- United States

- /

- Pharma

- /

- NasdaqCM:SAVA

Origin Materials And 2 Additional Promising Penny Stocks

Reviewed by Simply Wall St

The U.S. stock market has been riding a wave of optimism, with the S&P 500 recently hitting new highs amid positive trade deal developments and anticipation of earnings reports from major companies. In such a buoyant market, investors often look beyond the large-cap stocks to explore opportunities in smaller segments like penny stocks. While "penny stocks" might seem like an outdated term, they still represent a vibrant area for investment, offering potential growth at lower price points when backed by strong financials.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.67 | $614.83M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.60 | $258.53M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.9931 | $161.13M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.51 | $266.84M | ✅ 3 ⚠️ 0 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $101.15M | ✅ 3 ⚠️ 1 View Analysis > |

| Safe Bulkers (SB) | $4.14 | $416.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.8009 | $6.14M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.65 | $103.33M | ✅ 3 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.44 | $28.6M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 415 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Origin Materials (ORGN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Origin Materials, Inc. operates as a carbon-negative materials company and has a market cap of approximately $89.61 million.

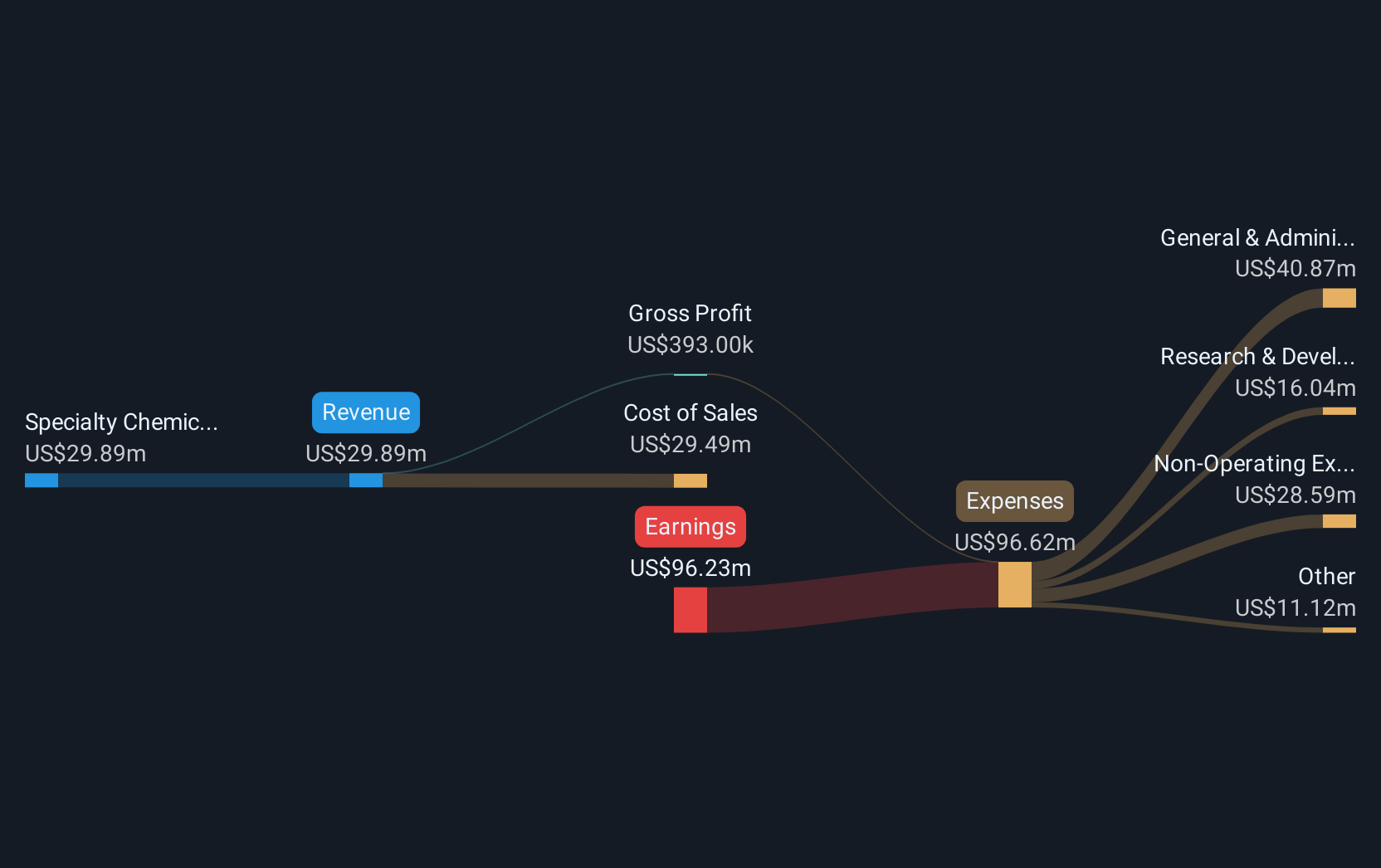

Operations: The company generates revenue from its Specialty Chemicals segment, which amounted to $29.89 million.

Market Cap: $89.61M

Origin Materials, Inc. presents a mixed picture for investors interested in penny stocks. The company has successfully reduced its debt to equity ratio from 44.8% to 1.1% over five years and maintains more cash than total debt, indicating financial prudence. However, it remains unprofitable with a negative return on equity of -30.59%, and earnings have declined significantly over the past five years by 26.6% annually. Despite this, Origin's short-term assets comfortably cover both short- and long-term liabilities, providing some financial stability amidst high share price volatility and an inexperienced board with an average tenure of 2.2 years.

- Unlock comprehensive insights into our analysis of Origin Materials stock in this financial health report.

- Learn about Origin Materials' historical performance here.

Cassava Sciences (SAVA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cassava Sciences, Inc. is a clinical-stage biotechnology company focused on developing drugs for neurodegenerative diseases, with a market cap of approximately $111.11 million.

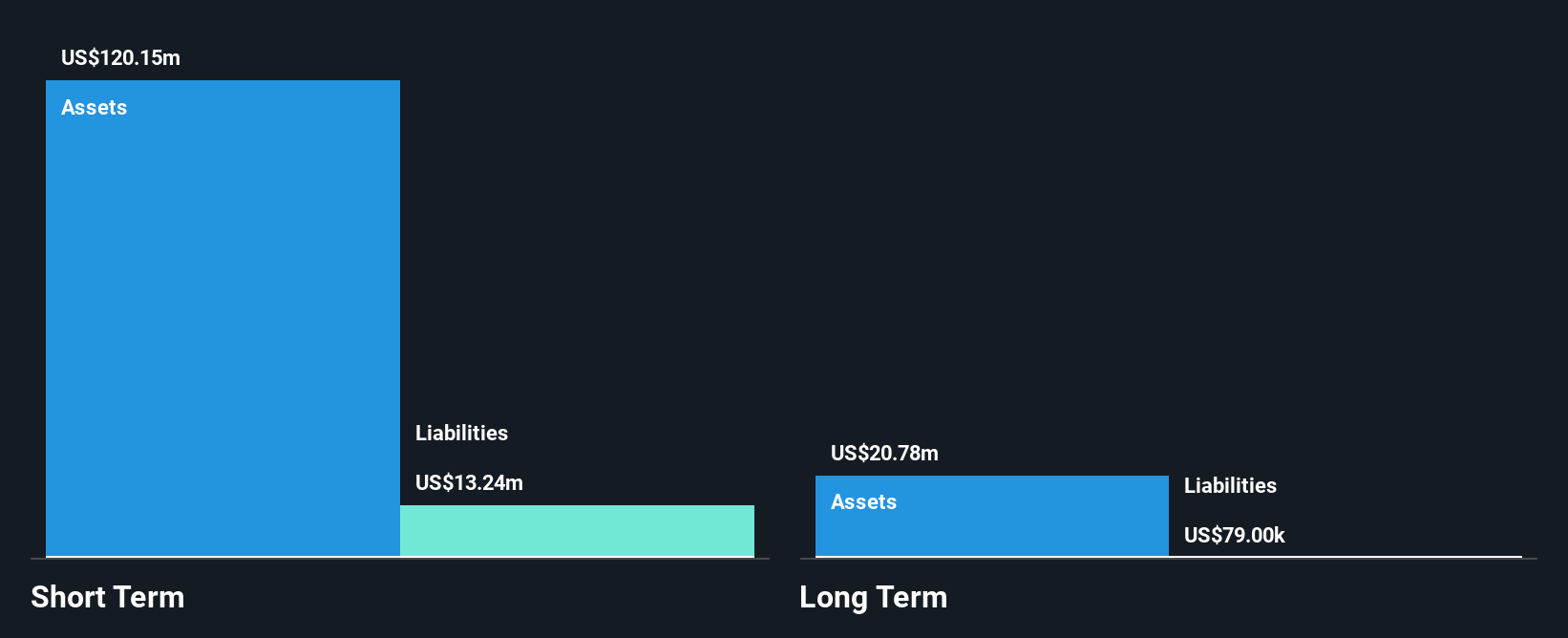

Operations: Cassava Sciences, Inc. currently does not report any revenue segments.

Market Cap: $111.11M

Cassava Sciences, Inc. offers a complex profile for penny stock investors. Despite being pre-revenue with no significant income streams, the company is debt-free and has short-term assets of US$120.2 million that exceed both its short- and long-term liabilities, indicating some financial resilience. However, it faces challenges such as increased losses over five years at 27.4% annually and less than a year of cash runway if its free cash flow continues to decrease at historical rates. Recent index reclassifications highlight volatility in investor sentiment as it shifts from growth to value benchmarks amidst ongoing strategic changes.

- Click here and access our complete financial health analysis report to understand the dynamics of Cassava Sciences.

- Assess Cassava Sciences' previous results with our detailed historical performance reports.

OraSure Technologies (OSUR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OraSure Technologies, Inc. develops, manufactures, markets, sells, and distributes diagnostic products and specimen collection devices globally with a market cap of $243.10 million.

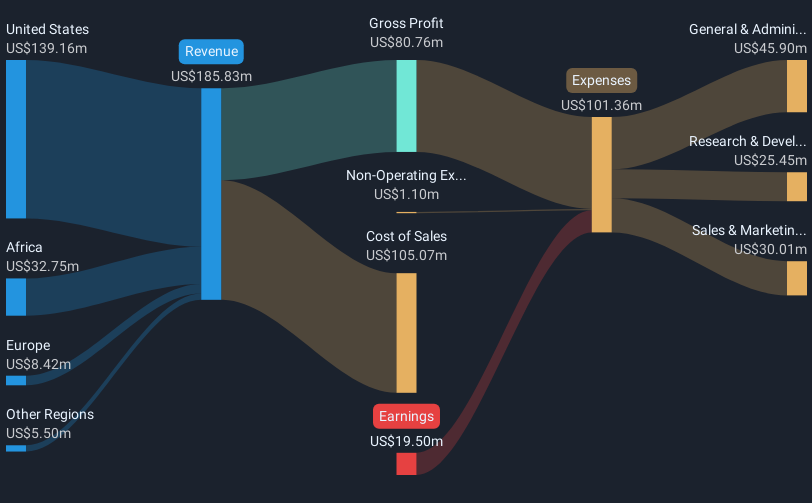

Operations: The company's revenue primarily comes from its Diagnostics and Molecular Solutions segment, totaling $161.63 million.

Market Cap: $243.1M

OraSure Technologies, Inc. presents a mixed picture for penny stock investors. The company is unprofitable but has managed to reduce its losses over the past five years by 18.8% annually. Its short-term assets of US$313.8 million comfortably cover both short- and long-term liabilities, suggesting financial stability without any debt burden. Recent developments include the launch of HEMAcollect™ PROTEIN for proteomic research and its addition to the Russell 2000 indices, indicating market recognition despite ongoing challenges with profitability and declining revenues from US$54.13 million to US$29.93 million year-over-year in Q1 2025 results.

- Click to explore a detailed breakdown of our findings in OraSure Technologies' financial health report.

- Gain insights into OraSure Technologies' future direction by reviewing our growth report.

Next Steps

- Embark on your investment journey to our 415 US Penny Stocks selection here.

- Contemplating Other Strategies? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SAVA

Cassava Sciences

A clinical stage biotechnology company, develops drugs for neurodegenerative diseases.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)