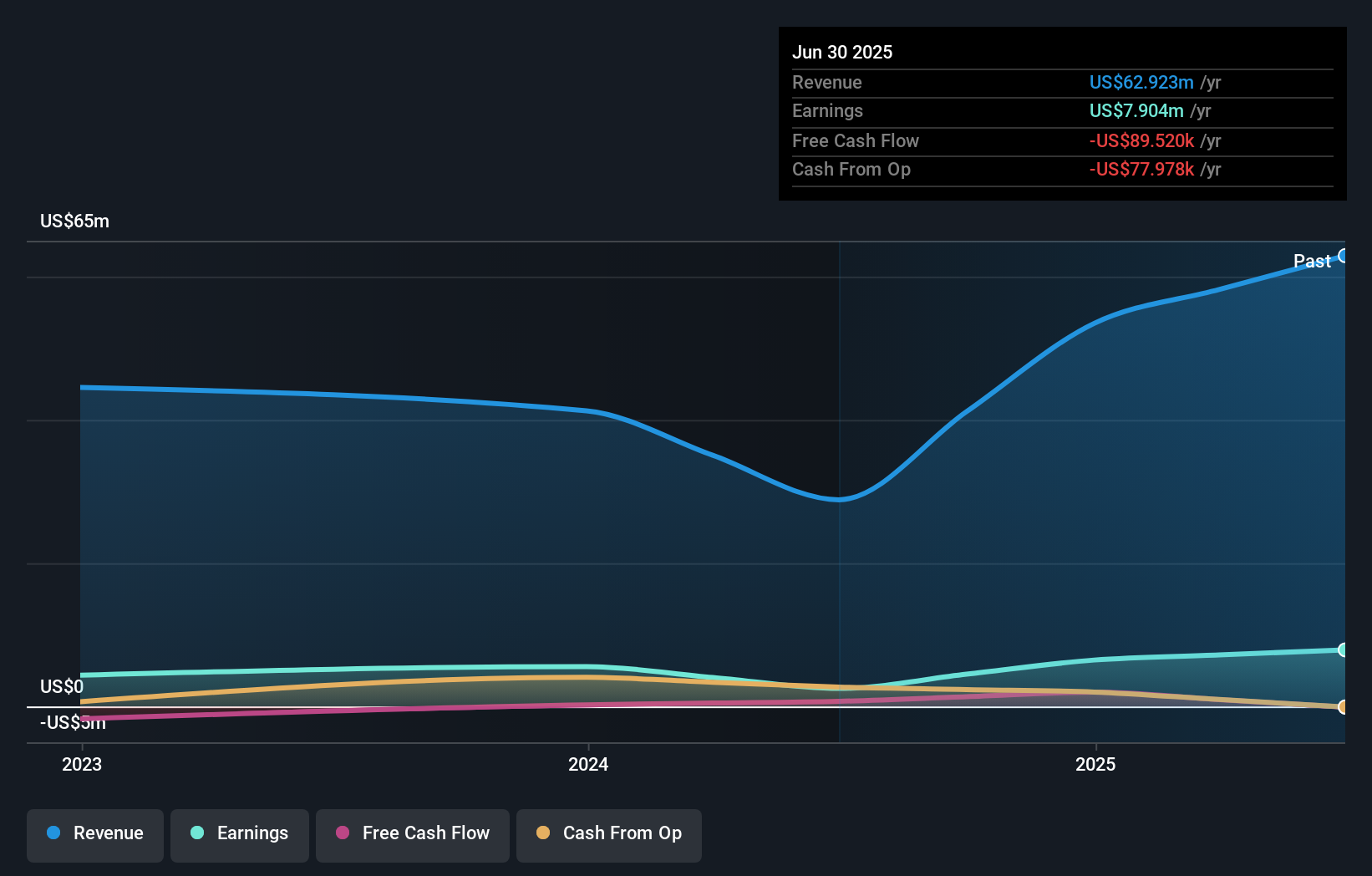

Operations: YDDL generates revenue primarily through its Metal Processors and Fabrication segment, which accounted for $62.92 million. The company's financial performance is influenced by its ability to manage costs associated with recycling and production processes.

One and one Green Technologies, a growing player in the green tech sector, recently reported a notable increase in sales to US$28.13 million for the first half of 2025, up from US$18.67 million last year. Net income also rose to US$3.83 million from US$2.4 million, reflecting solid operational performance with basic earnings per share climbing to US$0.074 from US$0.0461 previously. Following its recent IPO raising $10 million through the sale of 2 million shares at $5 each, this company has been added to the NASDAQ Composite Index, highlighting its increasing market presence and potential for future growth within this dynamic industry.

Caledonia Mining (CMCL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Caledonia Mining Corporation Plc primarily operates a gold mine in Jersey and has a market capitalization of $518.91 million.

Operations: The company generates revenue from its gold mining operations, with the primary focus on extracting and selling gold. It experiences fluctuations in net profit margin, which impacts overall profitability.

Caledonia Mining is making waves with its robust earnings growth, boasting a 917.5% increase over the past year, significantly outpacing the industry average of 3.5%. The company's price-to-earnings ratio stands at 10.4x, well below the US market's 19x, suggesting it trades at an attractive value compared to peers. Despite a rise in debt-to-equity from 0.3% to 8.2% over five years, Caledonia maintains strong interest coverage with EBIT covering interest payments by a factor of 46.7x. Recent developments include advancing the Bilboes Gold Project and maintaining steady production guidance for gold output in Zimbabwe.

Flotek Industries (FTK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Flotek Industries, Inc. is a technology-driven green chemistry and data company serving industrial and commercial markets globally, with a market cap of $486.32 million.

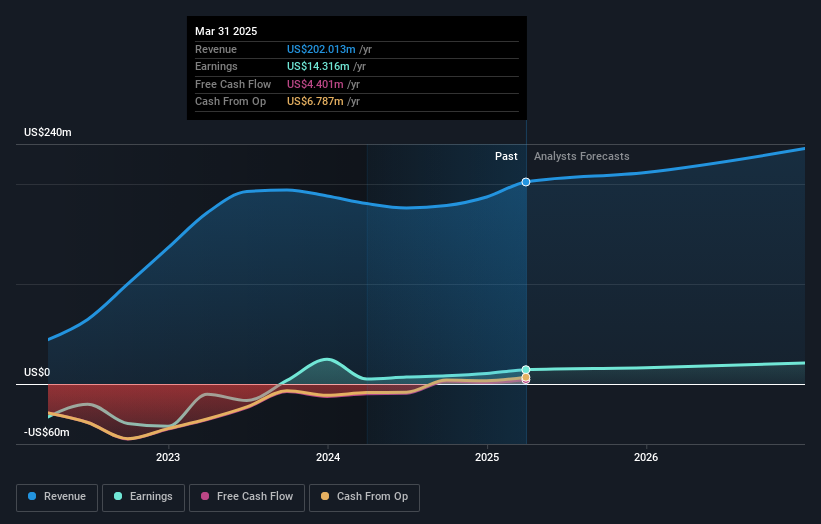

Operations: Flotek Industries generates revenue primarily from its Chemistry Technologies segment, which contributed $200.62 million, and its Data Analytics segment, contributing $19.88 million. The company's focus on these segments highlights its diversified approach to revenue generation within the industrial and commercial sectors globally.

Flotek Industries is carving a niche in digital and eco-friendly solutions, with recent earnings showing a net income of US$20.36 million for Q3 2025, up from US$2.53 million the previous year. Their innovative XSPCT optical spectrometer sets new standards in natural gas measurement, promising significant cost and efficiency gains for customers. Despite this growth, the company faces challenges such as reliance on key clients and market volatility. Trading at US$11.04 per share with a target of US$17.5 by 2028 suggests potential upside but requires careful consideration of associated risks like intense competition and execution hurdles in new ventures.

Key Takeaways

- Navigate through the entire inventory of 298 US Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:YDDL

One and one Green Technologies

A waste materials and scrap metal recycling company, engages in the recycling, production, and trading of recycled scrap metals in the Philippines.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion