- United States

- /

- Metals and Mining

- /

- NasdaqGS:RGLD

Earnings Tell The Story For Royal Gold, Inc. (NASDAQ:RGLD)

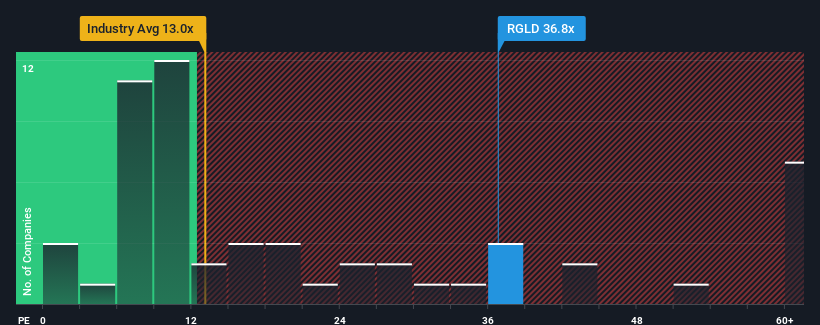

With a price-to-earnings (or "P/E") ratio of 36.8x Royal Gold, Inc. (NASDAQ:RGLD) may be sending very bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings that are retreating more than the market's of late, Royal Gold has been very sluggish. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Royal Gold

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Royal Gold's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 6.1%. The last three years don't look nice either as the company has shrunk EPS by 18% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 28% each year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 10% per annum, which is noticeably less attractive.

With this information, we can see why Royal Gold is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Royal Gold's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Royal Gold's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Royal Gold with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGLD

Royal Gold

Acquires and manages precious metal streams, royalties, and related interests.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives