- United States

- /

- Software

- /

- NasdaqGS:DDOG

3 Stocks Estimated To Be Undervalued By Up To 29.8%

Reviewed by Simply Wall St

As major U.S. stock indexes recently ended lower amidst ongoing earnings reports and renewed U.S.-China trade tensions, investors are keenly observing market fluctuations for potential opportunities. In such an environment, identifying undervalued stocks can be a strategic approach, as these equities might offer a margin of safety and potential for appreciation when market conditions stabilize or improve.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Udemy (UDMY) | $7.04 | $13.53 | 48% |

| TowneBank (TOWN) | $32.80 | $62.93 | 47.9% |

| SLM (SLM) | $26.73 | $53.09 | 49.6% |

| MoneyHero (MNY) | $1.31 | $2.53 | 48.3% |

| Hess Midstream (HESM) | $33.74 | $66.78 | 49.5% |

| GeneDx Holdings (WGS) | $125.07 | $248.76 | 49.7% |

| Flux Power Holdings (FLUX) | $6.61 | $13.19 | 49.9% |

| First Busey (BUSE) | $23.18 | $45.91 | 49.5% |

| Corpay (CPAY) | $284.45 | $546.77 | 48% |

| Compass (COMP) | $7.67 | $15.26 | 49.7% |

Let's review some notable picks from our screened stocks.

Datadog (DDOG)

Overview: Datadog, Inc. provides an observability and security platform for cloud applications globally, with a market cap of approximately $53.78 billion.

Operations: The company's revenue is primarily generated from its IT Infrastructure segment, totaling approximately $3.02 billion.

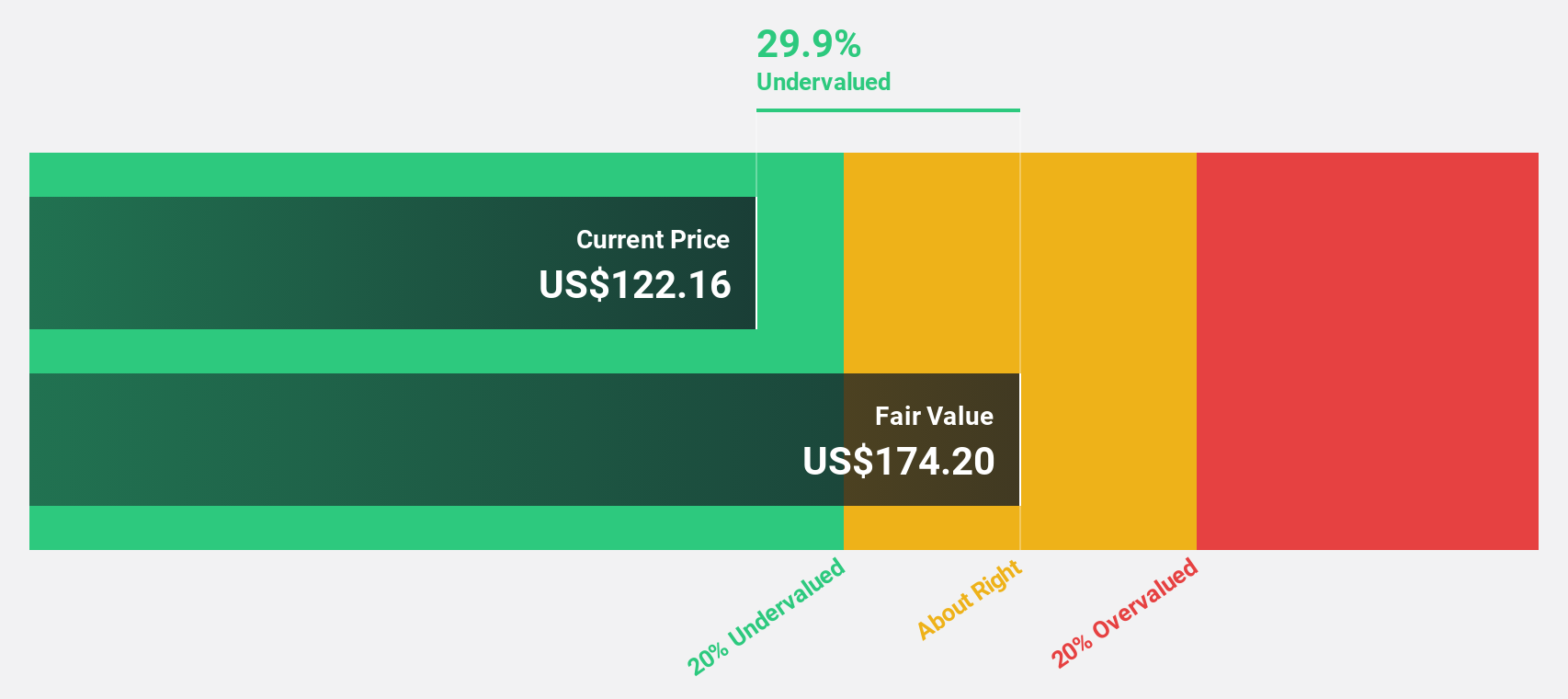

Estimated Discount To Fair Value: 20.2%

Datadog, Inc. appears undervalued with its stock trading at US$156.59, below the estimated fair value of US$196.19. Despite recent insider selling and a decline in profit margins from 6.8% to 4.1%, earnings are forecasted to grow significantly at over 32% annually, outpacing the market's 15.5%. Recent M&A discussions involving GitLab could impact future cash flows and strategic direction, while revenue growth is expected to exceed broader market trends at 16.1% annually.

- The growth report we've compiled suggests that Datadog's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Datadog.

Royal Gold (RGLD)

Overview: Royal Gold, Inc. acquires and manages precious metal streams, royalties, and related interests, with a market cap of $15.50 billion.

Operations: Revenue segments for the company include Stream Interests at $513.49 million and Royalty Interests at $278.44 million.

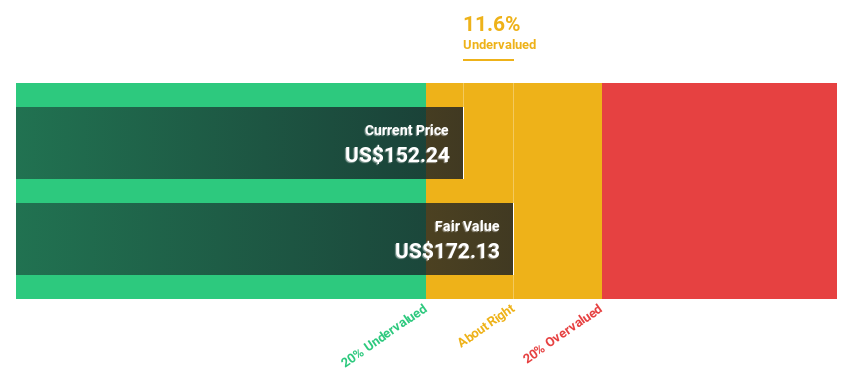

Estimated Discount To Fair Value: 27.3%

Royal Gold, Inc. is trading at US$183.41, below its estimated fair value of US$252.30, indicating it may be undervalued based on cash flows. The company reported strong earnings growth with net income rising to US$132.35 million in Q2 2025 from US$81.21 million the previous year and revenue growth forecasted at 24.4% annually, surpassing the market average of 10%. However, shareholders experienced dilution recently and return on equity is expected to remain low at 8.5%.

- Our comprehensive growth report raises the possibility that Royal Gold is poised for substantial financial growth.

- Get an in-depth perspective on Royal Gold's balance sheet by reading our health report here.

Eli Lilly (LLY)

Overview: Eli Lilly and Company discovers, develops, and markets human pharmaceuticals globally, with a market cap of approximately $729.35 billion.

Operations: The company's revenue primarily stems from its pharmaceutical products, generating $53.26 billion.

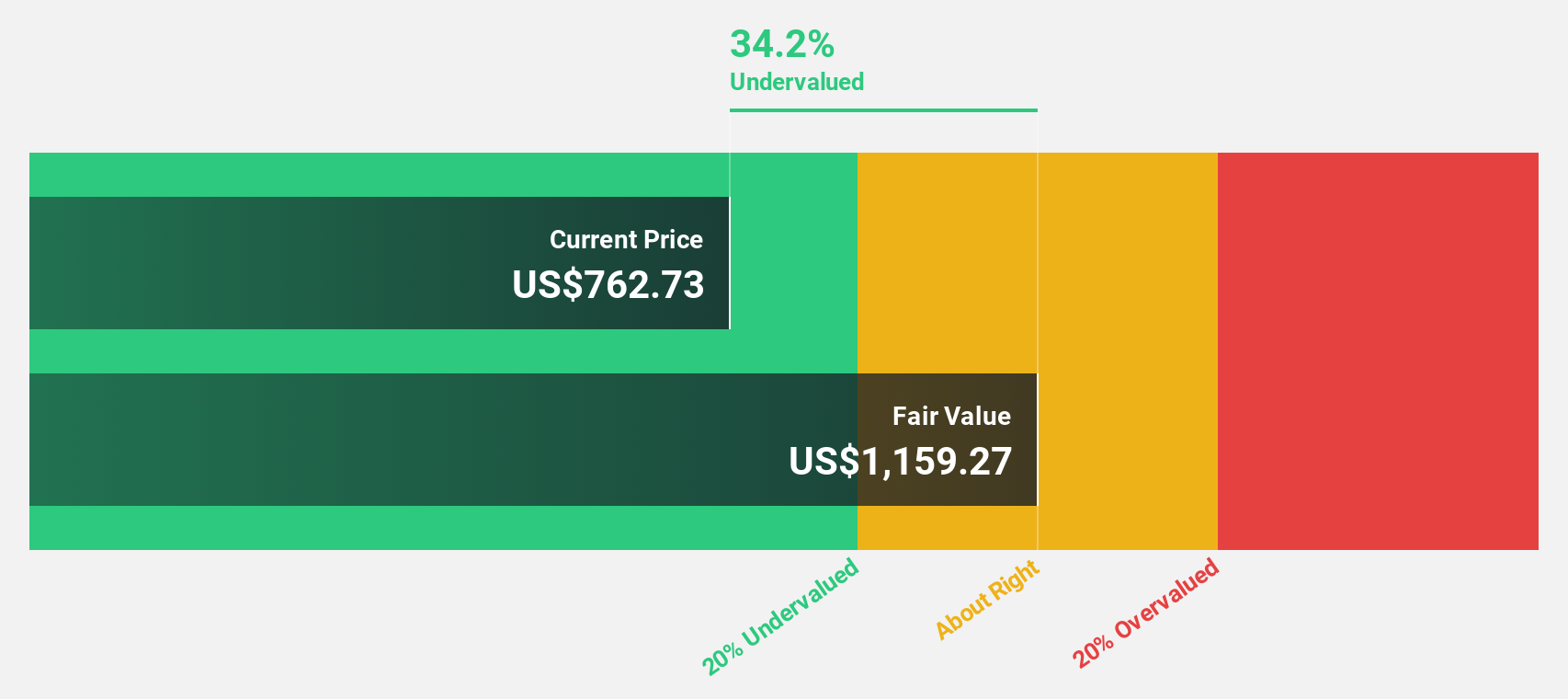

Estimated Discount To Fair Value: 29.8%

Eli Lilly is trading at US$821.04, below its estimated fair value of US$1169.31, suggesting it could be undervalued based on cash flows. The company's earnings are projected to grow significantly at 21.1% annually, outpacing the broader U.S. market's growth rate of 15.5%. Despite a high level of debt and substantial non-cash earnings, Eli Lilly's robust product pipeline and recent clinical trial successes underscore its potential for sustained revenue and profit growth.

- Insights from our recent growth report point to a promising forecast for Eli Lilly's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Eli Lilly.

Summing It All Up

- Navigate through the entire inventory of 179 Undervalued US Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion