- United States

- /

- Basic Materials

- /

- NasdaqCM:SMID

Smith-Midland (NASDAQ:SMID) sheds 11% this week, as yearly returns fall more in line with earnings growth

It's been a soft week for Smith-Midland Corporation (NASDAQ:SMID) shares, which are down 11%. But that doesn't undermine the fantastic longer term performance (measured over five years). In fact, during that period, the share price climbed 316%. Impressive! Arguably, the recent fall is to be expected after such a strong rise. But the real question is whether the business fundamentals can improve over the long term.

In light of the stock dropping 11% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

Check out our latest analysis for Smith-Midland

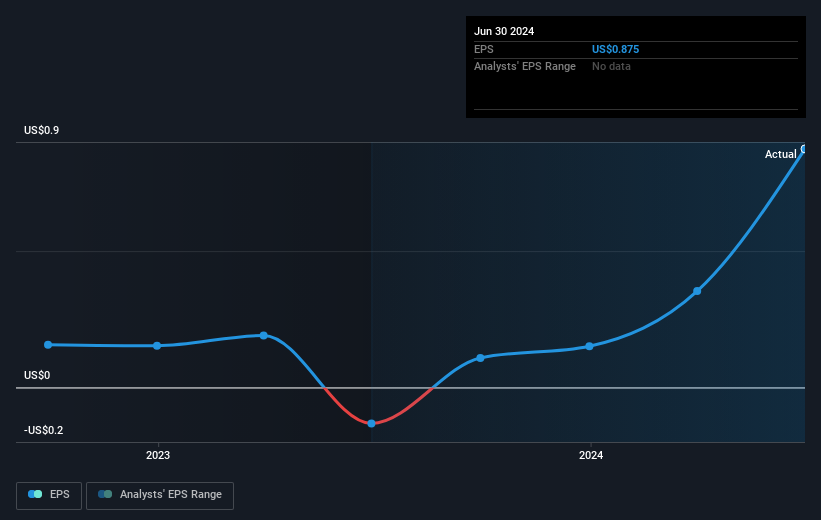

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last half decade, Smith-Midland became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Smith-Midland's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Smith-Midland's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Smith-Midland's TSR of 320% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

It's nice to see that Smith-Midland shareholders have received a total shareholder return of 69% over the last year. That's better than the annualised return of 33% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Smith-Midland better, we need to consider many other factors. For example, we've discovered 2 warning signs for Smith-Midland (1 can't be ignored!) that you should be aware of before investing here.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SMID

Smith-Midland

Smith-Midland Corporation invents, develops, manufactures, markets, leases, licenses, sells, and installs precast concrete products and systems in the United States.

Flawless balance sheet with proven track record.