- United States

- /

- Metals and Mining

- /

- NasdaqGM:NB

Will NioCorp Developments' (NB) Project Site Expansion Strengthen Its Role in the U.S. Minerals Supply Chain?

Reviewed by Sasha Jovanovic

- NioCorp Developments recently finalized the purchase of more than 325 additional acres tied to its Elk Creek Critical Minerals Project and advanced key steps for up to $800 million in potential financing, while also appointing David Hamm as General Counsel.

- These developments solidify NioCorp's control over its project site and surface rights, positioning the company in U.S. efforts to develop a resilient domestic critical minerals supply chain.

- We'll examine how gaining full project site control reinforces NioCorp's investment narrative and future role as a U.S. critical minerals supplier.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is NioCorp Developments' Investment Narrative?

For anyone considering NioCorp Developments, the core belief is that the company can transform its Elk Creek Project into a vital producer of critical minerals for the U.S. market. The recent land acquisition cements site control and removes a major operational roadblock, feeding into the investment story around enabling domestic supply chains. Progress towards up to US$800 million in EXIM-backed debt financing remains the next essential catalyst but still faces substantial hurdles, especially in light of ongoing auditor doubts about the company’s ability to continue as a going concern. Leadership upgrades like the addition of David Hamm as General Counsel should help manage regulatory and governance risks. While these developments have spurred a remarkable surge in share price, the financial risks remain real and material, particularly with no near-term revenue and recurring losses.

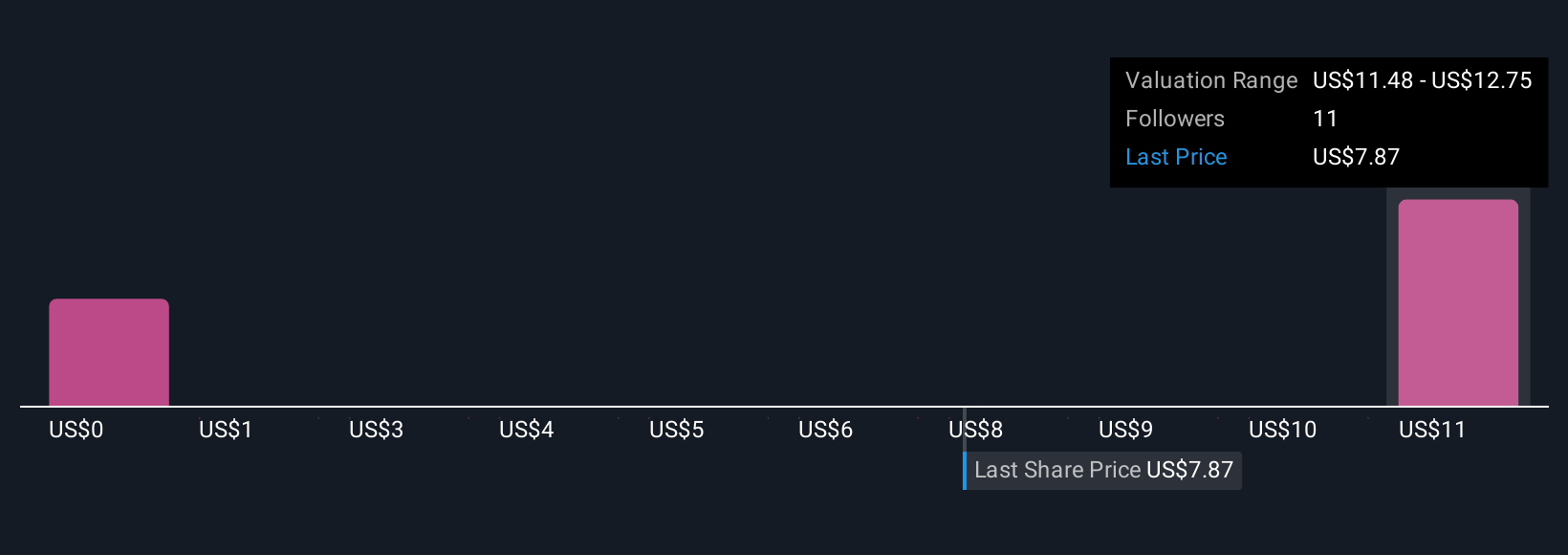

But, the uncertainty surrounding access to project financing is still something every investor should weigh. In light of our recent valuation report, it seems possible that NioCorp Developments is trading beyond its estimated value.Exploring Other Perspectives

Explore 6 other fair value estimates on NioCorp Developments - why the stock might be worth less than half the current price!

Build Your Own NioCorp Developments Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NioCorp Developments research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free NioCorp Developments research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NioCorp Developments' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NioCorp Developments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NB

NioCorp Developments

Engages in the exploration and development of mineral deposits in North America.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives