Key Takeaways

- Shifting global energy trends, stricter regulations, and technological changes threaten demand for Flotek's offerings, pressuring future revenue and profit stability.

- Heavy reliance on single clients and historic cash flow issues increase operational risk and limit Flotek's ability to invest in innovation.

- Strategic expansion into diversified, high-margin technology and international markets, alongside innovation and disciplined management, positions Flotek for sustained, stable growth and reduced cyclical risk.

Catalysts

About Flotek Industries- Operates as a technology-driven green chemistry and data company that serves customers across industrial and commercial markets in the United States, the United Arab Emirates, and internationally.

- The accelerating adoption of renewable energy and electrification globally could lead to reduced demand for oil and gas, directly lowering the need for Flotek's chemistry and data analytics solutions over the next decade. This trend is likely to result in significant declines in future revenue and profit growth as the addressable market contracts.

- Increasing regulatory pressure and the likelihood of expanded carbon pricing on fossil fuel usage in key economies may further erode customer budgets for chemical spending, making it difficult for oilfield suppliers like Flotek to maintain current revenue streams and potentially compressing net margins as clients cut discrete expenses.

- Flotek remains highly exposed to concentrated customer risk, especially with the majority of new data analytics assets currently serving one major client, ProFrac. Any reduction in spend, contract renegotiation, or a shift in customer strategy could sharply reduce recurring revenue and earnings visibility, heightening volatility in cash flow.

- Advances in drilling technology, increased automation, and ongoing digitalization in the oil & gas industry threaten to reduce the industry's reliance on traditional and even advanced chemical-based solutions, presenting a risk of secular margin compression and placing long-term downward pressure on Flotek's revenues.

- Historical challenges with generating consistent positive cash flow and recurring operating losses continue to constrain Flotek's ability to meaningfully reinvest in research and development. This persistent limitation could slow innovation, hinder the introduction of new products, and negatively impact long-term earnings potential if disruptive competitors emerge.

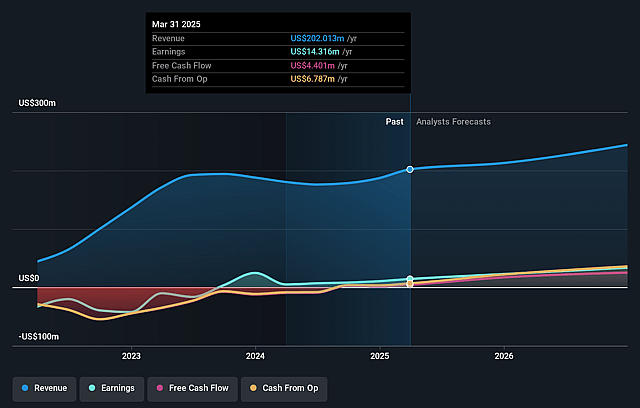

Flotek Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Flotek Industries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Flotek Industries's revenue will grow by 9.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 7.1% today to 22.1% in 3 years time.

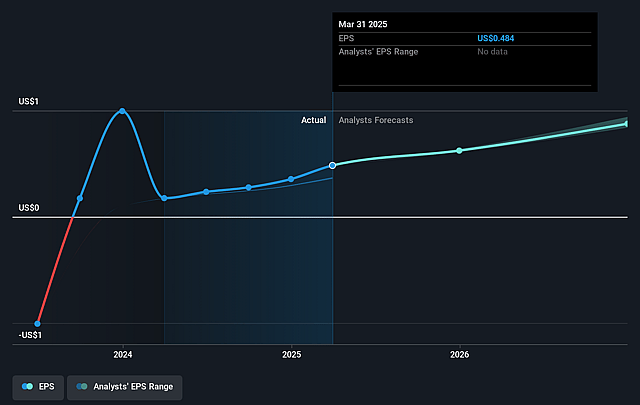

- The bearish analysts expect earnings to reach $58.0 million (and earnings per share of $1.32) by about July 2028, up from $14.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.9x on those 2028 earnings, down from 26.2x today. This future PE is lower than the current PE for the US Chemicals industry at 23.3x.

- Analysts expect the number of shares outstanding to grow by 0.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

Flotek Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Flotek has demonstrated five consecutive quarters of strong top and bottom-line growth, including a 37 percent surge in total revenue and a 244 percent increase in net income versus last year, underpinned by both Chemistry and Data Analytics segments-suggesting the company may be entering a long-term period of sustainable earnings and revenue growth.

- The recent acquisition of proprietary, patented real-time gas monitoring and dual-fuel optimization assets, along with a secured six-year $160 million recurring revenue contract, provides high-margin, multi-year backlog and substantially increases the company's recurring cash flow and profitability.

- The company's shift toward high-margin, technology-driven Data Analytics (such as the PWRtek and Verax measurement platforms) opens vast new addressable markets in power generation, custody transfer, and flare monitoring, setting up a diversified revenue base with multiple high-value growth engines that decrease reliance on oilfield cycles and support durable margin expansion.

- Flotek's international expansion, notably in stable and growing Middle Eastern and Argentinian markets with major NOCs and multinational clients, is driving robust, stable, and potentially long-term chemistry revenue growth, reducing company exposure to domestic oil and gas volatility and enhancing revenue stability.

- The company's ability to innovate rapidly-with over 30 patents and a strong pipeline of advanced products-coupled with a disciplined approach to cost control, automation, and balance sheet management, positions Flotek to capture market share, support higher net margins, and maintain strong earnings momentum well into the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Flotek Industries is $11.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Flotek Industries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $19.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $262.2 million, earnings will come to $58.0 million, and it would be trading on a PE ratio of 6.9x, assuming you use a discount rate of 6.9%.

- Given the current share price of $12.65, the bearish analyst price target of $11.0 is 15.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.