Key Takeaways

- Rapid customer adoption, unique technology, and international expansion position Flotek for accelerated revenue growth, stable margins, and significant outperformance versus market expectations.

- Sustainability leadership and increased reinvestment capability enable Flotek to capture new markets, command premium pricing, and extend its competitive advantage as industry consolidation occurs.

- Exposure to shrinking oilfield markets, customer concentration, regulatory pressures, and increased competition threatens Flotek's long-term revenue stability, profitability, and innovation capacity.

Catalysts

About Flotek Industries- Operates as a technology-driven green chemistry and data company that serves customers across industrial and commercial markets in the United States, the United Arab Emirates, and internationally.

- Analyst consensus expects the $160 million, six-year recurring revenue contract from the real-time gas monitoring and dual fuel optimization acquisition to steadily boost high-margin, predictable Data Analytics revenue, but given rapid customer adoption, strong third-party demand, and a turnkey end-to-end platform with no close competition, recurring revenues and EBITDA could scale materially faster and higher than current forecasts-a likely catalyst for major multiple expansion and outperformance in net margins.

- While the consensus highlights international expansion and early traction with major customers, the magnitude appears understated; Flotek is not just growing its international chemistry sales but is becoming the preferred supplier for megatenders with national oil companies and building crucial in-country partnerships, suggesting a potential step-change in both revenue scale and margin stability well above market expectations.

- Flotek's unique combination of real-time digital chemistry monitoring, patented analytics, and field-proven automation positions the company to pioneer large, adjacent markets like data center power and grid support-opening a multi-billion dollar addressable market beyond oil and gas, which could drive outsized topline growth and recurring, premium-margin service revenue.

- As environmental regulations tighten globally and demand soars for sustainability solutions, Flotek's leadership in advanced, eco-friendly chemicals and emission monitoring technology makes it a prime beneficiary of the accelerating transition toward cleaner energy operations, directly enabling premium pricing, greater customer stickiness, and boosting gross profit margin expansion.

- With a strengthened balance sheet, rapidly compounding free cash flow, and proven rapid ROI on new asset deployment, Flotek has the flexibility to aggressively reinvest in organic and inorganic growth-including ramping production of high-ROI monitoring units-which supports a virtuous cycle of above-peer earnings growth and further market share gains as industry consolidation continues.

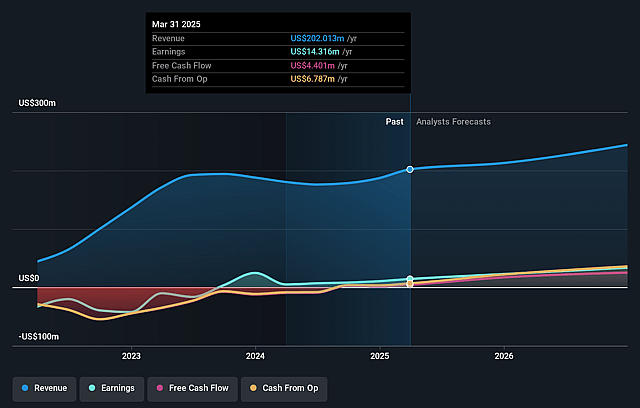

Flotek Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Flotek Industries compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Flotek Industries's revenue will grow by 14.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.1% today to 22.1% in 3 years time.

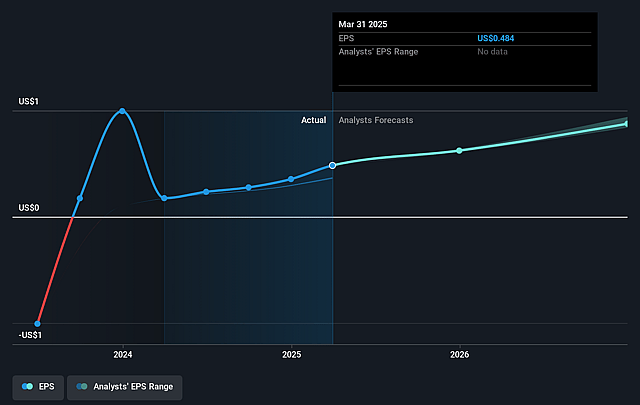

- The bullish analysts expect earnings to reach $66.4 million (and earnings per share of $1.48) by about July 2028, up from $14.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.5x on those 2028 earnings, down from 25.5x today. This future PE is lower than the current PE for the US Chemicals industry at 23.3x.

- Analysts expect the number of shares outstanding to grow by 0.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

Flotek Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global transition to renewable energy and decarbonization threatens to diminish long-term demand for Flotek's oilfield services and specialty chemicals, shrinking its core addressable market and ultimately pressuring long-term revenue growth.

- Heightened environmental, social, and governance regulations and disclosure requirements, particularly for chemical use and flare monitoring, could drive up compliance costs for Flotek and constrain its ability to sell certain products, negatively affecting net margins.

- Flotek's continued reliance on large contracts and a concentrated customer base, such as major relationships with ProFrac and select international NOCs, exposes the company to revenue volatility and earnings instability if these customers reduce volumes or seek alternative suppliers.

- Despite recent improvements, Flotek's historical struggle with sustained profitability and frequent operating losses limits its financial flexibility and restricts its ability to reinvest in research and development, potentially weakening future earnings.

- Intensifying competition and the risk of technological obsolescence pose a challenge as larger, well-capitalized peers invest in differentiated, advanced chemistry and digital solutions, which could erode Flotek's market share and lead to increased pricing pressure, harming overall revenue and net income prospects.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Flotek Industries is $19.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Flotek Industries's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $19.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $299.9 million, earnings will come to $66.4 million, and it would be trading on a PE ratio of 10.5x, assuming you use a discount rate of 6.9%.

- Given the current share price of $12.29, the bullish analyst price target of $19.0 is 35.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.