- United States

- /

- Medical Equipment

- /

- NasdaqCM:UFPT

Here's Why Shareholders May Want To Be Cautious With Increasing UFP Technologies, Inc.'s (NASDAQ:UFPT) CEO Pay Packet

Performance at UFP Technologies, Inc. (NASDAQ:UFPT) has been reasonably good and CEO R. Bailly has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 09 June 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

View our latest analysis for UFP Technologies

How Does Total Compensation For R. Bailly Compare With Other Companies In The Industry?

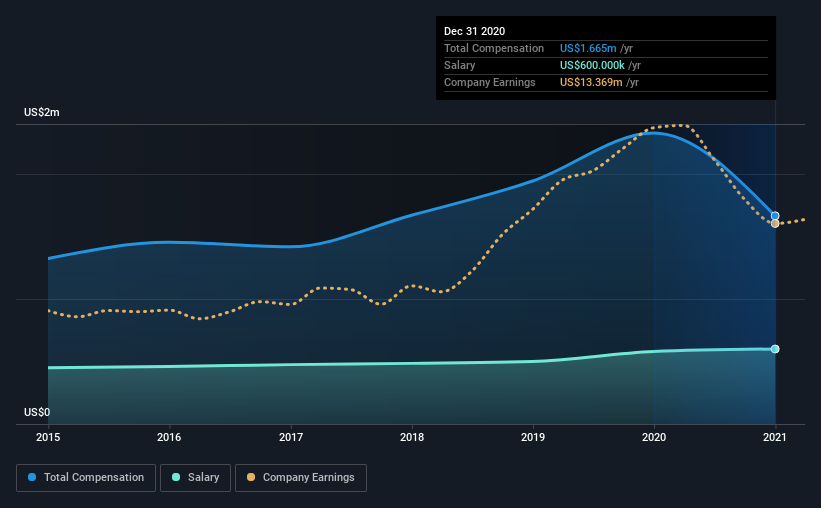

According to our data, UFP Technologies, Inc. has a market capitalization of US$423m, and paid its CEO total annual compensation worth US$1.7m over the year to December 2020. Notably, that's a decrease of 28% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$600k.

On comparing similar companies from the same industry with market caps ranging from US$200m to US$800m, we found that the median CEO total compensation was US$614k. Accordingly, our analysis reveals that UFP Technologies, Inc. pays R. Bailly north of the industry median. What's more, R. Bailly holds US$24m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$600k | US$580k | 36% |

| Other | US$1.1m | US$1.7m | 64% |

| Total Compensation | US$1.7m | US$2.3m | 100% |

On an industry level, around 13% of total compensation represents salary and 87% is other remuneration. UFP Technologies is paying a higher share of its remuneration through a salary in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

UFP Technologies, Inc.'s Growth

UFP Technologies, Inc.'s earnings per share (EPS) grew 14% per year over the last three years. It saw its revenue drop 9.9% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has UFP Technologies, Inc. Been A Good Investment?

Boasting a total shareholder return of 79% over three years, UFP Technologies, Inc. has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 1 warning sign for UFP Technologies that investors should look into moving forward.

Important note: UFP Technologies is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade UFP Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:UFPT

UFP Technologies

Designs and manufactures solutions for medical devices, sterile packaging, and other engineered custom products in the United States.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion