Last Update 12 Nov 25

Fair value Increased 8.57%FTK: Revenue Milestone Achievement Will Boost Shares Amid Rising Industry Validation

Analysts have raised their price target for Flotek Industries from $17.50 to $19.00. This reflects optimism over stronger projected revenue growth, even though profit margin expectations have moderated.

What's in the News

- Revised 2025 earnings guidance: Flotek expects total revenues between $220 million and $225 million, up from the previous guidance of $200 million to $220 million (Key Developments).

- Achieved a milestone in natural gas measurement: The XSPCT optical spectrometer from Flotek became the first to meet GPA 2172 standards. This solution offers real-time, highly accurate volume and quality data for custody transfer (Key Developments).

- Tested and approved by leading industry operators: Both E&P and Midstream companies validated the XSPCT for digital valuation of custody transfer. This demonstrates proven reliability in major U.S. basins (Key Developments).

- Added to S&P Global BMI Index, which increases visibility among investors (Key Developments).

Valuation Changes

- Consensus Analyst Price Target increased from $17.50 to $19.00, reflecting higher expected value per share.

- Discount Rate decreased slightly from 7.59% to 7.55%, suggesting a marginally lower risk premium in valuation assumptions.

- Revenue Growth forecast rose notably from 9.45% to 13.30%, indicating higher anticipated top-line expansion.

- Net Profit Margin estimate fell significantly from 23.50% to 14.46%, pointing to lower expected profitability.

- Future P/E ratio climbed from 9.91x to 15.81x, suggesting shares may now be priced higher relative to projected earnings.

Key Takeaways

- Expansion into digital and eco-friendly solutions drives high-margin, recurring revenues and positions the company for long-term growth amid global energy and sustainability trends.

- Innovative technologies, multi-year contracts, and diversification across customers and end markets enhance margin expansion, revenue stability, and competitive differentiation.

- Heavy dependence on key customers, shifting energy trends, intense competition, and execution risks in new ventures threaten revenue stability, growth prospects, and profitability.

Catalysts

About Flotek Industries- Operates as a technology-driven green chemistry and data company that serves customers across industrial and commercial markets in the United States, the United Arab Emirates, and internationally.

- Rapid expansion into energy infrastructure and digital data solutions, such as real-time gas monitoring and the PWRtek platform, positions Flotek to capitalize on the global trend toward energy security and domestic production, directly supporting long-term, recurring, high-margin revenue growth and enhanced cash flow stability.

- Increasing adoption of Flotek's proprietary, environmentally friendly chemistry solutions and prescriptive data-driven chemical optimization aligns with rising industry and regulatory demand for sustainable and efficient chemical usage, boosting net margins and enabling ongoing differentiation from commoditized competitors.

- Multi-year contracts and a growing customer base for high-margin Data Analytics offerings (including both power generation and custody transfer segments) provide significant revenue visibility and margin expansion potential, particularly as these segments shift to become the majority profit contributors by 2026.

- Strong pipeline of pilot programs and scalable deployments in both traditional O&G and fast-growing energy infrastructure/data center markets allow for faster ramp-up of recurring revenue streams and further diversification of end markets, reducing reliance on any single customer and bolstering long-term topline growth.

- Continuous innovation and proprietary technology (backed by over 35 patents in analytics, monitoring, and control) create high barriers to entry and enable premium pricing, supporting robust EBIT margin expansion and the potential for higher valuation as Flotek leverages long-term digitalization and automation trends in energy and chemicals.

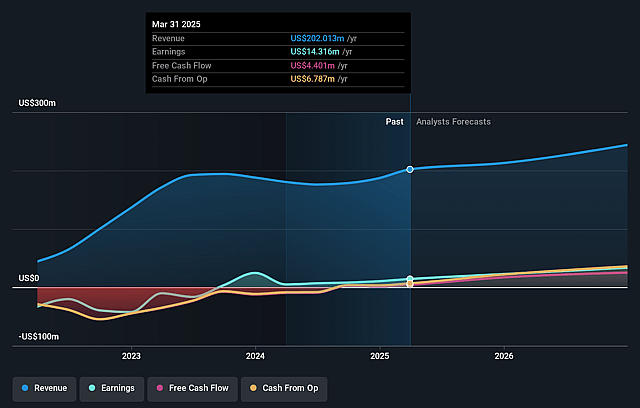

Flotek Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Flotek Industries's revenue will grow by 9.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.6% today to 23.5% in 3 years time.

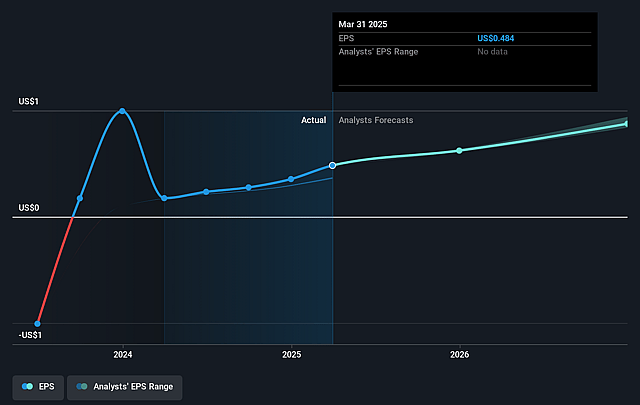

- Analysts expect earnings to reach $66.0 million (and earnings per share of $1.42) by about September 2028, up from $14.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.9x on those 2028 earnings, down from 23.2x today. This future PE is lower than the current PE for the US Chemicals industry at 25.9x.

- Analysts expect the number of shares outstanding to grow by 0.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.59%, as per the Simply Wall St company report.

Flotek Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- High customer concentration risk remains, particularly reliance on large contracts like ProFrac and select pilot clients for PWRtek and custody transfer deployments; loss or renegotiation by a major customer could result in significant revenue volatility and margin compression.

- The long-term secular trend towards renewable energy and decarbonization presents a structural threat to Flotek's core oilfield chemistry and infrastructure offerings, potentially shrinking the total addressable market for both segments and depressing future revenue and earnings.

- Persistent commodity price volatility, softness in North American oil & gas activity, and broader uncertainty regarding upstream demand could continue to pressure the company's chemistry segment-especially commoditized product lines like friction reducers-resulting in potential topline weakness and lower net margins.

- The company's rapid pivot and expansion into data analytics and energy infrastructure, while promising, carries execution and scaling risks; failure to achieve broad adoption beyond pilot phases, slower-than-expected ramp of new customer contracts, or operational setbacks could limit anticipated recurring revenue growth and profitability improvement.

- Competitive intensity and commoditization within both oilfield chemicals and analytics/monitoring solutions-particularly from lower-cost or better-capitalized providers-may restrict Flotek's ability to maintain premium pricing or differentiate its offerings, threatening gross margin resilience and future earnings quality.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.5 for Flotek Industries based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $280.9 million, earnings will come to $66.0 million, and it would be trading on a PE ratio of 9.9x, assuming you use a discount rate of 7.6%.

- Given the current share price of $11.04, the analyst price target of $17.5 is 36.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.