- United States

- /

- Metals and Mining

- /

- NasdaqCM:SGML

Can Sigma Lithium’s (SGML) Operational Upgrades Sustain Its Cost Edge Amid Lithium Price Pressures?

Reviewed by Sasha Jovanovic

- Earlier this month, Sigma Lithium announced an extensive upgrade to its mining operations, aiming to improve efficiency by modernizing equipment, enhancing safety standards, and reducing plant gate costs by around 20%, following significant gains in its Greentech plant recovery rates.

- This move is expected to support Sigma Lithium’s future production expansion and cost leadership, especially amid recent lithium price pressures and a focus on bridging safety performance across its facilities.

- We’ll now explore how these operational enhancements could influence Sigma Lithium’s investment narrative, particularly its focus on cost competitiveness and production scalability.

Find companies with promising cash flow potential yet trading below their fair value.

Sigma Lithium Investment Narrative Recap

To be a shareholder in Sigma Lithium, you need to believe in a rebound in lithium prices, expanding global EV demand, and the company's ability to translate operational efficiency into sustained cost leadership. The latest mining upgrade targets near-term cost savings and adds support to its scale-up narrative, but the primary short-term catalyst remains price improvement, while the principal risk continues to be lithium price volatility; this news helps cost resilience but may not fully offset that risk.

Among recent announcements, Sigma Lithium's 38% year-over-year production increase in Q2 2025 stands out, reinforcing management’s focus on execution and scalability. Consistent delivery on output targets directly supports catalysts such as expansion and economies of scale, although the path to margin stability is still sensitive to market conditions.

However, investors should also consider that despite operational advances, heavy exposure to spot lithium prices remains a key concern...

Read the full narrative on Sigma Lithium (it's free!)

Sigma Lithium's narrative projects $600.1 million revenue and $57.4 million earnings by 2028. This requires 64.6% yearly revenue growth and a $105.1 million increase in earnings from current earnings of $-47.7 million.

Uncover how Sigma Lithium's forecasts yield a $11.00 fair value, a 74% upside to its current price.

Exploring Other Perspectives

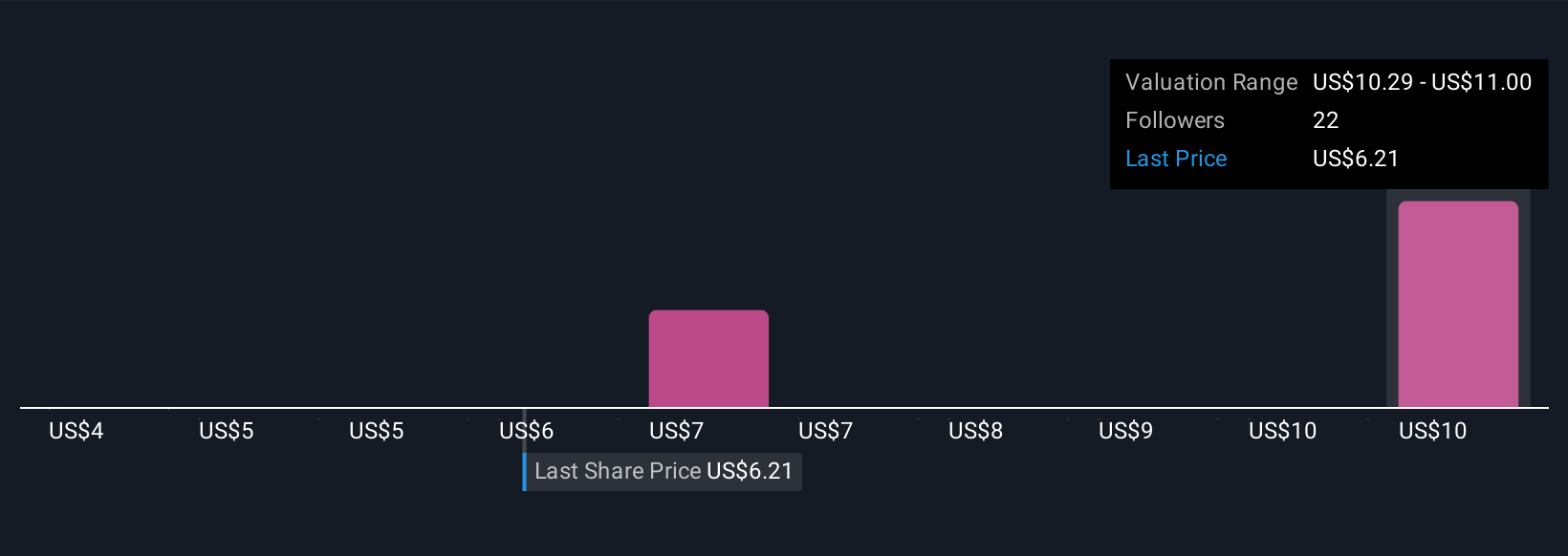

Simply Wall St Community members provided three fair value estimates for Sigma Lithium, ranging from US$3.86 to US$11 per share. Against this diversity of opinion, the company's cost-cutting upgrades target resilience in the face of volatile lithium prices, underscoring the importance of comparing different viewpoints.

Explore 3 other fair value estimates on Sigma Lithium - why the stock might be worth as much as 74% more than the current price!

Build Your Own Sigma Lithium Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sigma Lithium research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Sigma Lithium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sigma Lithium's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SGML

Sigma Lithium

Engages in the exploration and development of lithium deposits in Brazil.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives